Personal Loan eNACH vs UPI AutoPay for EMI Repayments: Failure Points, Chargeback Rights, and a Setup Checklist to Avoid Late-Payment Marks

Managing monthly EMIs for your personal loan can be stressful, especially when you have to juggle multiple payments. Missing even one EMI doesn’t just mean paying a penalty; it can also harm your credit score, leaving a negative mark that might affect your financial freedom for years. Managing a bank personal loan involves understanding key aspects such as the loan and interest rate, repayment tenure, and loan processing charges, all of which play a significant role in your overall loan experience. The interest rate on a personal loan depends on several factors, including your credit score, repayment history, principal amount, and loan tenure. To avoid such risks, many borrowers are shifting from manual payments to automated options like eNACH and UPI AutoPay. These solutions offer convenience and security, but understanding their differences is crucial to choosing the best method for your needs.

Timely EMI payments are crucial for maintaining a good interest rate and ensuring smooth loan approval for future credit needs.

If you’re wondering which auto-debit method is safer, easier to set up, or better suited for your personal loan EMI repayments, this guide will help you decide.

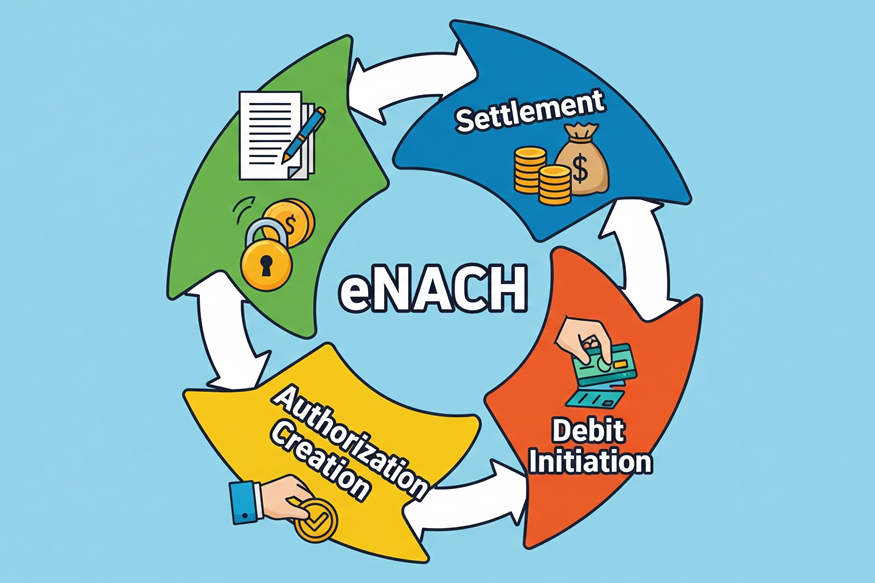

What is eNACH (Electronic National Automated Clearing House)?

eNACH is essentially a digital standing instruction linked to your bank account. Once you provide one-time approval, your personal loan EMI is automatically deducted every month without any further intervention. This paperless and secure method is backed by the National Payments Corporation of India (NPCI), ensuring reliability and safety. It’s an excellent option for borrowers who want a hassle-free way to keep their repayments on track, especially for long-term personal loans or insurance premiums.

With eNACH, once the setup is complete, you no longer need to worry about remembering due dates or manual payments. The fixed monthly instalments are deducted seamlessly, helping you maintain a good repayment history and avoid late fees. Each EMI consists of both the principal and the interest, which means that with every payment, the outstanding principal on your loan is gradually reduced over the loan tenure.

