What is the Electronic Clearing System (ECS)? Definition, Process, and Benefits

- What Is the Electronic Clearing System (ECS) in Banking and Why It Matters

- Types of Electronic Clearing System (ECS)

- Geographic Variants of ECS (Local, Regional & National)

- How Does the ECS Work?

- ECS Charges and Fees

- ECS vs Other Payment Modes

- How to Set Up and Cancel an ECS Mandate

- ECS in India: Regulatory Framework and RBI's Role

- Things to Keep in Mind While Using ECS

- Why Automating Your Payments Matters More Than You Think

- Frequently Asked Questions

Your financial life probably runs on recurring payments, monthly EMIs, insurance premiums, a SIP, utility bills, etc. These get deducted on the same date every month.

However, it’s still easy to lose track when you’re managing multiple payments. Missing a payment deadline by a day means penalties or service disruptions. This is why automated payment systems like Electronic Clearing System (ECS) in banking play an important role and change the game.

Introduced by the RBI, ECS is a behind-the-scenes payment system that offers convenience by handling bulk, repetitive payments. But what exactly is it, how does it work, and why should you care? Let’s break it down.

What Is the Electronic Clearing System (ECS) in Banking and Why It Matters

The Electronic Clearing System (ECS) is an RBI-regulated, paperless payment mechanism that enables automatic, recurring transfers between bank accounts. It is commonly used for EMIs, insurance premiums, utility bills, and subscriptions.

Once you authorise a mandate, ECS allows an institution to debit or credit your account on pre-decided dates, without requiring manual action each time. Your bank processes these transactions securely, ensuring payments are completed on schedule.

Beyond automation, ECS brings clear advantages for both individuals and financial institutions:

- Convenience: Payments happen automatically, so you don’t have to track due dates or initiate transfers.

- Lower risk of penalties: Timely debits reduce the chances of late fees or extra interest on EMIs and bills.

- Fewer payment errors: Pre-approved mandates minimise failures caused by incorrect details or delays.

- Suitability for long-term commitments: Ideal for loans and insurance, as it avoids repeated approvals.

- Operational efficiency for lenders: Automatic collections lower default risk and administrative effort.

- Security and predictability: RBI oversight, encryption, and audit trails ensure safety and easier budgeting.

- Cost-effective and eco-friendly: Reduced paperwork lowers costs and supports a digital-first ecosystem

Types of Electronic Clearing System (ECS)

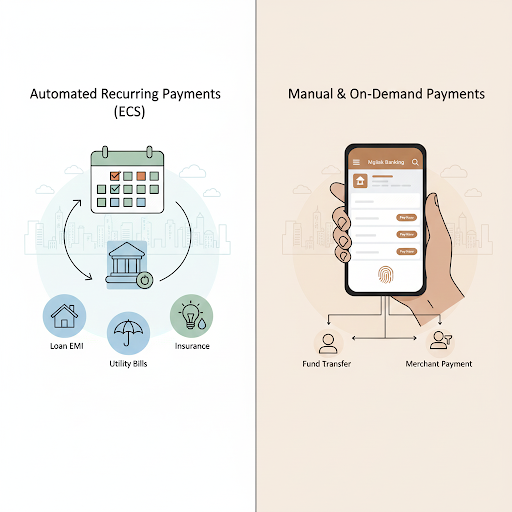

In India, ECS works in two modes: debit and credit.

- ECS debit is the most common method for deducting money from your account. This is for loan EMIs, insurance premiums, SIPs, utility bills, credit card payments, etc.

- ECS credit is used when money is credited to your account. Employers use this for salary disbursements, companies for refunds and dividends, interest payouts by banks, etc.

Both types of ECS reduce delay, errors, and dependency on manual work.

Geographic Variants of ECS (Local, Regional & National ECS)

ECS isn’t the same across India. It operates through different geographic formats based on coverage. The location-based ECSs ensure smooth payments even when banks operate within limited geographical networks.

There are three variants of ECS and each covers a specific location along with use cases given in the below table.

| Variant | Coverage | Use Case |

| Local ECS | City or region-specific | For local utility bill payments |

| Regional ECS | State or multi-state level | Regional bill payments, interstate salary disbursals |

| National ECS | Pan-India coverage | Large-scale EMI collections |

How Does the ECS Work?

ECS works on a mandate-based system. The process is quite straightforward, and here’s how it works:

Step 1: Authorisation

You give a written or digital consent (called an ECS mandate) to the institution to debit funds from your account.

Step 2: Submission

The institution submits this mandate to its bank, which contains the customer’s account details and deduction amounts. It then coordinates with the clearing house.

Step 3: Processing

Your bank receives the request on the predetermined date and verifies your account details. If everything checks out, the funds are held.

Step 4: Settlement

On the due date, the ECS system automatically processes the payment amount. The money moves from your account to the institution’s account without any manual intervention.

This means that ECS quietly runs in the background without any reminders, queues, or paperwork.

