What is VPA? Meaning, Benefits, and UPI ID Setup Guide - Hero FinCorp

A few years ago, sending money online never felt completely easy. Even after entering all the details, people would stop for a second and think, “What if something goes wrong?” That moment of doubt showed up almost every time, especially when money was involved.

Things have changed since then. Payments now happen in the middle of daily life, while buying groceries or paying a friend back after dinner. You no longer need to share bank details each time you send money.

The Virtual Payment Address made this possible by giving people a simpler way to transfer money. In this blog, you will learn what a VPA is, why it matters in everyday payments, and how you can set one up and start using it comfortably.

Decoding the Basics: What Does VPA Mean?

Digital payments seem simple on the surface, but many users still wonder how their money actually connects to the right person. Understanding the meaning of a VPA removes that confusion.

A Virtual Payment Address is a unique digital identifier linked to your bank account for UPI transactions. When you share this address, the system recognises where the money should go and completes the transfer securely. You do not need to enter bank account numbers, branch names, or IFSC codes during the process.

The easiest way to understand a VPA is through an email comparison. When you send an email, you type an address instead of technical server details. A VPA works in the same manner. It directs money accurately while keeping your sensitive banking information private.

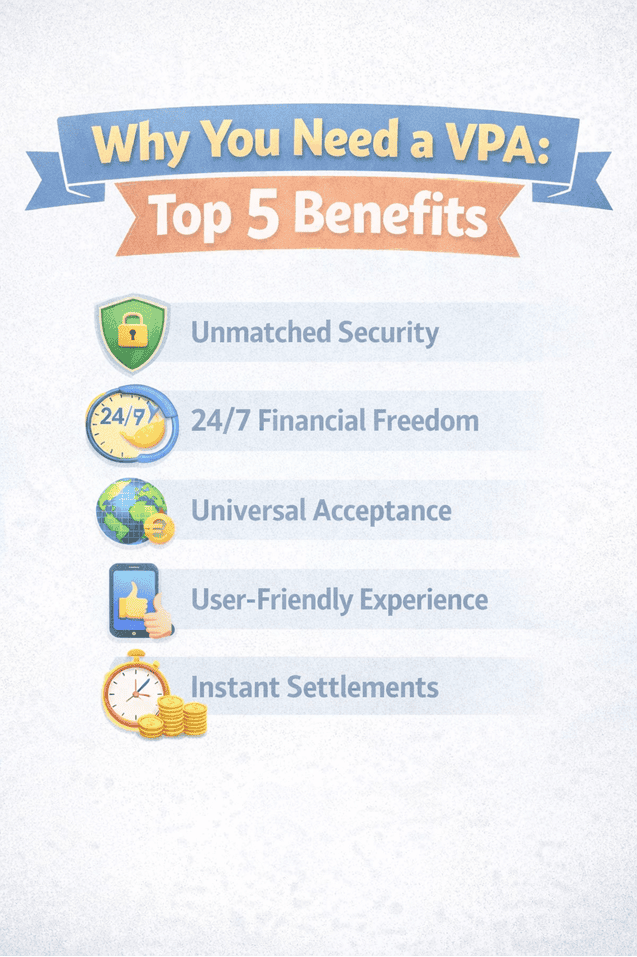

Why You Need a VPA: Top 5 Benefits

Using a VPA changes the way people experience everyday payments. It brings safety, convenience, and confidence into routine transactions.

1. Unmatched Security

A VPA keeps your bank details hidden from others. Since you never share account numbers, the risk of misuse is significantly reduced. Every transaction also requires verification via a UPI PIN or biometric authentication, ensuring full control remains with you.

2. 24/7 Financial Freedom

Payments no longer wait for banking hours. You can send money late at night, early in the morning, or on a public holiday. A VPA keeps working even when banks stay closed.

3. Universal Acceptance

UPI connects different banks and payment apps seamlessly. You can send money from one app while the receiver uses another.

4. User-Friendly Experience

A VPA feels easy to use because it follows familiar digital habits. Typing a short address feels far simpler than entering long banking details. Many users feel comfortable with the process after just a few transactions.

5. Instant Settlements

Payments through a VPA are reflected almost immediately in the receiver’s account. This instant movement of money brings certainty and helps people manage expenses without delay.

How to Create Your Own VPA: A Step-by-Step Guide

Creating a VPA does not require paperwork or branch visits. Most users complete the setup directly from their mobile phone.

Step 1: Choose Your App

Start by downloading a UPI-enabled bank app or a trusted third-party payment app that supports your bank.

Step 2: Link Your Bank

Use the mobile number registered with your bank account. The app verifies it via an automated SMS process and securely connects your account.

Step 3: Customizing Your ID

You can choose your own VPA handle, usually in a simple format such as name@bank or mobilenumber@upi. Selecting something easy to remember helps during frequent payments.

Step 4: Secure Your Account

Create a four or six-digit UPI PIN to protect transactions. This PIN authorises every payment and keeps control firmly in your hands. Avoid sharing it with anyone.

Transacting with VPA: Sending and Receiving Money

Once your VPA becomes active, daily transactions feel smooth and predictable. Understanding both directions helps avoid errors.

Sending Money

- Open the payment app

- Select the UPI option

- Enter the recipient’s VPA

- Add the amount and purpose

- Confirm using your UPI PIN

Receiving or Requesting Money

- Select the request money option

- Enter the sender’s VPA

- Send the request notification

- Approve once received

- Receive the amount instantly

Making Digital Money Management Simpler with VPA and Hero FinCorp

Once you get comfortable with a Virtual Payment Address, everyday payments stop feeling like a task. You send money, it goes through, and you move on with your day. That quiet confidence is what makes digital payments truly useful.

When life calls for something bigger, the same simplicity matters. Hero FinCorp makes this easier through its personal loan app, where you can check eligibility and apply digitally without running around. With the right support in place, handling money feels less stressful and far more manageable.

Frequently Asked Questions

Can I have multiple VPAs for one bank account?

Yes, many apps allow multiple VPA links to the same account, which helps manage different payment needs.

Is a VPA the same as a UPI ID?

Yes, both terms refer to the same digital address used for UPI transactions.

What happens if I enter the wrong VPA?

If the VPA does not exist, the transaction fails. If it belongs to another user, the amount may be credited to that account, so careful checking is important.

Do I need an internet connection to use VPA?

Yes, UPI transactions require an active internet connection.

Is there a limit on VPA transactions?

Transaction limits depend on your bank and current UPI guidelines.