When Is a Personal Loan a Good Idea?

Thinking of taking a personal loan? Maybe an unexpected expense has come up, or you’re preparing for something important and want to keep your savings intact.

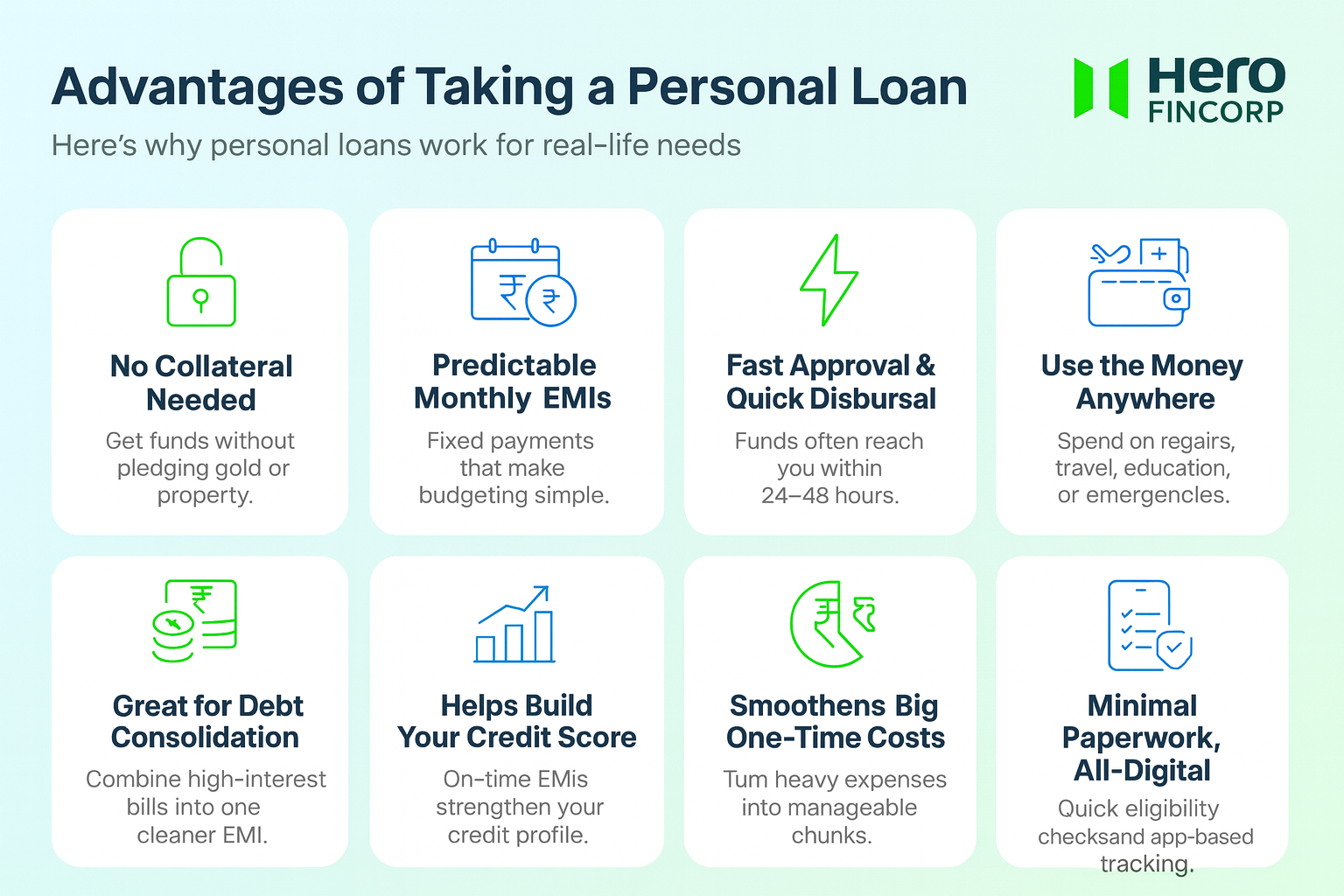

A personal loan is more than quick access to funds. It’s a flexible financial tool that supports your goals and gives you the freedom to act when it matters.

So when is the right time to choose one? This guide walks you through situations where a personal loan adds real value, how it helps you stay ahead, and tips to maintain financial confidence. Let’s get started.

When Should You Get a Personal Loan?

Personal loans are booming in India, with the market set to touch $78 billion by FY2032.

That’s not just a stat. It’s a reflection of real people taking debt to stay afloat, grab opportunities, or make life’s biggest moments more affordable. But with borrowing on the rise, one question matters most: when should you get a personal loan?

Here are practical moments when saying yes is the right move:

1. You’re Juggling Multiple High-Interest Debts

Too many EMIs, different due dates, and no breathing room? A debt consolidation personal loan can be your reset button. It lets you merge all those payments into one EMI, usually at a better rate.