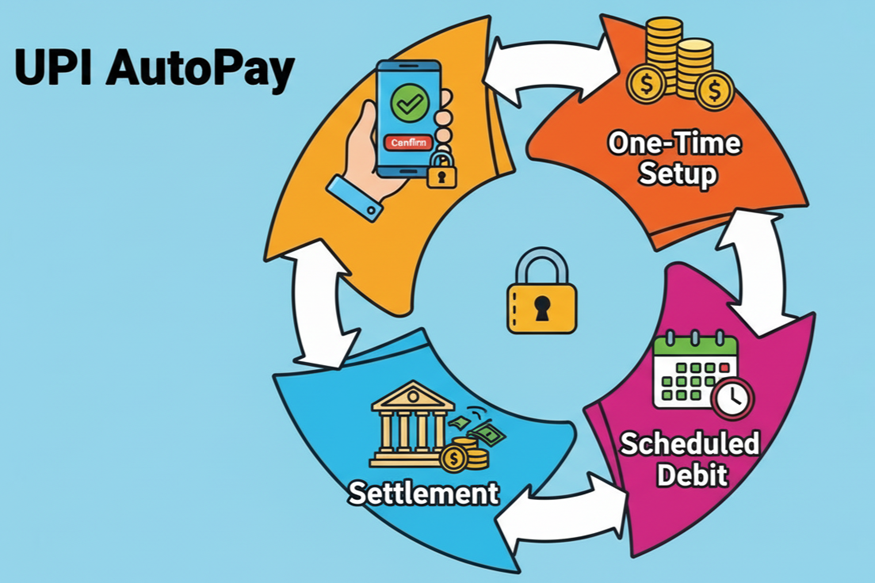

What Is UPI AutoPay (Unified Payments Interface AutoPay)?

UPI AutoPay is a newer, flexible payment method that works within popular UPI apps on your smartphone. It’s ideal for frequent or smaller recurring payments, including EMIs on short-term personal loans. Setting up UPI AutoPay takes just a few clicks via your UPI app, where you authorize payments using your UPI PIN. The personal loan application process is streamlined, often requiring only a simple loan application form and minimal documentation for approval. Some lenders also provide pre-approved personal loan offers, allowing eligible customers to access funds quickly and conveniently. This method offers real-time control, allowing you to pause, modify, or cancel payments as needed.

Because of its flexibility, UPI AutoPay is preferred by borrowers who want more control over their repayments and the ability to manage their personal loan EMI schedules actively. It’s also suitable for those who want to avoid the rigid structure of fixed mandates. UPI AutoPay can be linked directly to your personal loan application, making the entire process from application to repayment seamless and efficient.

eNACH vs UPI AutoPay: Key Differences in Personal Loan Interest Rates

To help you choose the right auto-debit method for your personal loan EMI repayments, here’s a comparison of eNACH and UPI AutoPay based on important factors:

| Factor | eNACH | UPI AutoPay |

| Best for | Long-term, high-value EMIs like personal loans; also suitable for unsecured loans and instant personal loans that require reliable, automated repayments | Small to medium EMIs with flexible control |

| Setup process | One-time authentication via net banking or debit card; fully digital and paperless | Instant setup inside your UPI app using UPI PIN |

| Transaction limit | Higher limits, often up to ₹1 crore | Generally up to ₹1 lakh |

| Failure points | Insufficient balance or bank-side glitches; less frequent but harder to resolve | Insufficient funds, network issues, or UPI PIN changes; payments above ₹15,000 need approval |

| Chargeback rights | Mandate can be canceled or stopped through your bank | Payments can be paused, modified, or canceled directly in UPI app |

| Control | Fixed mandate with less flexibility | Greater control with easy pause and modify options |

Pro Tip: Always keep a buffer amount in your bank account. This small extra balance can save you from failed deductions and late fees.

Both eNACH and UPI AutoPay are ideal for managing repayments on unsecured loans, including instant personal loans and instant personal loan online products. These loans are typically disbursed quickly and the funds are credited to your bank account instantly. Instant loans and instant personal loans are popular for their quick approval and minimal documentation, making automated repayment methods like eNACH and UPI AutoPay even more valuable for hassle-free EMI management.

A Practical Checklist to Avoid Personal Loan EMI Failure

Consider Priya, a 35-year-old financial analyst who once missed her personal loan EMI because her UPI-linked bank account lacked sufficient funds. That single missed payment led to late fees and negatively impacted her credit score. To avoid such situations, Priya now follows a simple checklist that you can adopt too:

• Gather all required loan documents and personal loan documents before applying to ensure a smooth process.

• Check the eligibility criteria and personal loan eligibility criteria, and use a personal loan eligibility calculator to determine your maximum loan amount or maximum loan eligibility.

• Specify the required loan amount clearly in your application, especially if you have an existing loan or existing personal loan and are seeking a top-up.

