Attractive Interest Rate

Hero FinCorp offers competitive interest rates starting from 18% p.a.

When you face any financial emergency, you require funds instantly. While a few use their savings, most rely on a Personal Loan. A 3.5 Lakh loan can be quite helpful when you have big expenses or emergencies like medical bills, home repairs, weddings, or education fees.

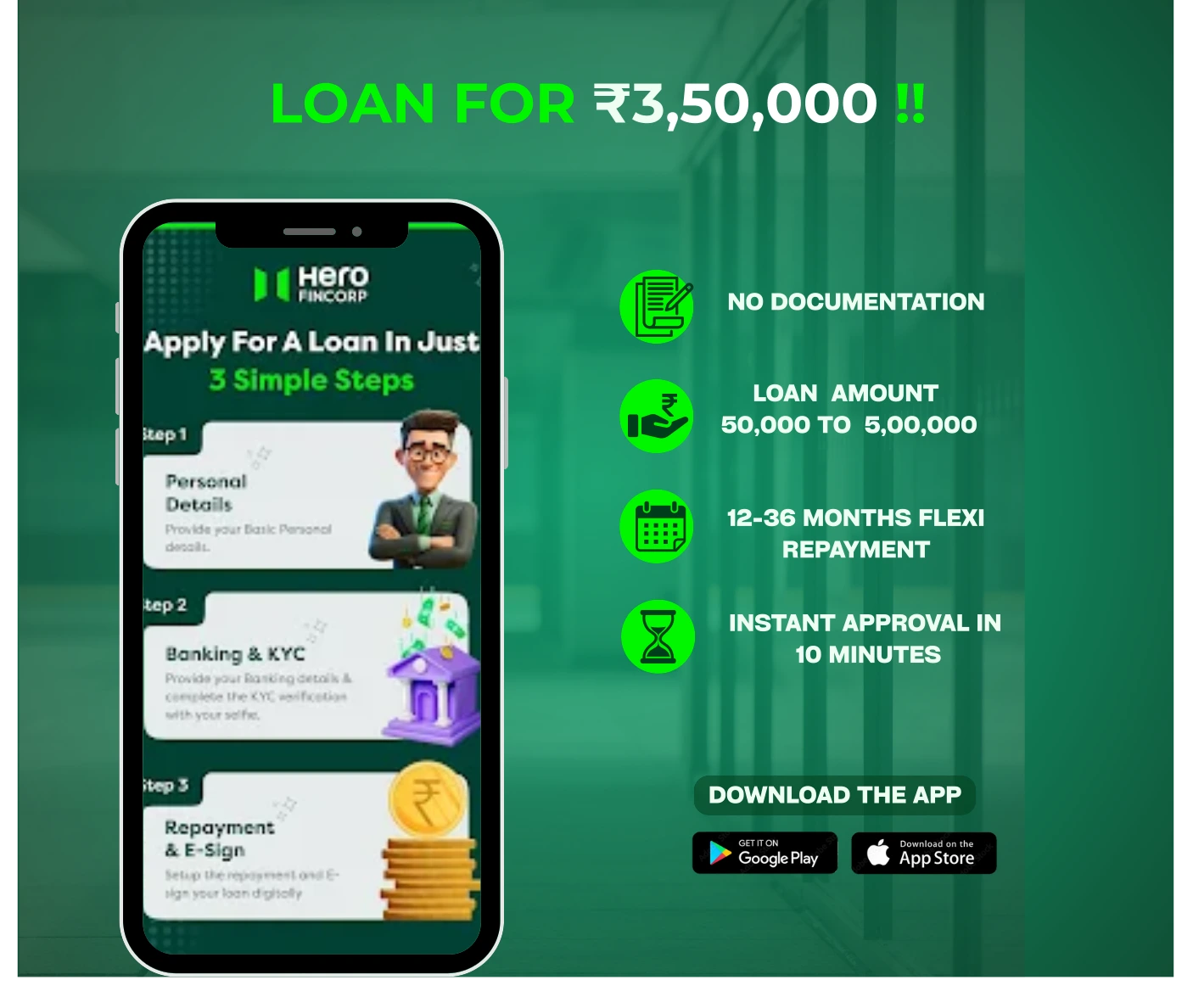

Hero FinCorp offers up to Rs 5 Lakh with interest rates starting from 18% p.a. and flexible repayment terms of up to 3 years. The best part is that you can get approval in 10 minutes when you apply online. You should have a minimum monthly income of Rs 15,000, a good credit score and a low debt-to-income ratio to be eligible for a Personal Loan of Rs 3.5 Lakh at Hero FinCorp.

You can cover your major expenses like medical emergencies, home renovations, weddings, or educational needs with Hero FinCorp's Rs 3.5 Lakh Personal Loan. Enjoy competitive interest rates (19% per annum), ensuring easy repayment. You can select flexible repayment periods of up to 36 months, alleviating financial strain. Our convenient digital application process streamlines the experience, saving time and effort. Access to instant funds offers peace of mind during unexpected financial hurdles. You can choose EMIs using our Personal Loan EMI Calculator to fit comfortably within your budget, ensuring smooth repayment.

