Flexible Repayment Tenure:

Choose a flexible repayment tenure of 12-36 months that fits your budget.

A Personal Loan is an absolute boon for anyone in need of urgent cash for any personal requirement. Be it a wedding, a home renovation project, or higher education, with a Personal Loan, you can avail of cash instantly online.

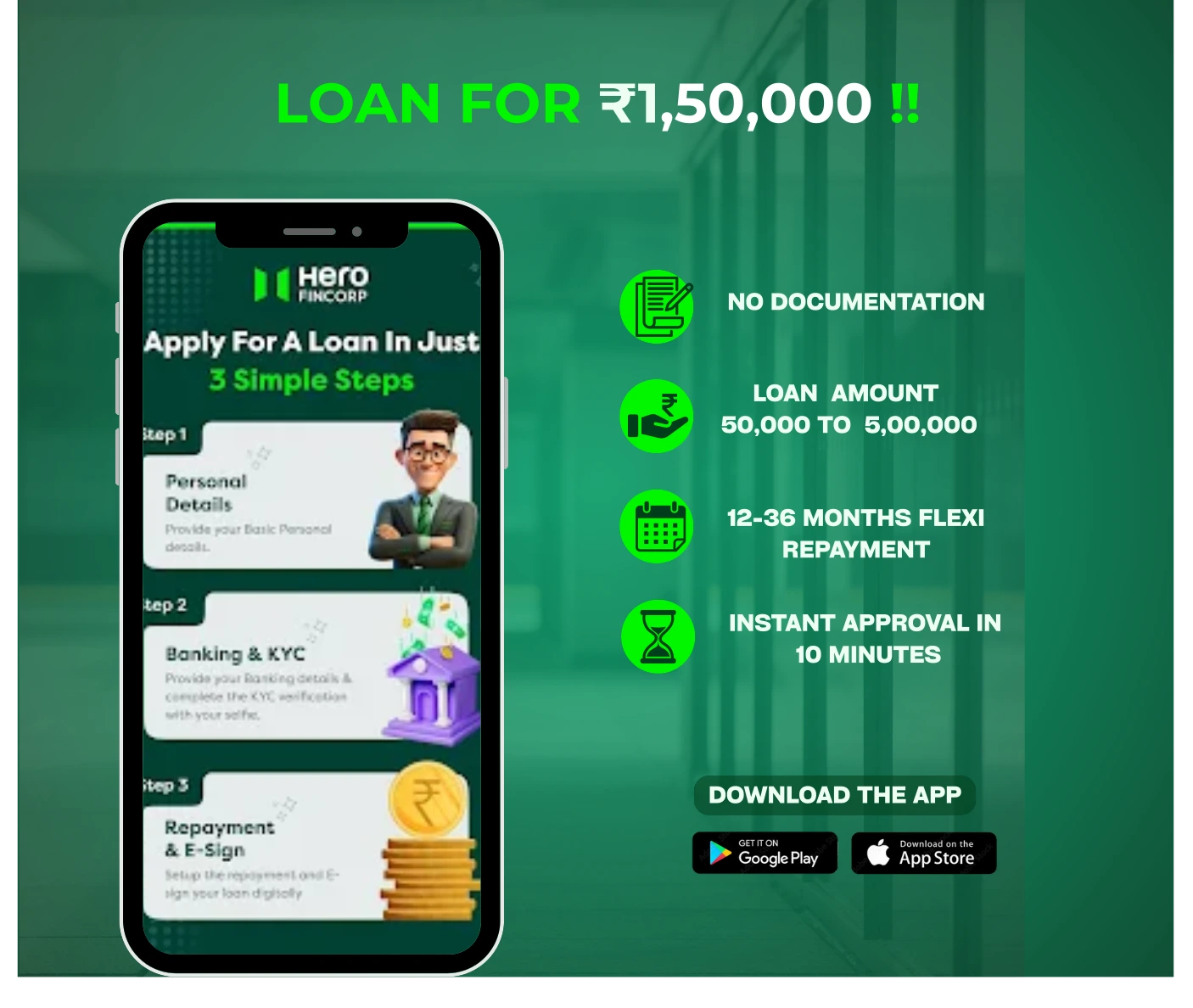

Although we can approve an instant loan from Rs 50,000 to 5,00,000 online, Rs 1.5 Lakh Personal Loan seekers can get approved instantly within 10 minutes.

Both salaried and self-employed loan seekers can avail of instant loans from Hero FinCorp. With competitive interest rates and a flexible repayment tenure of 12 to 36 months, our Personal Loans have no collateral requirement.

Simply check your eligibility, calculate your EMIs via the Personal Loan Calculator, and reduce the effort by applying on the Hero FinCorp loan app or website to get instant approval backed by quick disbursal.

A Personal Loan of Rs 1.5 lakh can be a helpful financial tool for unexpected expenses or short-term goals. This loan amount can help cover medical bills, home repairs, or even an international vacation. With our flexible repayment options, you can break down the 1.5 lakh Personal Loan EMI into affordable monthly instalments, making it easier to budget and avoid financial strain.

