High Loan Amount

A Rs 3 Lakh instant loan covers urgent expenses like medical, wedding, education, travel, or home renovation.

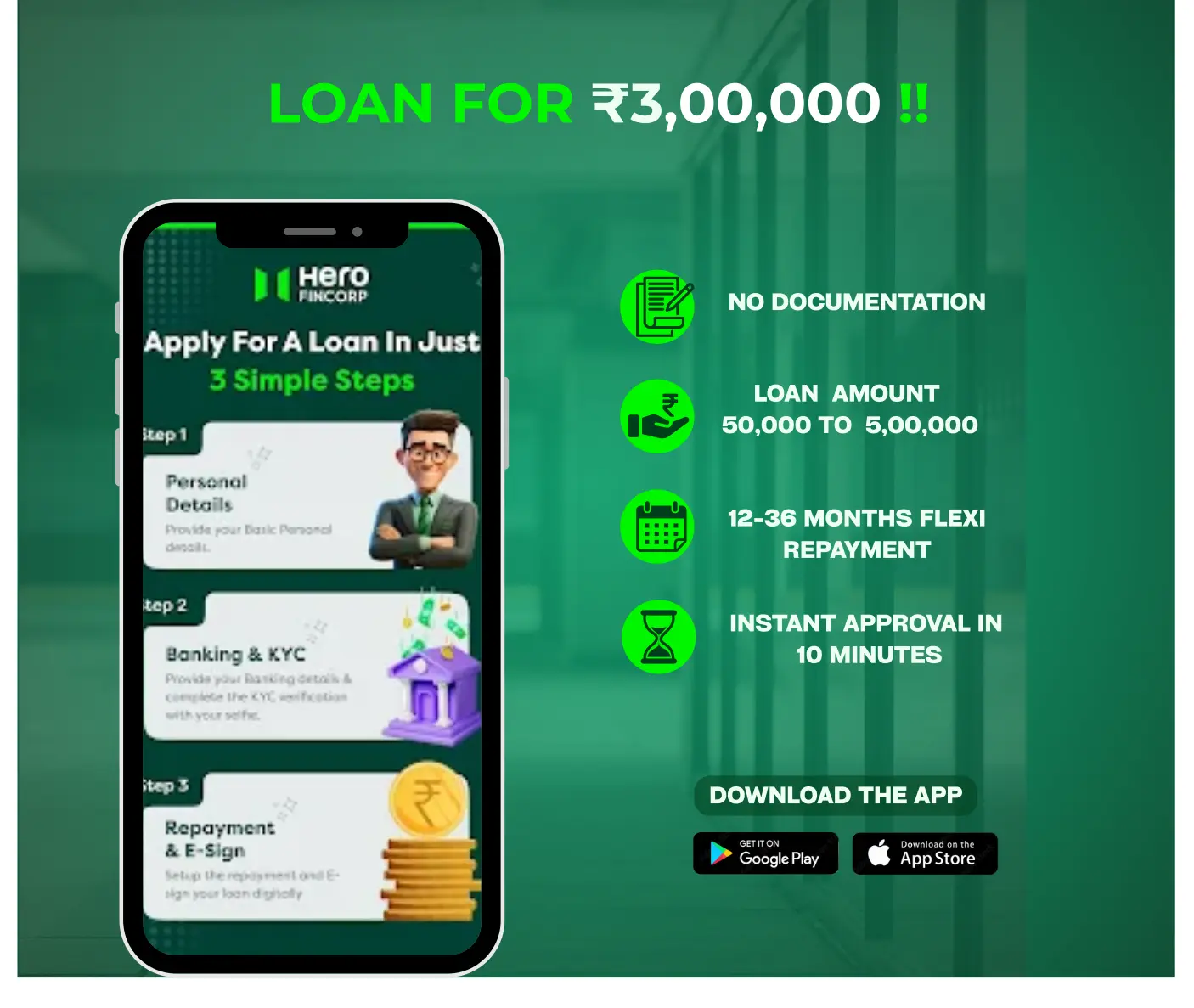

Apply for a Rs 3 Lakh loan from Hero FinCorp without collateral. Get instant approval with competitive interest rates and flexible repayment tenures.

A Personal Loan of Rs 3 Lakh is an unsecured funding option to help you manage urgent financial needs. It can be a medical emergency, home repair, higher education expenses or any personal requirement. To get an instant loan, you can apply online with Hero FinCorp from the comfort of your home. You can get a Rs 3 Lakh loan with better interest rates if you meet the eligibility criteria. A flexible tenure of up to 36 months makes repaying loan EMIs easier. With no collateral requirement, you can apply online and get approval within 10 minutes!