• Review the processing fee, processing fees, personal loan processing fee, and loan processing charges before finalizing your loan application.

• Consider your debt to income ratio when applying for a new loan, as it affects your eligibility and approval chances.

• Use personal loans for various needs such as medical emergency, medical emergencies, medical expenses, medical bills, unexpected expenses, emergency loan requirements, home renovations, home renovation, or as a personal loan for home improvements.

• Note that personal loans generally do not offer tax benefits.

• Keep your KYC and bank account details updated to ensure smooth mandate setup and processing.

• Maintain sufficient funds in your bank account at least 2–3 days before your EMI due date to avoid failed auto-debits.

• Double-check the mandate amount and frequency when setting up eNACH or UPI AutoPay to prevent errors.

• Use the same registered mobile number and email address to receive timely alerts about your EMIs.

• Monitor your SMS and UPI notifications daily. For UPI AutoPay, remember that transactions above ₹15,000 require your explicit approval.

• Regularly review your mandate status through your bank portal or UPI app to ensure active and error-free mandates.

• Have a backup plan: if auto-debit fails, log in to your lender’s app, such as Hero FinCorp, and make the payment manually.

Following this checklist helps you stay on top of your personal loan EMIs, protect your credit score, and avoid unnecessary penalties.

Pro Tip: Use Hero FinCorp’s Personal Loan EMI Calculator to estimate your monthly instalments and ensure they fit your budget comfortably.

Which Is Better for You? Understanding Personal Loan Eligibility Criteria

The choice between eNACH and UPI AutoPay depends largely on your repayment preferences and lifestyle.

• Choose eNACH if you prefer a “set and forget” approach. It’s ideal for long-term personal loans with fixed monthly instalments, offering hassle-free automatic deductions without needing frequent intervention.

• Choose UPI AutoPay if you want more control over your payments. This method suits borrowers who actively use UPI apps and prefer the flexibility to approve, pause, or modify EMIs on the go.

You can get a personal loan or apply for personal loan online with just a few clicks, and understanding how a personal loan work helps you choose the best repayment method.

Most lenders, including Hero FinCorp, provide both options, allowing you to select the one that best aligns with your financial habits and personal loan requirements. A wide range of personal loan offered by banks and financial institutions, including bank personal loan and online personal loan, can be managed using these repayment methods.

Pro Tip: Use Hero FinCorp’s Personal Loan App to check your personal loan eligibility quickly and plan your loan application process better.

Choose the Right Repayment with Flexible Repayment Options from Hero FinCorp!

Both eNACH and UPI AutoPay offer reliable and secure ways to manage your personal loan EMI repayments. Understanding their differences empowers you to pick a repayment method that fits your loan tenure, repayment capacity, and lifestyle.

Hero FinCorp simplifies your personal loan journey with a fully digital, paperless process—from application to repayment. You can check your personal loan eligibility in just a few clicks, apply for a personal loan online, and set up your preferred repayment plan with minimal documentation and competitive interest rates. Hero FinCorp offers a personal loan interest rate and personal loan interest rates that are transparent and affordable, making it easier for borrowers to manage their finances with affordable interest rates.

Ready to take control of your financial needs? Sign in to Hero FinCorp and get started on your path to financial freedom today.

Apply for a personal loan now and experience instant approval and flexible repayment options.

Frequently Asked Questions

1. Is UPI AutoPay safe for loan EMIs?

Yes, UPI AutoPay is completely safe. It is regulated by the RBI and uses two-factor authentication for every transaction. Additionally, you have instant control to pause or raise disputes directly within your UPI app.

2. What happens if my EMI auto-debit fails?

A failed EMI can lead to bounce charges and negatively affect your credit score. To avoid this, always maintain a buffer balance in your bank account and monitor payment alerts regularly.

3. Can I switch from eNACH to UPI AutoPay?

Yes, many lenders, including Hero FinCorp, allow you to switch repayment modes. You just need to cancel the existing mandate and set up a new one as per your preference.

4. Do I need physical documents for mandate setup?

No, with lenders like Hero FinCorp, the entire process is digital and paperless. You only need your PAN, Aadhaar, and bank account details to complete the setup quickly and securely.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented Here is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.