Collateral-Free

Getting an instant loan of Rs 50,000 is easy and stress-free, with no collateral required, simplifying the process.

Need funds for renovation, travel, or urgent expenses? Apply for an Rs 50,000 personal loan from RBI-licensed NBFC Hero FinCorp with flexible EMIs, minimal paperwork, and a 100% secure digital process.

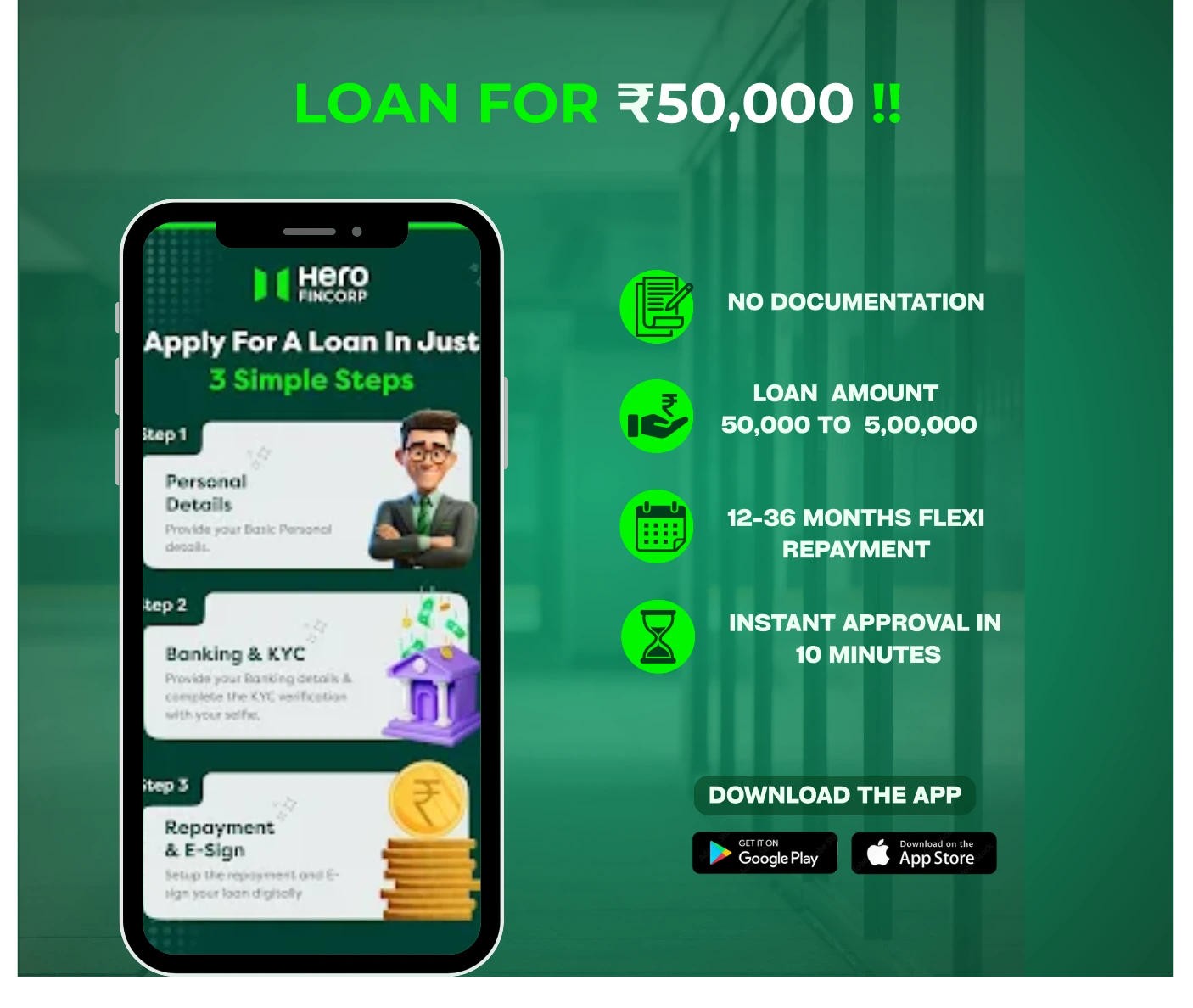

When sudden expenses like a medical emergency, urgent home repair, or last-minute payments come up, arranging money quickly can be stressful. That is where Hero FinCorp comes to rescue. You can apply for a Rs 50,000 Personal Loan online with Hero FinCorp and get instant approval in just 10 minutes. The online process is simple, quick and hassle-free, and requires only minimal documentation to complete your application. Plus, you get the flexibility to choose a repayment plan that suits your budget, making it easier for both salaried and self-employed individuals to manage their needs without worry.

