UPI for Business: Key Benefits, Usage, and Tips

Today, UPI has emerged as a complete game-changer for individuals. This payment system is highly efficient and imperceptible to the user, and it has completely supplanted the traditional, still unbranded way of transacting, making it a necessity in the digitally adept era.

But UPI is not just for individuals; it’s equally useful for corporations and small businesses. In this post, we'll explore more about UPI for business, how it works and the benefits it could bring to your finances.

What Is UPI for Business?

UPI for business is a comprehensive payment system developed by the National Payments Corporation of India (NPCI). It enables companies to send and receive instant payments via mobile devices.

With UPI, businesses can accept payments via a unique UPI ID, QR code, or phone number, without requiring customers to enter their card details.

A business must first register with a bank that accepts UPI to begin operations. Customers can use any UPI-capable app to pay businesses after registering, at which point the company is given a unique UPI ID.

Key Benefits of Using UPI for Businesses

Businesses can get significant advantages by using the Unified Payments Interface. Among the top benefits of UPI for businesses are:

Instant Real-Time Payments

UPI transfers funds instantly between the customer's and the business's bank accounts. This is applicable 24/7, including weekends and holidays.

Enhanced Security

UPI transactions are completely secure, utilising multi-factor authentication. This mitigates the risk of fraud or data breaches.

Wide Customer Reach and Ease of Use

With a massive and growing user base in India, accepting UPI enables businesses to serve a broad segment of customers who prefer this convenient payment method.

Cost-Effectiveness

UPI transactions generally have lower (often minimal or zero) transaction fees for merchants.

How to Get UPI for Business: Step-by-Step Guide

Using UPI increases your company's consumer base and streamlines operations. The steps to set it up are as follows:

1. Check your Eligibility

First and foremost, ensure your business has a registered entity (sole proprietorship, partnership, or company) and a current account with a UPI-enabled bank.

2. Collate Required Documents

Collect all the documents required, such as the PAN card, GST certificate (if required), proof of business registration, proof of address, and the current bank account details of the business.

3. Open or Link a Current Account

UPI for business can only work with a current account. It is important to open one with a bank that offers UPI merchant services.

4. Install BHIM UPI or the Bank’s UPI App

Now, download BHIM UPI or your bank’s business banking app.

5. Register & Verify

Register using your business mobile number, verify with OTP, and select your current account for UPI setup.

6. Create a BHIM UPI ID for Business

Set a UPI ID (e.g., yourbiz@bank), create a UPI PIN, and enable merchant features.

7. Activate Business Tools

Enable QR codes, payment links, and settlement preferences.

Among the major banks offering UPI for business are HDFC Bank, ICICI Bank, Axis Bank, SBI, Yes Bank, IDFC First Bank, and Bank of Baroda.

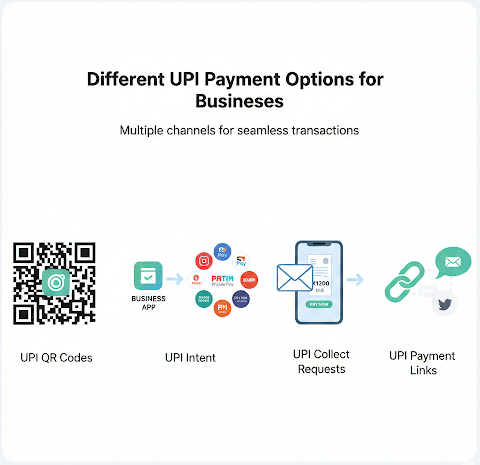

UPI Payment Options for Businesses to Explore

Businesses today can accept UPI payments through multiple channels.

Some of these UPI payment for business options are discussed below:

- UPI QR Codes:A simple,widely used method for both online and in-store payments.

- UPI Intent: A mobile-centric approach that smoothly takes the user from the business's app or site to the preferred UPI app.

- UPI Collect Requests: The merchant sends a payment request to the customer’s Virtual Payment Address (VPA) or UPI ID. This is a suitable method for utilities, insurance, and educational fees.

- UPI Payment Links: Merchants can generate a payment link via social media, email, or SMS that contains all transaction information. For digital invoicing and freelancers, this no-code solution is perfect.

Tips to Maximise UPI Transaction Success Rate in Business

To maximise UPI transaction success rates in business, it is important to optimise the payment flow to improve ease of use. This can be done in various ways.

Some of these UPI payment business tips are discussed below:

- Offer multiple options:Present UPI via QR codes, UPI ID, and other methods like cards and wallets to cater to all customers.

- Smooth checkout:Simplify the process by reducing form fields, implementing single-page checkouts, and enabling guest checkouts where possible.

- Stable Internet & Devices:Ensure a stable internet connection and reliable hardware to prevent technical glitches.

- Customer Support:Offer dedicated support for payment-related queries to build trust.

- Clear Instructions:Use timers and informative wait pages to guide users on the next steps.

Also Read: Using Two Bank Accounts with One Mobile Number for UPI

Common Challenges & How to Overcome Them When Using UPI for Business

Here are some common UPI challenges for businesses and ways to overcome them:

Transaction Failures & Delays

Ensure your company's UPI application is up to date to maintain a stable internet connection and avoid repeatedly clicking during transaction processing, which can cause issues.

Reconciliation

This problem can be eliminated by using automated reconciliation solutions that integrate your accounting software with your payment processor.

Disputes

One of the best ways to avoid disputes is to work with a payment provider that offers reliable, multi-channel customer support (phone, chat, email) and has clear Service Level Agreements (SLAs).

Also Read: How to Register PSP in UPI: A Complete Step-by-Step Guide

Transaction Limits

UPI typically has daily and per-transaction limits (e.g., usually ₹1 lakh for individuals and higher for registered businesses).

Supercharge your Business with UPI

Businesses tend to use UPI because it offers a cost-effective, instant, and secure way to send and receive payments.

Hero FinCorp acknowledges that, even with efficient payment procedures in place, businesses may periodically experience short-term liquidity shortfalls due to pressing operational requirements, seasonal demand, or delayed receivables. In these situations, timely access to loans can help maintain momentum without disrupting regular payments.

So why wait? Explore our digitally enabled loan solutions designed for quick approvals and smoother cash flow management now!

Frequently Asked Questions

What documents are needed to get a UPI for business?

To get UPI for business, you need business proof such as a GST certificate, registration certificate, or partnership deed, along with the authorised signatory's ID and address proof.

Can I use the same UPI ID for personal and business payments?

Yes, you can use the same UPI ID for both personal and business use.

Are UPI transactions free for businesses?

Yes, UPI transactions are largely free for businesses when payments are made directly from a customer's bank account.

What is the UPI transaction limit for businesses?

The standard UPI limit for businesses is around ₹1 lakh per day, but this varies greatly by bank and business type.

How secure is UPI for business?

UPI is highly secure for business transactions due to a multi-layered security framework.

How to resolve failed or disputed UPI payments?

To fix unsuccessful UPI payments, use the "Help/Support" feature of your UPI app to report the problem with transaction information after waiting 24 to 48 hours for automatic refunds.