Attractive Interest Rate

You can access competitive interest rates up to 18% per annum, ensuring you can pay off your borrowed amount without much hassle.

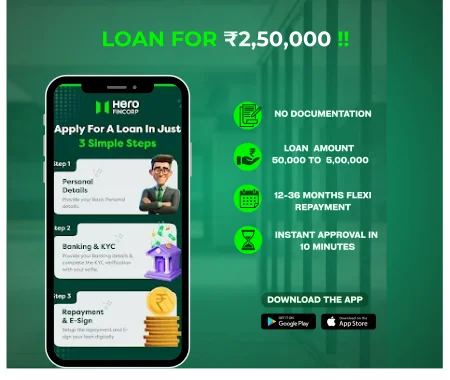

Need urgent funds? Hero FinCorp makes it easy to apply for a Personal Loan of up to Rs 2.5 Lakh. Whether you're planning a vacation or managing personal expenses, we offer instant approval in just 10 minutes. Enjoy competitive interest rates, flexible repayment tenures, and a hassle-free digital process. With a minimum monthly income of just Rs 15,000, you can qualify easily. Experience the convenience of fast, reliable, and transparent financial solutions. Apply now with Hero FinCorp and take the first step toward achieving your goals—without delays or complications.

Applying for a 2.5 Lakh Personal Loan can be very helpful for various reasons, such as a wedding, an unforeseen emergency, medical expenses, home renovation, higher education, and more. With Hero FinCorp, applicants do not need to pledge any collateral, making it easy to borrow. To apply, you need to meet the basic loan criteria, and we'll get back to you with a loan offer.

To plan your loan repayment better, it is important to know the EMI amount of your Personal Loan. You can use a personal loan emi calculator on our website. For your convenience, here is a table showing EMI for a Personal Loan of Rs 2.5 Lakh for different tenures.

| Loan Amount (Rs) | Tenure (in Months) | Interest Rate* (%) | Monthly EMI (Rs) | Total Interest | Total Amount Payable |

| ₹ 2,50,000 | 12 | 18% | ₹ 23,039 | ₹ 26,470 | ₹ 2,76,470 |

| ₹ 2,50,000 | 18 | 18% | ₹ 16,071 | ₹ 39,276 | ₹ 2,89,276 |

| ₹ 2,50,000 | 24 | 18% | ₹ 12,602 | ₹ 52,452 | ₹ 3,02,452 |

| ₹ 2,50,000 | 30 | 18% | ₹ 10,533 | ₹ 65,996 | ₹ 3,15,996 |

| ₹ 2,50,000 | 36 | 18% | ₹ 9,164 | ₹ 79,904 | ₹ 3,29,904 |

Disclaimer: The given calculations of the EMI are for illustrative purposes only and may be different according to relevant interest rates, processing fees, and other such considerations. Actual loan terms will be assessed at the time of application and approval. Hero FinCorp does not guarantee these numbers, and recommends independent review.

For a Personal Loan of Rs 2.5 Lakh, the EMI calculator will determine the monthly instalments based on the tenure and applicable interest rate. Every EMI includes principal and interest. Select a tenure that is right for you. Shorter tenures, typically, have higher EMIs but total interest is lower, while longer tenures typically mean lower EMIs, but total interest is higher.

Here are the key features and benefits of a 2.5 Lakh Personal Loan from Hero FinCorp:

The personal loan eligibility criteria for a loan of up to Rs 2.5 Lakh are easy to meet. You simply need to fulfil the basic requirements related to age, citizenship, monthly income, and work experience. Here are the details.

| Criteria | Requirement |

|---|---|

| Age | You must be between 21 to 58 years of age. |

| Citizenship | You must be an Indian citizen to apply for a Personal Loan at Hero FinCorp. |

| Work Experience | 1. Salaried Individuals: Minimum 6 months 2. Self-employed Individuals: Minimum 2 years of stable business operations |

| Monthly Income | The minimum income requirement is Rs 15,000 per month. |

| Credit Score | A score of 750+ is generally preferred for instant approval. |

At Hero FinCorp, the documentation requirement is minima. Still, it is important to understand the documents required for a personal loan application, which may vary slightly for salaried and self-employed applicants. Here are the details.

Duly filled application form, Passport-size photograph

Driving License, Passport, PAN Card, Aadhaar Card (Any One)

Driving License, Passport, Aadhaar Card, Ration Card, Utility Bill (Any One)

Residence Ownership Proof (Electricity Bill, Maintenance Bill, Property Document)

Last 6 Months’ Salary Slips, Bank Statements & Form 16

Duly filled application form, Passport-size photograph

Driving License, Passport, PAN Card, Aadhaar Card (Any One)

Driving License, Passport, Aadhaar Card, Ration Card, Utility Bill (Any One), Office Address Proof (if applicable)

Business Existence Proof (Tax Registration, Shop Establishment Proof, Company Registration Certificate)

Last 6 Months Bank Statements & ITR for 2 Years

With Hero FinCorp, you can get an instant loan at competitive interest rates starting from 18% p.a. Our fee structure is clear, and we do not have any hidden costs other than those specified here. Apart from the personal loan interest rate, below is a summary of the fees and charges.

| Fees & Charges | Amount Chargeable |

| Interest Rate | Starting from 18% p.a. |

| Loan Processing Charges | Minimum 2.5% + GST |

| Prepayment Charges | N.A. |

| Foreclosure Charges | 5% + GST |

| EMI Bounce Charges | Rs 350/- |

| Interest on Overdue EMIs | 1-2% of the loan/EMI Overdue Amount Per Month |

| Cheque Bounce | Fixed Nominal Penalty |

| Loan Cancellation | 1. Online loan app does not charge any cancellation charges 2. Interest amount paid is non-refundable 3. Processing charges are also non-refundable |

Note: The above rates are effective from 27.10.2023.

Here are the steps to apply for a 2.5 Lakh loan at Hero FinCorp:

Visit the Hero FinCorp website or install the personal loan app

Go to the personal loan page and click ‘apply now’

Enter your mobile number and verify with the OTP received

Choose the loan amount you need

Verify your KYC details to check income eligibility

Click ‘Submit’ to complete your application

You can use a Personal Loan for any planned or unexpected expenses. Let’s explore just a few of the many common uses of a Personal Loan of Rs 2.5 Lakh.

*Approval & Agreement: Loan approval is at Hero FinCorp's discretion. By applying, you agree to our Terms & Conditions, Privacy Policy, and Loan Agreement.

*Data Use: You consent to electronic processes and data use for loan assessment, as per our Privacy Policy.

*Security: Keep your account and device secure. Report our customer care for unauthorized activity immediately.

*Grievances: For concerns, refer to our Grievance Redressal Policy.

*EMI Payment: Refer to our T&Cs here*

*RBI Mandate: RBI requires transparent disclosures. Learn more from RBI.