Instant Approval

Get instant approval for a Rs 5 Lakh Instant Personal Loan when you apply through the Hero FinCorp website or loan app.

Need funds for renovation, travel, or urgent expenses? Apply for a Rs 5 Lakh Personal Loan from RBI-licensed NBFC Hero FinCorp with flexible EMIs, minimal paperwork, and a 100% secure digital process.

When you need quick financial support, a loan can help you manage expenses without disturbing your savings. With Hero FinCorp, you can get a Personal Loan of up to Rs 5 Lakh instantly through a simple hassle-free application. Apply for a loan online instantly with flexible repayment options of up to 36 months and enjoy flexible EMI plans that suit your budget. With a low-interest rate starting from 18% p.a., repayments stay affordable. Plus, with only the basic documents required for Rs 5 lakh personal loan, approval is quick and effortless.

Hеro FinCorp makes it easier to get a personal loan of Rs 5,00,000 perfect for handling urgent financial needs without stress. Here is why choosing Hero FinCorp is a smart decision:

Instant Approval in 10 Minutes: Get quick approval and access to your money in just 10 minutes, so you don't have to wait long.

No Security Needed: You can apply without having to put up any security or collateral, which makes the process easier.

100% Digital Process: The entire process, from application approval to submission, is online and paperless.

Flexible Tenure: Choose a repayment period that suits your budget and make it easy to repay with EMIs.

Minimal Documentation: Just a few basic documents are all it takes to complete your loan process.

While looking for a 5 Lakh instant loan, you can opt for a loan tenure of up to 3 years, according to your repayment capacity. For instance, assuming that the interest rate is 18% per annum, a 5 Lakh instant loan EMI calculator can calculate the EMI for for various loan terms as follows:

| Loan Amount | Tenure (in Months) | Interest Rate (per annum) | Monthly EMI | Total Interest | Total Amount Payable |

|---|---|---|---|---|---|

| Rs 5,00,000 | 12 | 18% | Rs 46,078 | Rs 52,936 | Rs 5,52,936 |

| Rs 5,00,000 | 18 | 18% | Rs 32,142 | Rs 78,556 | Rs 5,78,556 |

| Rs 5,00,000 | 24 | 18% | Rs 25,204 | Rs 1,04,896 | Rs 6,04,896 |

| Rs 5,00,000 | 30 | 18% | Rs 21,066 | Rs 1,31,980 | Rs 6,31,980 |

| Rs 5,00,000 | 36 | 18% | Rs 18,328 | Rs 1,59,808 | Rs 6,59,808 |

Disclaimer: The EMI calculations provided are approximations, and actual figures may differ.

Are you looking for an instant loan of Rs 5 Lakh? Here’s a look at its most important features and benefits:

At Hero FinCorp, securing a personal loan of up to Rs 5 lakh is easy with our simple personal loan eligibility criteria. Just meet the basic conditions and apply online!

| Criteria | Requirement |

|---|---|

| Age | You must be between 21 to 58 years of age. |

| Citizenship | You must be an Indian citizen to apply for a Personal Loan at Hero FinCorp. |

| Work Experience | 1. Salaried Individuals: Minimum 6 months 2. Self-employed Individuals: Minimum 2 years of stable business operations |

| Monthly Income | The minimum income requirement is Rs 15,000 per month. |

| Credit Score | A score of 750+ is generally preferred for instant approval. |

It is quick and easy to get a personal loan of Rs 5,00,000 without documentation. Just have the following required documents ready for salaried and self-employed individuals and get your application processed quickly.

Hero FinCorp charges nominal interest on personal loans, making the repayment of a Rs 5 lakh loan manageable. However, several factors can influence personal loan interest rates.

| Fees & Charges | Amount Chargeable |

| Interest Rate | Starting from 18% p.a. |

| Loan Processing Charges | Minimum 2.5% + GST |

| Prepayment Charges | N.A. |

| Foreclosure Charges | 5% + GST |

| EMI Bounce Charges | Rs 350/- |

| Interest on Overdue EMIs | 1-2% of the loan/EMI Overdue Amount Per Month |

| Cheque Bounce | Fixed Nominal Penalty |

| Loan Cancellation | 1. Online loan app does not charge any cancellation charges 2. Interest amount paid is non-refundable 3. Processing charges are also non-refundable |

Note: The above rates are effective from 27.10.2023.

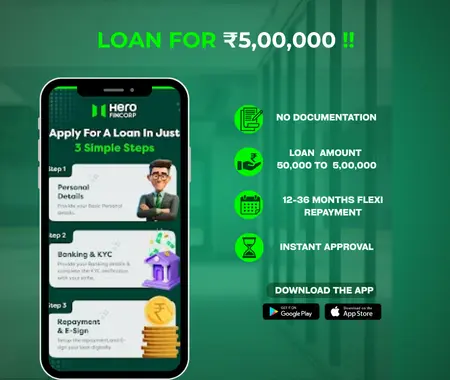

Applying for a Rs 5,00,000 personal loan with Hero FinCorp is quick and easy through the online process. Just follow these simple steps to complete your loan application and get the funds you need:

Visit the Hero FinCorp website or download the personal loan app.

Go to the instant personal loan section and click ‘apply now’.

Enter your mobile number. Register yourself by submitting the OTP received.

Select the desired loan amount.

Complete your KYC verification. Check the income eligibility.

Click ‘Submit’ to finish your application.

A Personal Loan of Rs 5 Lakh can be used for various financial needs, including:

*Approval & Agreement: Loan approval is at Hero FinCorp's discretion. By applying, you agree to our Terms & Conditions, Privacy Policy, and Loan Agreement.

*Data Use: You consent to electronic processes and data use for loan assessment, as per our Privacy Policy.

*Security: Keep your account and device secure. Report our customer care for unauthorized activity immediately.

*Grievances: For concerns, refer to our Grievance Redressal Policy.

*EMI Payment: Refer to our T&Cs here*

*RBI Mandate: RBI requires transparent disclosures. Learn more from RBI.