Flexible Repayment Tenure

Depending on your financial capability, you can choose a repayment tenure of 12 to 36 months.

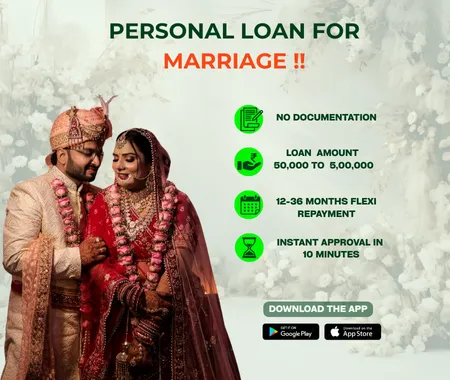

Worried about wedding expenses? Hero FinCorp makes it simple to get a wedding loan online. Apply in minutes, get quick approval, and enjoy your big day without money stress.

A wedding often involves unexpected costs like upgrading the venue, better food, hiring a preferred photographer, and last-minute changes. These extra expenses can quickly strain your budget and add stress to your special day. Without financial support, managing these costs can be challenging.

Hero FinCorp’s marriage loan lets you have your dream wedding without compromise. You can apply for a wedding loan for up to Rs 5 Lakh with a quick, hassle-free process and approval in just 10 minutes. Both salaried and self-employed individuals earning at least Rs 15,000 a month are eligible. The loan features attractive interest rates, flexible repayments options, and requires no collateral.

Instead of worrying about funds, get quick access to the money you need and enjoy a stress-free wedding.

Before applying for a Personal Loan for wedding from Hero FinCorp, make sure to check out the features and benefits the loan offers.

| Eligibility Criteria | Details |

|---|---|

| Age | 21 - 58 years |

| Citizenship | Should be an Indian citizen |

| Work Experience | Minimum 6 months of work experience for salaried employees and 2 years for self-employed. |

| Monthly Income | Minimum Rs 15,000 |

Obtaining a loan to finance your dream wedding is easy and fast and without any paperwork required. Just keep these documents required for wedding loan handy, and both salaried and self-employed individuals can instantly complete the application process:

Before applying for a marriage loan online, it is important to understand the overall costs, including the interest rate and processing fees. At Hero FinCorp, you benefit from attractive personal loan rates with minimal charges, making it easier to plan your wedding budget without financial stress.

| Fees & Charges | Amount Chargeable |

|---|---|

| Interest Rate | Starting from 19% p.a. |

| Loan Processing Charges | Minimum 2.5%+ GST |

| Prepayment Charges | N.A. |

| Foreclosure Charges | 5% + GST |

| EMI Bounce Charges | Rs 350/- |

| Interest on Overdue EMIs | 1-2% of the loan/EMI Overdue Amount Per Month |

| Cheque Bounce | Fixed Nominal Penalty |

| Loan Cancellation | 1. Online loan app does not charge any cancellation charges |

| 2. Interest amount paid is non-refundable | |

| 3. Processing charges are also non-refundable |

Make your big day stress-free with a Hero FinCorp wedding loan online. Get quick approval for your loan for marriage expenses at low interest rates in just a few simple steps:

Visit the Hero FinCorp website or download the personal loan app.

In the instant personal loan section, click 'apply now'.

Enter your mobile number and register by submitting the OTP you receive.

Enter your loan amount.

Complete your KYC verification and verify your income eligibility.

Click 'Submit' to complete your online application and get closer to your dream wedding.

*Approval & Agreement: Loan approval is at Hero FinCorp's discretion. By applying, you agree to our Terms & Conditions, Privacy Policy, and Loan Agreement.

*Data Use: You consent to electronic processes and data use for loan assessment, as per our Privacy Policy.

*Security: Keep your account and device secure. Report our customer care for unauthorized activity immediately.

*Grievances: For concerns, refer to our Grievance Redressal Policy.

*EMI Payment: Refer to our T&Cs here*

*RBI Mandate: RBI requires transparent disclosures. Learn more from RBI.