High Loan Amount

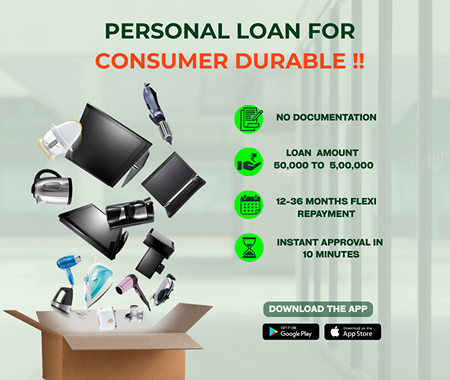

Avail instant loans ranging from Rs 50,000 to 5 Lakh.

A consumer durable loan helps you instantly to buy appliances, electronics, or gadgets right away and pay them off in easy installments. Get quick approval, minimal paperwork, and zero or low down payment through a 100% online process.

Elevate your lifestyle without financial stress by bringing home the products you love today. Hero FinCorp, an RBI-licensed NBFC, helps you purchase home appliances, gadgets, electronics, and lifestyle products with Consumer Durable Loans starting from ₹50,000 up to ₹5 Lakh.

Turn big purchases into small, affordable EMIs with flexible tenures of 12 to 36 months and interest rates starting at just 18% per annum. With zero collateral, no down payment, and a 100% online application, you get instant loan approval without branch visits or paperwork.

At Hero FinCorp, the Personal Loan for Consumer Durables is available to both salaried and self-employed individuals. Before applying, make sure to check the personal loan eligibility criteria.

| Eligibility Criteria | Details |

|---|---|

| Age | Applicant should be between 21-58 years. |

| Citizenship | You should be a citizen of India. |

| Work Experience | Minimum 6 months of work experience for salaried employees and 2 years for self-employed. |

| Monthly Income | Applicant should have a minimum monthly income of Rs 15,000. |

Documentation plays an important role in the loan application process. The documents required for a Personal Loan for Consumer Durables vary slightly for salaried and self-employed individuals. Let’s take a look at the documents needed for personal loan at Hero FinCorp.

Hero FinCorp provides Personal Loans from Rs 50,000 to 5 lakh online with instant approvals. The personal loan interest rates offered are competitive, while the processing charges are nominal. Nonetheless, before applying, you must know the applicable fees and charges to understand your actual cost of borrowing. Here's a quick summary.

| Fees & Charges | Amount Chargeable |

|---|---|

| Interest Rate | Starting from 18% p.a. |

| Loan Processing Charges | Minimum Processing fee is 2.5%+ GST |

| Prepayment Charges | N.A. |

| Foreclosure Charges | 5% + GST |

| EMI Bounce Charges | Rs 350/- |

| Interest on Overdue EMIs | 1-2% of the loan/EMI Overdue Amount Per Month |

| Cheque Bounce | Fixed Nominal Penalty |

| Loan Cancellation | 1. Online loan app does not charge any cancellation charges |

| 2. Interest amount paid is non-refundable | |

| 3. Processing charges are also non-refundable |

If you're looking to finance your dream smartphone through a mobile loan, Hero FinCorp provides a hassle-free process through their Personal Loan app. Here's how to apply:

Visit the Hero FinCorp website or install the personal loan app

Go to the instant personal loan page and click ‘apply now’.

Enter your mobile number and verify with the OTP received

Choose the loan amount you need

Verify your KYC details to check income eligibility

Click ‘Submit’ to complete your application

A borrower with a high CIBIL score and stable financial history is more likely to be eligible for a Personal Loan for Consumer Durables. The CIBIL score helps lenders assess financial behaviour and plays a key role in loan approval.

Consumer durable loans bring dreams to the reality of owning an expensive gadget that might be difficult to purchase otherwise. Some key benefits of consumer durable loan are:

The salary requirements could differ from lender to lender. At Hero FinCorp, the income requirement for applying for a Personal Loan is Rs 15,000.

*Approval & Agreement: Loan approval is at Hero FinCorp's discretion. By applying, you agree to our Terms & Conditions, Privacy Policy, and Loan Agreement.

*Data Use: You consent to electronic processes and data use for loan assessment, as per our Privacy Policy.

*Security: Keep your account and device secure. Report our customer care for unauthorized activity immediately.

*Grievances: For concerns, refer to our Grievance Redressal Policy.

*EMI Payment: Refer to our T&Cs here*

*RBI Mandate: RBI requires transparent disclosures. Learn more from RBI.