Meet Anil, 29, a graphic designer from Pune. He was paying nearly ₹20,000 every month, split between his credit card, bike loan, and an old personal loan. Three EMIs, endless reminders, and constant stress.

So, he applied for a ₹5 lakh personal loan at 20% for 3 years. His new EMI? About ₹18,500. All old dues are paid off, and he now has ₹1 lakh to rebuild savings or fund his next big goal.

2. A Medical Emergency Catches You Off-Guard

Health emergencies don’t give you a warning. Even with insurance, you might have to cover treatment gaps, medicines, or post-op care. A personal loan helps you bridge those gaps quickly. Here’s what makes it a smart choice:

- It’s unsecured; no need to pledge your home, gold, or other assets

- Protects your savings you don’t have to break FDs or tap into mutual funds

- No awkward favours or money requests from friends or family

- Quick approval and fast disbursal, often within 24 to 48 hours

Handling medical bills right now? Check your personal loan eligibility online and get support when it matters most.

Also Read: Raise Loans for Medical Emergencies: 5 Key Reasons to Choose a Personal Loan

3. Your Home Needs Repairs You Can’t Ignore

Leaky roof? Broken water line? Damp walls during monsoon? Some repairs can’t wait, even when your bank balance says otherwise. That’s when a personal loan for home renovation can help you act fast without draining your emergency fund.

- Sort out issues quickly before they snowball into major expenses

- Convert sudden home expenses into steady EMIs that fit your monthly flow

- Improve your day-to-day comfort and your property’s value

4. A Wedding or Big Life Event Is Around the Corner

In India, big moments rarely stick to the budget. A wedding, a milestone birthday, or even an overdue family trip can go from simple to full-scale in days.

A personal loan for a wedding lets you enjoy without emptying the savings you’ve worked hard to build. Since it isn’t tied to a single purpose, you can use it wherever the money is needed most.

- Lock in venue, caterer, or photographer before prices jump

- Handle last-minute extras like outfits, décor changes, or travel

- Avoid swiping multiple high-interest credit cards just to keep things moving

Dreaming big? Make sure the EMIs feel manageable. Try the Hero FinCorp Personal Loan EMI Calculator and see what fits your budget in seconds.

5. You Want to Upskill or Take a Short-Term Course

Short-term courses and professional certifications can open new doors fast. The catch? Most need full payment upfront, and education loans usually don’t cover them. A personal loan helps you invest in yourself without putting your career plans on hold.

But life doesn’t always fit into neat boxes. Here are a few other moments when getting a personal loan comes in handy:

| Situation | How Personal Loan Helps |

|---|---|

| Moving to a new city for work | Pay for packers & movers, advance rent, or setup costs your employer may not reimburse |

| Security deposit for a new home | Home loans don’t cover deposits; a personal loan spreads this upfront cost into EMIs |

| Starting a side hustle or business setup | Helps you buy essential tools or equipment, faster than a business loan |

| Upgrading household essentials (fridge, AC, inverter) | Cheaper than credit card EMIs; replace essentials without delay |

| Temporary income slowdown | Bridge a short-term dip without breaking investments |

5 Things You Should NOT Do With Your Personal Loan

Even the smartest loan can backfire if used carelessly. To stay confident and in control, avoid these common mistakes with personal loans.

- Don’t spend it on non-essentials. A sudden shopping urge or a fancy upgrade isn’t worth months of EMIs.

- Don’t borrow more than you need. That “extra cushion” becomes extra interest, and long-term repayment fatigue.

- Don’t miss EMIs or pay late. Even one delay can dent your credit scoreand add penalties. Set UPI AutoPay and forget the stress.

- Don’t consolidate debt without changing habits. One EMI works only if you stop adding new debt.

- Don’t pick a loan just because of the “low rate”. Always compare the Annual Percentage Rate (APR) to see the true cost, including fees and conditions.

Want a smoother loan experience? Use the Hero FinCorp Digital Lending App (Android) or iOS version to manage EMIs and build strong credit habits.

Making the Right Personal Loan Move with Hero FinCorp

A personal loan works best when it solves a real need and fits easily into your monthly budget. Make your choices clear, keep your EMIs comfortable, and borrow on your terms.

With Hero FinCorp, you get the clarity to do exactly that. From quick checks to easy tracking, everything is designed to give you a smooth digital experience from start to finish.

Ready to move forward? Start your personal loan journey in just a few clicks!

Frequently Asked Questions

1. When should I consider taking a personal loan in India?

When the need is real and the EMI fits your monthly flow without straining your budget.

2. Can I get a personal loan with a low credit score?

Yes, you might. Today’s lenders don’t rely only on scores. Your income stability, bill payments, and digital spending behaviour also matter.

3. Is it better to consolidate debt with a personal loan or a credit card?

Usually, a personal loan. One fixed EMI and a defined timeline make it safer than revolving credit card dues.