Competitive Interest Rate

Get competitive interest rates starting from 18% p.a., making your loan cost-effective over the repayment tenure.

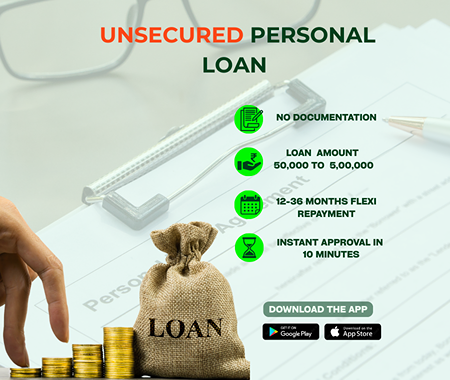

Struggling to manage unexpected expenses? Hero FinCorp's unsecured personal loan offers quick access to funds online, without the need for collateral, so you can handle your financial needs with ease.

Unexpected expenses can put a lot of stress on your finances, whether it’s a medical emergency, a home renovation project, or education costs. Finding the right funds quickly without going through complex procedures can feel overwhelming.

Hero FinCorp can help you with unsecured personal loans online, providing financial flexibility and convenience. You can borrow up to Rs 5 Lakh without requiring any collateral or pledging an asset and use it for any purpose, from holidays to medical emergencies uor higher education.

You can apply from home via the app, or website. With KYC documents and a minimum income of Rs 15,000, you can get instant approval online in just 10 minutes.

Obtaining an Unsecured Personal Loan can be a significant financial aid if you require funds for a major expense or an emergency. Here is how.

Enjoy numerous advantages offered by Hero FinCorp's unsecured Personal Loan, customized to your requirements:

Before applying for an unsecured loan online, make sure you are eligible for the loan. The eligibility criteria include your age, stable income, work experience, and Indian citizenship. At Hero FinCorp, the personal loan eligibility criteria are simple and easy to fulfil.

| Eligibility Criteria | Details |

|---|---|

| Age | Applicants should be between 21 and 58 years. |

| Citizenship | You should be a citizen of India. |

| Work Experience | Six months for salaried individuals and 2 years for self-employed individuals. |

| Monthly Income | You should have a minimum income of Rs 15,000 monthly. |

Obtaining a collateral-free personal loan is fast and easy, provided you have a monthly salary of Rs 15,000. No heavy paperwork is required; if you are eligible, simply keep the following documentation ready. This option is available to both salaried and self-employed individuals, making the loan approval process smooth and allowing you to process your application instantly.

You should be aware of the loan costs, like the interest rates and processing fees, before applying for an unsecured personal loan online. At Hero FinCorp, the interest rates on personal loans are competitive, and other charges are nominal, making it an ideal choice for those who need quick funds. Here are the details.

| Fees & Charges | Amount Chargeable |

|---|---|

| Interest Rate | Starting from 18% p.a. |

| Loan Processing Charges | Minimum 2.5% + GST |

| Prepayment Charges | N.A. |

| Foreclosure Charges | 5% + GST |

| EMI Bounce Charges | Rs 350/- |

| Interest on Overdue EMIs | 1-2% of the loan/EMI Overdue Amount Per Month |

| Cheque Bounce | Fixed Nominal Penalty |

| Loan Cancellation |

|

Applying for an unsecured personal loan online is now more accessible than ever. With a quick and easy process, you can easily get instant funds to meet your financial needs.

Visit the Hero FinCorp website or download the personal loan app.

Click on the 'Apply Now' tab on the Instant Personal Loan page.

Enter your mobile number and register yourself with the OTP received.

Enter your loan amount.

Complete your KYC verification and verify your income eligibility.

Click 'Submit' to complete your online loan application and receive instant approval for your unsecured personal loan.