Difference Between CRR and SLR

- Introduction to CRR and SLR

- What Is CRR in Banking?

- Differences Between CRR and SLR in Banking Explained

- Why Are CRR and SLR Crucial for Banking and the Economy?

- Why Are SLR and CRR Important in Personal Finance?

- What Happens If Banks Don’t Comply?

- Understanding the Difference Between CRR and SLR

- Frequently Asked Questions

Sometimes it can be difficult to understand how banks handle your money, particularly when you come across extremely technical terminology like Statutory Liquidity Ratio (SLR) and Cash Reserve Ratio (CRR).

CRR and SLR are essential for understanding why loan interest rates fluctuate, why credit availability tightens at certain times, and how the Reserve Bank of India (RBI) manages inflation and liquidity.

Sliding down the difference between CRR and SLR gives you a good grounding in how the RBI plays a hand in the money supply and the financial stability of the country as well. In this post, we explore CRR and SLR in banking, their functioning, and the differences that separate them.

Introduction to CRR and SLR

CRR and SLR are key monetary policy instruments that banks must follow to maintain financial discipline.

• A commercial bank is required to hold a minimum percentage of its total deposits as a cash reserve with the RBI, known as the CRR.

• The percentage of total deposits that must be kept in cash, gold, or other authorised securities is known as SLR.

What precisely distinguishes CRR from SLR, then?

Where the money is kept, how it is spent, and how it impacts a bank's ability to lend and its financial stability are the primary areas of distinction.

What Is CRR in Banking?

The minimum proportion of total deposits that a commercial bank must maintain as a cash reserve with the RBI is known as the CRR.

CRR is a regulatory mandate to control excess money flow in the financial system. CRR is expressed as a fixed percentage of a bank’s net demand and time liabilities (NDTL). The RBI increases CRR to absorb excess cash from the economy and lowers it to stimulate economic activity.

Need quick financial support? Check your loan options on our instant loan app and apply in minutes.

What Is SLR in Banking?

SLR is a mandatory reserve that commercial banks must hold in the form of cash, gold and approved securities. SLR is the minimum percentage of a commercial bank's NDTL held as approved securities.

SLR ensures bank stability and controls the money supply. It prevents banks from lending out all of their deposits, serves as a buffer against bank runs, offers emergency funding, and aids in controlling credit flows in the economy.

Differences Between CRR and SLR in Banking Explained

Here are the key differences between SLR and CRR:

Basis of Difference | CRR (Cash Reserve Ratio) | SLR (Statutory Liquidity Ratio) |

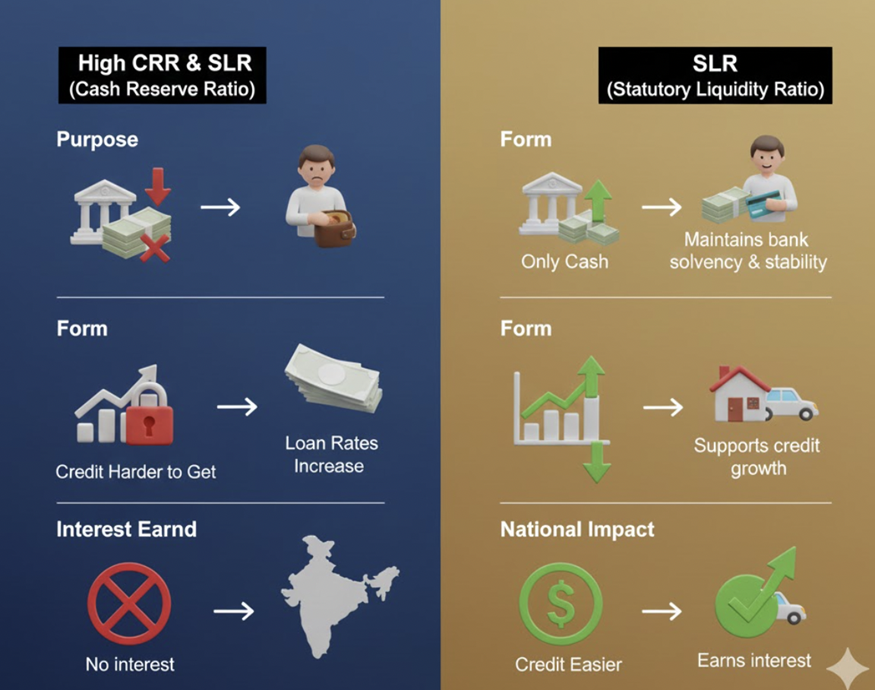

Purpose | Manages liquidity and controls the overall money supply in the economy | Maintains bank solvency and financial stability |