You can achieve your dreams easily with Hero FinCorp Rs 3 lakh loan. Here are the reasons to choose Hero FinCorp for personal loan with fast approval:

Multiple Uses: It is best for education, home renovation, weddings, or unexpected expenses.

Competitive Interest Rates: Borrow at starting from 18% p.a. interest rates that suit your budget.

Flexible Repayment: Pick the repayment terms that work best for you.

Quick Approval in 10 Minutes: Fast and hassle-free loan sanctioning.

100% Digital Process: Easy application with paperless documentation.

While looking for a 3 lakh Personal Loan EMI, you can choose a repayment loan tenure of up to 36 months (three years). For instance, if you borrow an instant loan of 3 Lakh at an interest rate of 18%, your EMIs for different loan terms would be as follows:

| Loan Amount | Tenure (In Year) | Interest Rate (per annum) | Monthly EMI | Total Interest | Total Amount Payable |

|---|---|---|---|---|---|

| Rs 3,00,000 | 1 Year | 18% | Rs 27,647 | Rs 31,764 | Rs 3,31,764 |

| Rs 3,00,000 | 1.5 Year | 18% | Rs 19,285 | Rs 47,130 | Rs 3,47,130 |

| Rs 3,00,000 | 2 Year | 18% | Rs 15,123 | Rs 62,952 | Rs 3,62,952 |

| Rs 3,00,000 | 2.5 Year | 18% | Rs 12,640 | Rs 79,200 | Rs 3,79,200 |

| Rs 3,00,000 | 3 Year | 18% | Rs 10,997 | Rs 95,892 | Rs 3,95,892 |

Disclaimer: The EMI calculations provided are approximations, and actual figures may differ.

At Hero FinCorp, you can apply for a Personal Loan of up to 3 Lakh and repay it in easy EMIs spread across a maximum tenure of 36 months. Here are some features and benefits you must know:

At Hero FinCorp, we have simple personal loan eligibility criteria that anyone can fulfill to qualify for a Rs 3 Lakh loan with a 3 year tenure. However, check these conditions before applying to ensure you meet the requirements and avoid rejection.

| Criteria | Requirement |

|---|---|

| Age | You must be between 21 to 58 years of age. |

| Citizenship | You must be an Indian citizen to apply for a Personal Loan at Hero FinCorp. |

| Work Experience | 1. Salaried Individuals: Minimum 6 months 2. Self-employed Individuals: Minimum 2 years of stable business operations |

| Monthly Income | The minimum income requirement is Rs 15,000 per month. |

| Credit Score | A score of 750+ is generally preferred for instant approval. |

We support a 100% digital loan process with zero paperwork and no branch visits at Hero FinCorp. Simply handy the following documents for instant verification.

Hero FinCorp provides Rs 3 lakh personal loan with the best personal loan interest rates. Our interest rates are highly competitive. However, before applying, you should be aware of other fees and charges to determine the total cost of your loan. Here is an overview.

| Charge Type | Details |

|---|---|

| Interest Rate | Starting from 18% p.a. |

| Loan Processing Charges | Starting from 2.5% + GST |

| Prepayment Charges | N.A. |

| Foreclosure Charges | 5% + GST |

| EMI Bounce Charges | Rs 350/- |

| Interest on Overdue EMIs | 1-2% of the loan/EMI Overdue Amount Per Month |

| Cheque Bounce | Fixed Nominal Penalty |

| Loan Cancellation | 1. Our online loan app does not charge any cancellation charges |

| 2. Interest amount paid is non-refundable | |

| 3. Processing charges are also non-refundable |

Note: The above rates are effective from 27.10.2023.

To apply for a loan online at Hero FinCorp is easy and simple. Here are the steps on how to get Rs 3 lakh loan online instantly:

Visit the Hero FinCorp website or download the personal loan app.

Go to the instant personal loan section and click ‘apply now’.

Enter your mobile number. Register yourself by submitting the OTP received.

Select the desired loan amount.

Complete your KYC verification. Check the income eligibility.

Click ‘Submit’ to finish your application.

A Personal Loan up to Rs 3 lakh can be used for various financial needs. Here are some common uses:

*Approval & Agreement: Loan approval is at Hero FinCorp's discretion. By applying, you agree to our Terms & Conditions, Privacy Policy, and Loan Agreement.

*Data Use: You consent to electronic processes and data use for loan assessment, as per our Privacy Policy.

*Security: Keep your account and device secure. Report our customer care for unauthorized activity immediately.

*Grievances: For concerns, refer to our Grievance Redressal Policy.

*EMI Payment: Refer to our T&Cs here*

*RBI Mandate: RBI requires transparent disclosures. Learn more from RBI.