High Loan Amount

You can get up to Rs 5 Lakh, based on your eligibility, for various planned and unplanned expenses.

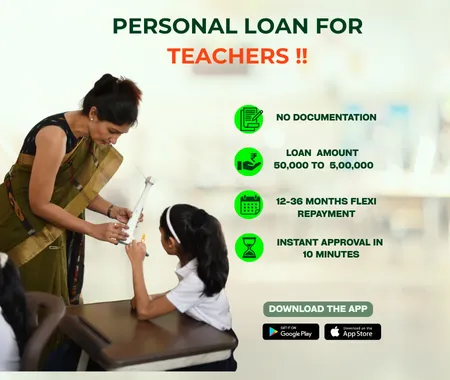

Teachers are important in the overall development of any nation. We at Hero FinCorp recognise your hard work and are always ready to help you with financing when you need it. Whether you need cash for a family wedding, medical emergency, repairs to your home, or for something for yourself, our Personal Loans for teachers can help.

You can avail a loan of up to Rs 5 Lakh if your monthly income is Rs 15,000 or more and there is no collateral or guarantor required. We offer competitive interest rates and you can choose repayment terms of up to 36 months.

The best part? Our process is totally online and you can get instant approval in just 10 minutes!

A personal loan for teacher helps in plenty of instances when you need instant loan. Here’s a look at its top features and benefits:

| Criteria | Requirement |

|---|---|

| Age | Applicants should be between 21 and 58 years. |

| Citizenship | You should be a citizen of India. |

| Work Experience | Six months for salaried individuals and 2 years for self-employed individuals. |

| Monthly Income | You should have a minimum income of Rs 15,000 monthly. |

| Credit Score | You should have a credit score of 725 or above. |

Documentation is an essential part of the personal loan application process. Requirements may vary slightly for salaried and self-employed applicants, so it’s advisable to understand them beforehand. Being prepared with the necessary personal loan documents can help ensure a smooth and hassle-free application process. Here’s a list of the commonly required documents.

Duly filled loan application form Passport-size photograph (coloured)

Driver’s licence, passport, PAN card, or Aadhaar card

Driver’s licence, passport, Aadhaar card, ration card, or utility bill

Residence ownership proof, like electricity bills, maintenance bills, or property documents

Last six months' salary slips, the previous six months' salary account statement, and Form 16 Job continuity proof, like an appointment letter from the current employer or experience certificate from the previous employer

Duly filled loan application form Passport-size photograph (coloured)

Driver’s licence, passport, PAN card, or Aadhaar card

Driver’s licence, passport, Aadhaar card, ration card, or utility bill Office address proof, like maintenance bills, utility bills, property documents, or rent agreement

Business existence proof, like a copy of tax registration, shop establishment proof, or company registration certificate.

Last six months' bank statements and ITR for the previous two consecutive years

You should be aware of the loan costs, like the interest rates and processing fees, before applying for a Personal Loan for Teachers. At Hero FinCorp, the interest rates on personal loans are competitive, and other charges are nominal. Check out the details.

| Fees & Charges | Amount Chargeable |

|---|---|

| Interest Rate | Starting from 18% p.a. |

| Loan Processing Charges | Minimum 2.5%+ GST |

| Prepayment Charges | N.A. |

| Foreclosure Charges | 5% + GST |

| EMI Bounce Charges | Rs 350/- |

| Interest on Overdue EMIs | 1-2% of the loan/EMI Overdue Amount Per Month |

| Cheque Bounce | Fixed Nominal Penalty |

| Loan Cancellation | 1. Online loan app does not charge any cancellation charges |

| 2. Interest amount paid is non-refundable | |

| 3. Processing charges are also non-refundable |

Here is a stepwise process you need to follow to apply for a personal loan for teachers online with Hero FinCorp.

Visit the Hero FinCorp website or install the personal loan app

Go to the personal loan page and click ‘apply now’

Enter your mobile number and verify with the OTP received

Choose the loan amount you need

Verify your KYC details to check income eligibility

Click ‘Submit’ to complete your application

*Approval & Agreement: Loan approval is at Hero FinCorp's discretion. By applying, you agree to our Terms & Conditions, Privacy Policy, and Loan Agreement.

*Data Use: You consent to electronic processes and data use for loan assessment, as per our Privacy Policy.

*Security: Keep your account and device secure. Report our customer care for unauthorized activity immediately.

*Grievances: For concerns, refer to our Grievance Redressal Policy.

*EMI Payment: Refer to our T&Cs here*

*RBI Mandate: RBI requires transparent disclosures. Learn more from RBI.