Hero FinCorp provides a Rs 50,000 personal loan that is ideal for dealing with urgent financial challenges. Here are some reasons why it is a smart choice.

Entirely Digital Process: The entire process from application approval to application submission is online and paperless.

No Security Required: You do not need to provide any form of security/collateral when applying making the application process simple.

Competitive Interest Rates: Interest rates starting from 18% p.a. meaning you can borrow affordably.

Instant Approval: You can get approved in 10 minutes so you do not have to wait to meet your needs.

Flexible Repayment: You can choose the appropriate tenure that allows monthly EMIs to be comfortable in your budget.

Here's the calculation of a personal loan of up to Rs 50,000 at an interest rate of 18% p.a. for different tenures.

| Loan Amount (Rs) | Tenure (in Months) | Interest Rate* (per annum) | Monthly EMI (Rs) | Total Interest (Rs) | Total Amount Payable (Rs) |

|---|---|---|---|---|---|

| 50,000 | 12 | 18% | 4,608 | 5,296 | 55,296 |

| 50,000 | 18 | 18% | 3,214 | 7,852 | 57,852 |

| 50,000 | 24 | 18% | 2,520 | 10,480 | 60,480 |

| 50,000 | 30 | 18% | 2,107 | 13,210 | 63,210 |

| 50,000 | 36 | 18% | 1,833 | 15,988 | 65,988 |

Disclaimer: The EMI calculations provided are approximations, and actual figures may differ.

Securing a Rs 50,000 loan opens doors to financial flexibility. Explore the features and benefits to understand how a Rs 50k loan can empower you financially.

If you meet the requirements for eligibility for a personal loan, then getting a Rs 50,000 loan is much easier. Doing so means you have a good credit history, stable source of income, and a solid employment history. If you fulfill the criteria for personal loans, then it would enhance the chances of your application getting approved.

| Criteria | Requirement |

|---|---|

| Age | You must be between 21 to 58 years of age. |

| Citizenship | You must be an Indian citizen to apply for a Personal Loan at Hero FinCorp. |

| Work Experience | 1. Salaried Individuals: Minimum 6 months 2. Self-employed Individuals: Minimum 2 years of stable business operations |

| Monthly Income | The minimum income requirement is Rs 15,000 per month. |

| Credit Score | A score of 750+ is generally preferred for instant approval. |

It is quick and easy to get a personal loan of Rs 50,000 without documentation. Just have the following required documents ready for salaried and self-employed individuals and get your application processed quickly.

Securing a Rs 50,000 loan depends on existing personal loan interest rates, which impact your total repayment. Lower rates reduce costs, so comparing options is crucial for affordable borrowing.

| Loan Details | Charges/Details |

|---|---|

| Interest Rate | Starting from 19% p.a. |

| Loan Processing Charges | Minimum Processing fee is 2.5% + GST |

| Prepayment Charges | N.A. |

| Foreclosure Charges | 5% + GST |

| EMI Bounce Charges | Rs 350/- |

| Interest on Overdue EMIs | 1-2% of the loan/EMI Overdue Amount Per Month |

| Cheque Bounce | Fixed Nominal Penalty |

| Loan Cancellation | 1. Loan app does not charge cancellation charges 2. Interest amount paid is non-refundable 3. Processing charges are non-refundable |

Note: The above rates are effective from 27.10.2023.

Applying for a Rs 50,000 personal loan is a simple process. Follow the instructions below to complete the personal loan application:

Visit the Hero FinCorp website or download the personal loan application

Select instant personal loan and click on apply now

Enter your mobile number and register yourself by OTP.

Select your loan amount.

KYC verification and eligibility check.

Complete online application form and then submit.

A Personal Loan of Rs 50,000 can be used for various financial needs, including:

The loan amount you can get depends on various factors. Lenders typically consider your salary, credit score, and existing financial commitments to determine loan eligibility.

You can use a personal loan EMI calculator online. It is a free-to-use digital tool that calculates your EMIs based on loan amount, loan tenure and interest rate.

Yes, you can obtain a Rs 50000 loan amount with a low CIBIL score, but it will depend on the lender's policies and may result in a higher interest or lower amount.

Hero FinCorp loan app provides an instant approval of a Personal Loan of Rs 50K in 10 minutes with minimum documents.

*Approval & Agreement: Loan approval is at Hero FinCorp's discretion. By applying, you agree to our Terms & Conditions, Privacy Policy, and Loan Agreement.

*Data Use: You consent to electronic processes and data use for loan assessment, as per our Privacy Policy.

*Security: Keep your account and device secure. Report our customer care for unauthorized activity immediately.

*Grievances: For concerns, refer to our Grievance Redressal Policy.

*EMI Payment: Refer to our T&Cs here*

*RBI Mandate: RBI requires transparent disclosures. Learn more from RBI.