Using Two Bank Accounts with One Mobile Number for UPI

- What Does It Mean to Have Two Bank Accounts with the Same Mobile Number for UPI?

- Is It Possible to Link Two Bank Accounts With the Same Mobile Number for UPI?

- How to Add Another Bank Account with the Same Mobile Number in PhonePe

- Benefits of Using Two Bank Accounts with the Same Mobile Number for UPI Transactions

- Is Having Two Bank Accounts Linked to One Mobile Number for UPI Worth It?

- Frequently Asked Questions

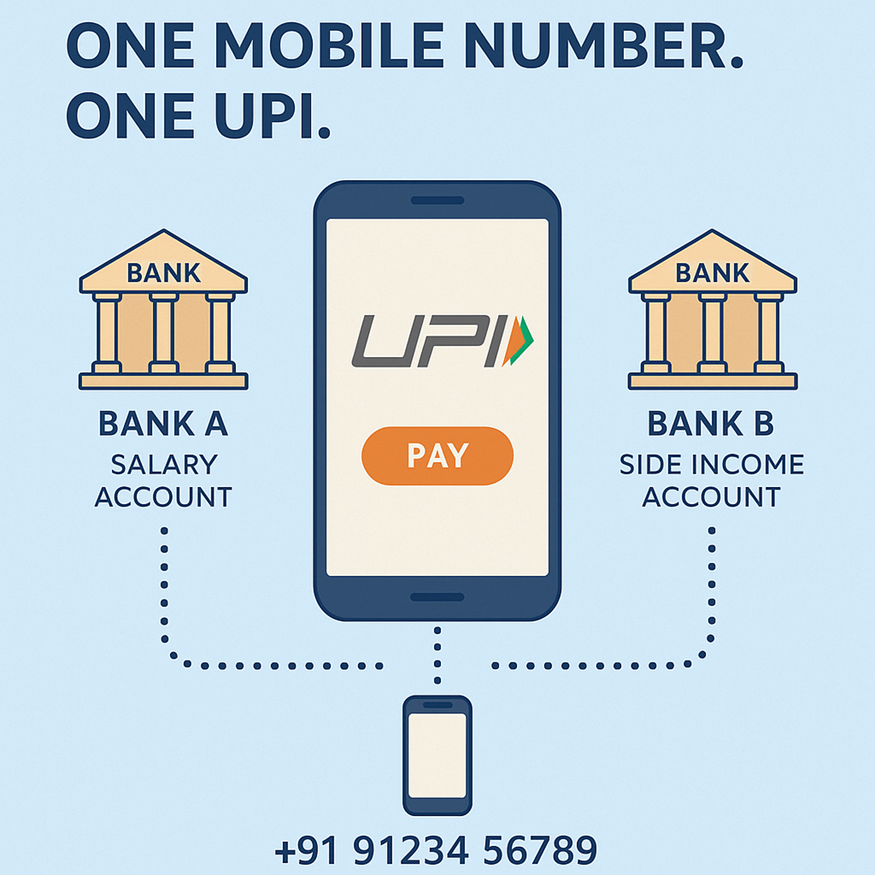

Imagine you have savings in two banks. One for salary, another for side income. Wouldn’t it be handy if you could manage both using the same UPI setup? Good news: many UPI apps today let you link multiple bank accounts under a single mobile number. That means smoother money flow and easier fund management.

In this guide, we explain what it means to have two bank accounts with the same mobile number UPI. We also guide you on how to set it up and when it makes sense.

What Does It Mean to Have Two Bank Accounts with the Same Mobile Number for UPI?

Linking two bank accounts to the same mobile number for UPI means that the same mobile number is registered with both banks. Both accounts are added to your UPI-enabled app.

UPI identifies accounts via the mobile number linked to the bank account, along with account details. As long as both accounts are KYC-verified with that number, you can manage transfers from either account within a single app.

That makes it easier: you don’t need different numbers or separate apps. Simply choose the account you wish to pay from at transaction time.

Is It Possible to Link Two Bank Accounts With the Same Mobile Number for UPI?

Yes. Many banks and UPI apps allow you to use two bank accounts with the same mobile number for UPI, as long as that number is registered with each bank account.

However, one UPI ID (VPA) maps to only one bank account. So, if Priya has two bank accounts with the same mobile number, she might see something like:

• priya@axis linked to her Axis Bank account

• priya.work@hdfc linked to her HDFC Bank account

Both VPAs use the same mobile number, but each UPI ID clearly points to a different UPI-linked bank account. This keeps transaction routing clean and reduces confusion when sending or receiving money.

Also Read - How to Create Your UPI Number Using a Mobile Banking App

How to Add Another Bank Account with the Same Mobile Number in PhonePe

If you want to manage more than one bank account in a single app, PhonePe makes it simple. Here is how to add another bank account in PhonePe using the same mobile number.

1. Open the PhonePe app and log in with your registered mobile number.

2. Tap on your profile picture or name at the top to open the account menu.

3. Select the “Bank Accounts” option under the Payment Methods section.

4. Tap on “Add New Bank Account” to start adding another account.

5. Choose your bank from the list. PhonePe will automatically fetch accounts linked to your mobile number.

6. Confirm the account you want to link and complete OTP verification.

7. Set or confirm the UPI PIN for this bank account.

You can repeat these steps to add another account in PhonePe, so that one mobile number conveniently handles multiple banks.

Benefits of Using Two Bank Accounts with the Same Mobile Number for UPI Transactions

Multiple accounts under one mobile number can offer -

• Flexibility to choose which account balance to debit

• Easy fund management without juggling different numbers or apps

• Simplified tracking of expenses by separating accounts for different uses

• Convenience of single login and one UPI app to handle all accounts

• No need to maintain multiple mobile numbers for different accounts

• Better control, as you can prioritise which account to use

Also Read - Using The Newest UPI Features Safely During Emergencies

Is Having Two Bank Accounts Linked to One Mobile Number for UPI Worth It?

Linking two bank accounts under the same mobile number with UPI is worth it if you value convenience, flexibility, and clear fund management. Just ensure both accounts have the same mobile number registered and are KYC-compliant. If you manage multiple income sources or need separate accounts for work and personal expenses, this setup makes managing money easier.

A well-organised digital life starts with strong financial awareness. If you value the ease of handling multiple bank accounts in one UPI setup, you’ll appreciate how effortless borrowing can be, too.

With Hero FinCorp, apply for a personal loan online and get funds quickly with transparent terms.

Explore your options today.

Frequently Asked Questions

Can I use the same mobile number for UPI on two different bank accounts?

Yes. As long as the mobile number is registered with both bank accounts, you can link both in a UPI app.

How many bank accounts can be linked to one mobile number?

There’s no strict public limit. You can add multiple accounts (from different banks) to a single UPI app.

Can I add two accounts from the same bank on UPI with one mobile number?

It depends on the bank policy and account type. But most banks allow adding multiple accounts (different types or joint/personal) as long as the same mobile number is registered.

What happens if my mobile number is linked to multiple bank accounts on UPI apps?

You will see all linked accounts under “Bank Accounts.” When making payments, you choose which account to debit. UPI will route accordingly.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.