Also Read - What is an Electronic Payment System & How Does It Work?

ECS Charges and Fees

ECS is a cost-effective system for both individuals and institutions. Setting up an ECS mandate is usually free for customers. But there are charges to be aware of:

Standard Charges

Many banks offer free ECS registrations or charge a nominal amount of ₹50. The institution usually bears ECS transaction charges and not the customer.

Return/Failure Charges

An ECS return can happen due to insufficient balance, incorrect account details, or account closure. In such cases, you may face return charges and penalties.

- Due to insufficient balance or failed transaction, you may be levied with ₹50-₹100 per bounce.

- Repeated ECS failures may attract late payment fees and damage your credit score.

Bank Variations: ECS charges vary across banks. It’s recommended to always check with your bank for setting up a mandate.

How to avoid charges: Maintain an adequate balance before the deduction date, set up SMS alerts, and monitor your account regularly to avoid transaction failures.

ECS vs Other Payment Modes

ECS is governed by RBI guidelines and is designed specifically for recurring payments. Meanwhile, standing instructions let you set fixed account-level transfers.

Here’s how ECS compares to other payment systems:

| System | Speed | Best for | Recurring |

| ECS | 1-2 days | Recurring payments, EMIs | Yes |

| NEFT | 30 mins - 2 hours | P2P transfers | No |

| RTGS | Real-time | High-transaction, urgent transfers | No |

| NACH | 1-2 days | Recurring, modern payments / EMIs | Yes |

NACH (National Automated Clearing House) and AutoPay are newer systems that have evolved from ECS but the core idea of automated, reliable payments without manual intervention stays. Although ECS continues to work reliably for millions of daily transactions, NACH is becoming the industry standard and is preferred by modern lenders.

Also Read - Personal Loan eNACH vs UPI AutoPay for EMI Repayments

How to Set Up and Cancel an ECS Mandate

Setting up ECS

- Request an ECS mandate form from the institution or download it from their website

- Fill in your bank account details, account type, and IFSC code

- Sign the form and submit it to the institution or your bank

- The details are verified within 2-3 business days by your bank

- Once the mandate is activated, the deductions begin on the agreed date

Today, many banks allow setting up an ECS mandate via net banking and mobile apps. It’s faster and paperless, too.

Cancelling ECS

- Inform your bank or institution in writing or via net banking

- Provide your mandate reference number

- The cancellation process typically takes 5-7 business days

- Confirm cancellation via email or SMS

ECS in India: Regulatory Framework and RBI's Role

ECS operates under strict RBI guidelines and oversight. This ensures security, reliability, and standardisation across banks. ECS mandates are protected under RBI rules and any unauthorised debits can be disputed and reversed.

The National Payments Corporation of India (NPCI) modernised ECS with NACH. While ECS continues working smoothly, NACH is now the gold standard with a faster and more robust clearing system.

All ECS transactions are encrypted, making it the safest recurring payment method in India. Banks have to maintain audit trails and customers have dispute resolution mechanisms if anything goes wrong.

Things to keep in mind while using ECS

Before setting up the ECS mandate, remember these essentials:

- Ensure sufficient balance in the account before the due date

- Banks retry failed transactions, but they can hurt your credit history if EMIs and credit card dues are not cleared on time

- You can stop or reverse ECS mandates, but this requires formal intimation and time.

- Set up SMS alerts for ECS transactions so you’re aware of the deductions.

Why Automating Your Payments Matters More Than You Think

ECS and its impact on everyday finances are significant. It brings peace of mind for anybody managing monthly financial commitments. The system has made recurring payments smoother, faster, and more reliable. Understanding this helps you stay financially organised and stress-free, especially if you’re managing loans or planning one soon.

If you need quick access to funds, explore Hero FinCorp's personal loan options. We offer loans of up to ₹5 lakh. Apply online in minutes with clear terms and fast disbursal!

Frequently Asked Questions

Is ECS safe to use?

Yes. Your bank and RBI oversee the system. You can dispute any unauthorised transactions within a reasonable timeframe. Contact your bank immediately if you notice any unusual deductions.

What happens if I don’t have enough balance and the ECS fails?

The transaction may fail or bounce, and this can impact your credit score if it’s a loan EMI. It may also attract penalties or late fees in case of utility bills.

Can I cancel the ECS mandate?

You can stop or modify an ECS mandate by informing the bank or institution.

What are ECS return charges, and how can I avoid them?

ECS return charges are penalties applied when the ECS debit transaction fails. It happens due to insufficient balance, incorrect account details, or account closure. Maintaining adequate balance and updating mandate details helps avoid the charges.

How long does ECS processing take for debits and credits?

Typically 1-2 business days. They are usually processed on the scheduled date. Settlement timelines may vary slightly depending on the bank and clearing cycle.

What is the difference between ECS and NACH?

NACH is the new successor to ECS. It is faster, more secure, and increasingly used by lenders. Both serve the same purpose of handling recurring payments reliably.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.