When considering a Personal Loan of Rs 3.5 Lakh, it's essential to understand how the repayment amount varies based on the chosen tenure. You can use a personal loan EMI calculator to calculate your EMIs instantly online.

Here is a table illustrating the monthly EMI for Rs 3.5 Lakh Personal Loan for different repayment periods ranging from 12 to 36 months, assuming an interest rate of 18% per annum:

| Loan Amount (Rs) | Tenure (in Months) | Interest Rate* (%) | Monthly EMI (Rs) | Total Interest | Total Amount Payable |

| 3,50,000 | 12 | 18% | 32,255 | 37,060 | 3,87,060 |

| 3,50,000 | 18 | 18% | 22,499 | 54,982 | 4,04,982 |

| 3,50,000 | 24 | 18% | 17,643 | 73,432 | 4,23,432 |

| 3,50,000 | 30 | 18% | 14,746 | 92,380 | 4,42,380 |

| 3,50,000 | 36 | 18% | 12,830 | 1,11,880 | 4,61,880 |

Disclaimer: The EMI calculations provided are for illustrative purposes only and may vary based on applicable interest rates, processing fees, and other factors. Actual loan terms will be determined at the time of application and approval.

Hero FinCorp’s Personal Loan has several advantages. Here are the key features and benefits of our loan:

Before applying for a Personal Loan of Rs 3.5 Lakh, make sure you meet the eligibility criteria. These include your age, monthly income, work experience, and Indian citizenship. At Hero FinCorp, the personal loan eligibility criteria are simple and easy to fulfil.

| Criteria | Requirement |

|---|---|

| Age | You must be between 21 to 58 years of age. |

| Citizenship | You must be an Indian citizen to apply for a Personal Loan at Hero FinCorp. |

| Work Experience | 1. Salaried Individuals: Minimum 6 months 2. Self-employed Individuals: Minimum 2 years of stable business operations |

| Monthly Income | The minimum income requirement is Rs 15,000 per month. |

| Credit Score | A score of 750+ is generally preferred for instant approval. |

At Hero FinCorp, the documentation requirements differ for salaried and self-employed applicants. Knowing the requirements before applying and being ready with the documents required for a personal loan is better to ensure a smooth application process. Here is the list of documents.

Duly filled application form, Passport-size photograph

Driving License, Passport, PAN Card, Aadhaar Card (Any One)

Driving License, Passport, Aadhaar Card, Ration Card, Utility Bill (Any One)

Residence Ownership Proof (Electricity Bill, Maintenance Bill, Property Document)

Last 6 Months’ Salary Slips, Bank Statements & Form 16

Duly filled application form, Passport-size photograph

Driving License, Passport, PAN Card, Aadhaar Card (Any One)

Driving License, Passport, Aadhaar Card, Ration Card, Utility Bill (Any One), Office Address Proof (if applicable)

Business Existence Proof (Tax Registration, Shop Establishment Proof, Company Registration Certificate)

Last 6 Months Bank Statements & ITR for 2 Years

At Hero FinCorp, we offer hassle-free personal loans of Rs 3.5 Lakh with competitive personal loan interest rates and minimum paperwork. But before you apply, you must know about any extra charges that might add up and affect your total loan cost. Here's a simple breakdown:

| Fees & Charges | Amount Chargeable |

| Interest Rate | Starting from 18% p.a. |

| Loan Processing Charges | Minimum 2.5%+ GST |

| Prepayment Charges | N.A. |

| Foreclosure Charges | 5% + GST |

| EMI Bounce Charges | Rs 350/- |

| Interest on Overdue EMIs | 1-2% of the loan/EMI Overdue Amount Per Month |

| Cheque Bounce | Fixed Nominal Penalty |

| Loan Cancellation |

|

Note: The above rates are effective from 27.10.2023.

The instant loan online application process at Hero FinCorp is quick and simple. Here are the steps to apply for a Personal Loan of Rs 3.5 Lakh online.

Visit the Hero FinCorp website or install the personal loan app

Go to the personal loan page and click ‘apply now’

Enter your mobile number and verify with the OTP received

Choose the loan amount you need

Verify your KYC details to check income eligibility

Click ‘Submit’ to complete your application

A Personal Loan of Rs 3.5 Lakh can be used for various purposes. Here are the most common uses:

*Approval & Agreement: Loan approval is at Hero FinCorp's discretion. By applying, you agree to our Terms & Conditions, Privacy Policy, and Loan Agreement.

*Data Use: You consent to electronic processes and data use for loan assessment, as per our Privacy Policy.

*Security: Keep your account and device secure. Report our customer care for unauthorized activity immediately.

*Grievances: For concerns, refer to our Grievance Redressal Policy.

*EMI Payment: Refer to our T&Cs here*

*RBI Mandate: RBI requires transparent disclosures. Learn more from RBI.