Form | Maintained only as cash | Maintained as cash, gold, and approved government securities |

National Impact | Regulates the country’s cash liquidity | Supports and regulates overall credit growth |

Interest Earned | No interest is earned on the CRR balance kept with the RBI | Banks earn interest on government securities held as SLR |

CRR is an effective strategy for managing inflation since it takes money out of circulation directly by sending it to the RBI. In contrast, SLR keeps money within the banking system but restricts its use for risky lending.

While CRR affects temporary liquidity, SLR offers long-term financial safety.

Why Are CRR and SLR Crucial for Banking and the Economy?

The importance of CRR and SLR extends beyond the banking industry and plays a vital role in the overall economy.

These ratios assist the RBI in:

• Controlling inflation and excessive monetary supply

• Making sure that the banks are financially healthy

• Controlling the availability of credit

• Stabilising interest rates

• Promoting balanced growth

The RBI periodically assesses the CRR and SLR in light of inflation, GDP growth, and liquidity conditions.

In recent years, CRR cuts have been followed by full hikes after monetary easing. The RBI slashed the CRR by 50 basis points to 4%, injecting ₹1.16 lakh crore into the banking system in 2024.

SLR has not changed significantly to maintain the banking system's resilience.

Like changes in the Repo rate, changes in CRR and SLR affect lending, loan interest rates, deposit returns and overall credit growth in the Indian economy.

Also Read: Reverse Repo Rate: Meaning and How It Works?

Why Are SLR and CRR Important in Personal Finance?

CRR and SLR are two significant factors that affect lending costs in personal finance.

• A rise in CRR means banks have less money to lend, and borrowing rates on personal loans and EMIs usually go up.

• A high SLR can also restrict aggressive lending, impacting the availability of home and auto loans.

During periods of higher CRR and SLR, borrowers must meet more stringent eligibility criteria, and access to credit becomes more difficult.

A reduction in SLR and CRR rates means good news for borrowers.

Also Read: What is the Interest Coverage Ratio?

What Happens If Banks Don’t Comply?

If banks fail to comply with CRR and SLR requirements, they face strict penalties from the RBI.

These include

• Financial fines

• Higher interest penalties

• Reputational risks

Persistent non-compliance may also result in

• Regulatory action

• Operational restrictions

• Heightened supervision could impair the bank's overall credibility.

Understanding the Difference Between CRR and SLR

Two essential monetary policy instruments used by the RBI to control liquidity and financial stability in the Indian economy are CRR and SLR.

Borrowers can anticipate rate changes, apply for loans on schedule, and make wise personal financial decisions by knowing how CRR and SLR operate and the distinctions between the two.

At Hero FinCorp, we understand how changes in monetary policy affect your borrowing decisions. Our digital lending solutions are designed to help you access funds with clarity, speed, and confidence—no matter the market conditions.

Download our instant loan app now and explore personalised loan options with quick approvals and a seamless digital experience!

Frequently Asked Questions

1. Who fixes the CRR and SLR rates in India?

In India, the RBI sets and controls the SLR and CRR rates.

2. How many times can RBI change CRR and SLR rates?

The CRR and SLR ratios may occasionally be modified by the RBI, usually during reviews of its monetary policy pronouncements.

3. Does every Indian bank need to maintain CRR and SLR?

Yes, all scheduled commercial banks in India are mandated to maintain CRR and SLR in accordance with RBI norms.

4. Can CRR and SLR impact inflation?

Indeed. Banks have less money available for lending when the RBI raises the CRR or SLR, which helps reduce excess demand and manage inflation. Reducing these ratios boosts liquidity, which promotes loan expansion and spending.