Minimum Salary Required for Personal Loan in India: What Lenders Really Look For

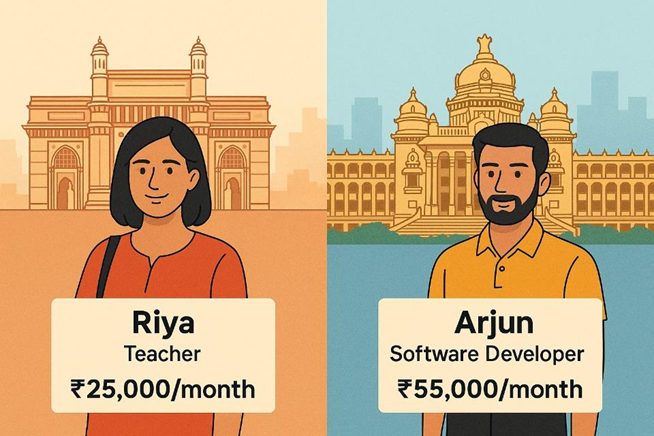

Riya and Arjun both applied for a personal loan last week.

She’s a teacher in Thane earning ₹25,000/month. He’s a software developer in Bengaluru with a ₹55,000/month salary.

Guess who got the approval faster? (Hint: The answer may be too obvious!)

In India, your salary does matter when applying for a personal loan, but it’s not the only factor. Let’s decode what lenders are really looking at and how you can boost your chances.

Does Your Salary Decide Your Personal Loan Approval?

Not entirely, but your salary plays a big role.

Let’s go back to Riya and Arjun.

Arjun got a quick green light. Riya didn’t. Why?

Because banks and NBFCs don’t just see the number on your payslip. They assess the full picture.

Here’s what lenders consider while approving a personal loan for salaried employees:

Your monthly income

Lenders don’t just look at your gross income; they care about what you actually take home. This net salary gives them a clearer idea of how much they can comfortably repay every month.

Job stability

Being in a permanent role signals stability and lower risk. If you’re still on probation or frequently switch jobs, lenders may worry about future income disruptions.

Employer category

Working for a reputable company strengthens your profile as it indicates financial stability. That’s why your prospects may be better if you work at an MNC or in a government organisation.

Location

Your city of residence matters. Metro and Tier-1 city residents may get better terms or faster approval due to higher average incomes and better access to banking infrastructure. But this may not be the case for those living in Tier 2/3 cities.

Debt-to-income ratio

You may be seen as a high risk if a significant portion of your salary is already tied up in existing loans or credit card bills. Ideally, your total EMI outgo should be under 40%–50% of your net income.

What Is the Minimum Salary Required for a Personal Loan in India?

There’s no single magic number. It varies across lenders and cities. But here’s the common minimum salary expectations in India-

● Metro cities- ₹25,000/month and above

● Tier 2/3 cities- ₹15,000–₹20,000/month

● Gig or self-employed professionals- Case-by-case, with income proof

Remember, this is just the starting point. If you are near the eligibility threshold, a strong credit score or a longer employment history may work in your favour.

Other Key Eligibility Criteria for Personal Loans

While salary is a key, it's just one aspect of your personal loan eligibility. You also need to understand that most lenders in India look beyond income. They want to ensure you're creditworthy.

Here are some additional factors that influence your personal loan approval:

● Credit score- Ideally above 700, but flexible for salaried applicants

● Age- Usually 21–58 years

● Employment type- Salaried (private/public/MNC) or self-employed

● Work experience- At least 6 months with current employer

● Residential status- Owned or rented homes in serviceable locations

● Documents- PAN card, Aadhaar, six-month salary slips, bank statements, and Form 16

● Existing EMIs- The fewer, the better. A high EMI load weakens your case

Other than these, lenders assess-

● Net monthly income after deductions

● Job continuity and stability

● Whether your location is within serviceable PIN codes

If your profile looks strong overall, a slightly lower salary may still get you approved, especially through an Instant Loan App.

Quick Tips to Improve Your Personal Loan Approval Chances

Whether you're planning a big purchase or need funds in an emergency, these quick tips can help you improve your chances of getting approved with better terms.

● Pay credit card bills and EMIs on time for 3+ months

● Reduce or clear outstanding debts and other financial liabilities before applying

● Keep salary slips and bank statements handy

● Consider applying via the Instant Loan App for faster processing

● Apply only when you meet the minimum salary and document required for personal loan

Personal Loan Approval Takes More Than Salary

While minimum salary is a key eligibility factor for personal loans in India, lenders look beyond just your income. They assess your credit score, repayment history, employment stability, and existing liabilities to determine your creditworthiness.

Meeting the minimum salary helps you qualify, but improving your overall financial health is what increases your chances of approval and getting better loan offers.

And with Hero FinCorp, there’s room for flexibility. You can get loans of up to ₹5 lakhs for a minimum monthly salary of ₹15,000 in just 10 minutes.

Apply for a personal loan or try our personal loan eligibility calculator to check your chances right now.

Frequently Asked Questions

1. Can I get a personal loan with a ₹12,000 salary?

It’s tough. Most lenders, including Hero FinCorp, require at least ₹15,000/month.

2. Is there a difference in salary requirement for metro vs non-metro?

Yes. Applicants in metro cities generally face higher minimum income thresholds.

3. What if my salary is low but my credit score is high?

A strong credit score can improve your chances. Hero FinCorp considers multiple factors, not just salary.

4. Do self-employed applicants have a different minimum income rule?

Yes. Self-employed individuals are considered on a case-by-case basis. Here, income stability and documentation are key for deciding approval.