At Hero FinCorp, we offer a minimum tenure of 12 months to make it simpler for you to manage your 1.5 lakh Personal Loan EMI. And if you would like to spread your repayment over a year or two, we also have a maximum tenure of 36 months. Check out the table below for more insights:

| Loan Amount (Rs) | Tenure (in Months) | Interest Rate* (%) | Monthly EMI (Rs) | Total Interest | Total Amount Payable |

| Rs 1,50,000 | 12 | 18% | Rs 13,823 | Rs 15,882 | Rs 1,65,882 |

| Rs 1,50,000 | 18 | 18% | Rs 9,643 | Rs 23,565 | Rs 1,73,565 |

| Rs 1,50,000 | 24 | 18% | Rs 7,561 | Rs 31,471 | Rs 1,81,471 |

| Rs 1,50,000 | 30 | 18% | Rs 6,320 | Rs 39,597 | Rs 1,89,597 |

| Rs 1,50,000 | 36 | 18% | Rs 5,498 | Rs 47,943 | Rs 1,97,943 |

Unlock flexibility with a Personal Loan. Explore features & benefits of a Rs 1.5 lakh loan:

Before applying for a Rs 1.5 Lakh Personal Loan, you must check the eligibility criteria. You can use the personal loan eligibility calculator on our website to know the eligible loan amount, loan EMI and max loan tenure by entering your profession, current EMI payments, monthly income and loan tenure.

The basic requirements to apply for a Personal loan with Hero FinCorp include:

| Criteria | Requirement |

|---|---|

| Age | Be between 21-58 years. |

| Citizenship | Being an Indian resident citizen is a must. |

| Work Experience | Minimum work experience for salaried employees is 6 months and 2 years for self-employed. |

| Monthly Income | Minimum income requirements of Rs 15,000 per month. |

Hero FinCorp does not have very rigorous documentation requirements to apply for its Personal Loan. Hero FinCorp accepts applications for a loan from salaried and self-employed individuals. The required documents for the personal loan differ from salaried to self-employed applicants. Let’s see.

Duly filled application form, Passport-size photograph

Driving License, Passport, PAN Card, Aadhaar Card (Any One)

Driving License, Passport, Aadhaar Card, Ration Card, Utility Bill (Any One)

Residence Ownership Proof (Electricity Bill, Maintenance Bill, Property Document)

Last 6 Months Salary Slips, Bank Statements and Form 16

Duly filled application form, Passport-size photograph

Driving License, Passport, PAN Card, Aadhaar Card (Any One)

Driving License, Passport, Aadhaar Card, Ration Card, Utility Bill (Any One), Office Address Proof (if applicable)

Business Existence Proof (Tax Registration, Shop Establishment Proof, Company Registration Certificate)

Last 6 Months' Bank Statements and ITR for 2 Years

At Hero FinCorp, we understand that unexpected expenses can arise anytime. That's why we offer Rs 1.5 Lakh Personal Loans with a hassle-free application process that minimises paperwork. Plus, we offer competitive personal loan interest rates to make repayment manageable.

However, it's important to consider additional fees beyond the interest rate to determine your total loan cost. Here's a quick breakdown:

| Loan Details | Charges/Details |

|---|---|

| Interest Rate | Starting from 18% p.a. |

| Loan Processing Charges | Minimum Processing fee is 2.5% + GST |

| Prepayment Charges | N.A. |

| Foreclosure Charges | 5% + GST |

| EMI Bounce Charges | Rs 350/- |

| Interest on Overdue EMIs | 1-2% of the loan/EMI Overdue Amount Per Month |

| Cheque Bounce | Fixed Nominal Penalty |

| Loan Cancellation | 1. Loan app does not charge cancellation charges 2. Interest amount paid is non-refundable 3. Processing charges are non-refundable |

To secure a loan of 1.5 lakh from Hero FinCorp, here are a few steps you need to follow:

Visit the Hero FinCorp website or install the personal loan app

Go to the instant personal loan page and click ‘apply now’.

Enter your mobile number and verify with the OTP received

Choose the loan amount you need

Verify your KYC details to check income eligibility

Click ‘Submit’ to complete your application

You can use a Personal Loan of Rs 1.5 Lakh for a variety of reasons. Here are some of the applications of a Personal Loan:

*Approval & Agreement: Loan approval is at Hero FinCorp's discretion. By applying, you agree to our Terms & Conditions, Privacy Policy, and Loan Agreement.

*Data Use: You consent to electronic processes and data use for loan assessment, as per our Privacy Policy.

*Security: Keep your account and device secure. Report our customer care for unauthorized activity immediately.

*Grievances: For concerns, refer to our Grievance Redressal Policy.

*EMI Payment: Refer to our T&Cs here*

*RBI Mandate: RBI requires transparent disclosures. Learn more from RBI.