What is UPI and How Does UPI Work?

Picture this: you’re sipping tea at a roadside stall. It’s time to pay. You grab your phone, scan a QR code, and ka-ching. The payment is settled within minutes. Now imagine you’re in the queue for the next iPhone. When it’s your time to pay, you repeat the action. Scan and pay.

No cash, no card, just a quick UPI payment. That’s how common it’s become in India. From street vendors to large retailers, Unified Payments Interface (UPI) has changed the way we pay. It’s fast, safe, and built for the modern, digital India.

What Is UPI?

Unified Payments Interface (UPI) is a real-time payment system. It was launched in 2016 by the National Payments Corporation of India (NPCI). With UPI, you can transfer or receive money right away; there is no need to memorise bank account numbers and IFSC codes.

Every transaction is done via a Virtual Payment Address (VPA). You can freely check your UPI transactions whenever you want to keep an eye on payments, check receipts, help control spending, and maintain a record for personal or business financial management. In this manner, you will always be in control of your finances, notice errors promptly, and have secure, stress-free money management.

Also Read: UPI Mandate Meaning

Key Features and Benefits of UPI in India

UPI combines speed, security, and convenience.

Here are the key UPI transaction features and benefits of UPI payment that make it so popular:

● Instant Fund Transfers: Money transfers between accounts take just a few seconds. At any time, from any place, 24/7 Availability: UPI is available 24/7, including weekends and holidays.

● Interoperability: UPI can be used for money transfers, no matter which bank or payment app you have

● Robust Security: UPI adopts two-factor authentication and secure PIN verification that keep your online transactions safe and prevent unauthorised access

● No Additional Fees or Charges: Most P2P and P2M payments are free of cost

● Convenience: A single app can manage multiple bank accounts, bills, loans, and payments

● Merchant Benefits: Businesses get instant payments without setup costs or hardware

Also Read: Using Two Bank Accounts with One Mobile Number for UPI

What Is a UPI PIN and How to Set It?

Your UPI PIN is a 4- or 6-digit secret code used to authorise every transaction. Think of it as your personal digital signature. Unlike an MPIN, which is used for mobile banking, the UPI PIN is specific to your UPI payment app and linked bank account.

Here’s how to set or reset your UPI PIN:

1. Open your UPI app and go to “Bank Account” or “Set UPI PIN”

2. Select your bank. The app will verify your linked number via SMS

3. Enter the last six digits of your debit card and expiry date

4. Set your desired UPI PIN and confirm

Done! You can now make secure payments using your PIN.

Short on cash? Get instant funds - download our Instant Loan App and apply for your loan today!

Read Also: A Simple Guide to Scanning and Paying with QR Codes via Mobile Banking

Understanding UPI ID, UPI Number, and UPI Address

UPI ID, address, or number is like your digital identifier. It allows people to send or receive money without needing your bank details.

● Your UPI ID, also known as a Virtual Payment Address (VPA), is your unique digital identity, such as name@bankname.

● UPI address is just another term for your VPA.

● A UPI number, usually your mobile number. It can also act as a payment identifier if linked to your bank.

They all serve the same purpose: to simplify payments and keep your account information private.

Also Read: What is a UPI Address? Meaning and How It Works

How Does UPI Payment Work? Step-by-Step Process

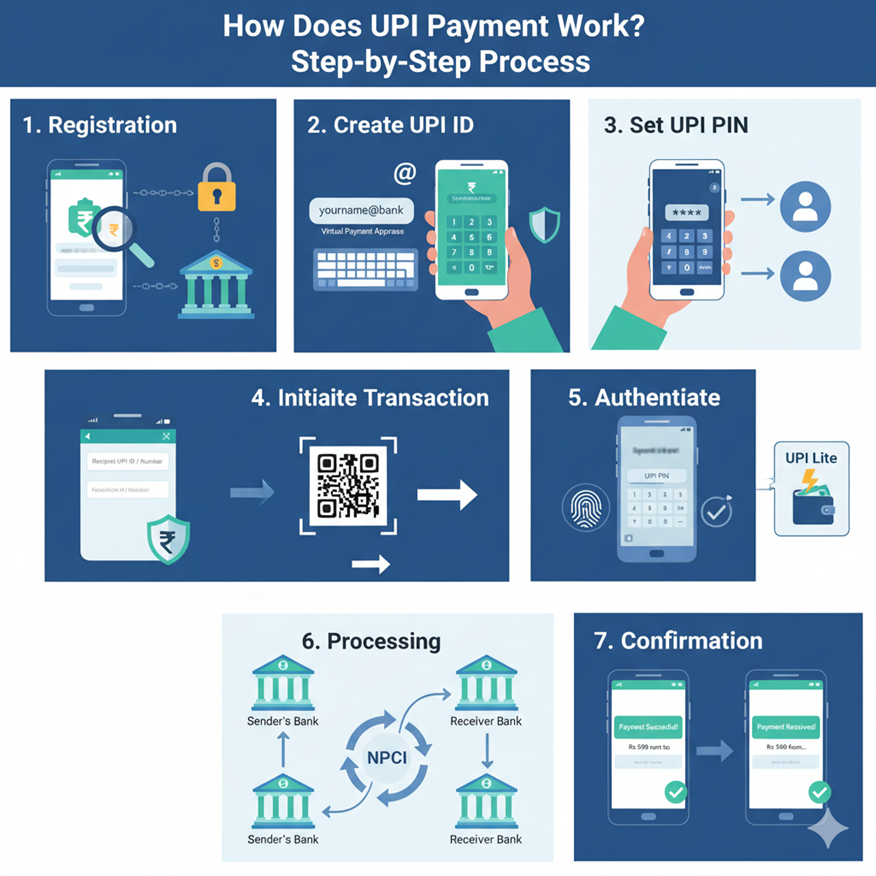

Here’s a simple breakdown of how UPI payment works:

1. Registration: Download a UPI app and link your bank account

2. Create UPI ID: Generate your unique Virtual Payment Address (VPA)

3. Set UPI PIN: Create your secure code for authorising transactions

4. Initiate Transaction: Enter the recipient’s UPI ID, number, or scan their QR code

5. Authenticate: Verify the payment by entering your UPI PIN

6. Processing: The app connects both banks via NPCI for real-time transfer. For small transactions, UPI Lite allows instant payments without fully going through the bank

7. Confirmation: You and the receiver get instant notifications once the payment is successful

Also Read: UPI Daily Transaction Limit

Wrapping Up

UPI is a financial revolution, positioning India as a leader in the global digital finance movement. New features like UPI AutoPay, UPI Lite, and even international UPI payments are only making it better. It’s surely an exciting time to be at the centre of all the action.

Want to make payments without touching your savings? Go for a personal loan by Hero FinCorp.

We not only offer quick and hassle-free disbursal but also flexible repayment options tailored to your needs, helping you manage your finances with ease and confidence. So why wait? Explore our range of options and apply for a loan today!

Frequently Asked Questions

1. How are a UPI ID and a UPI number different?

Your UPI ID is your Virtual Payment Address (like name@bank). On the other hand, your UPI number is your mobile number linked to the account.

2. Can I use UPI without a smartphone?

No, you need a smartphone to use UPI.

3. What if I forget my UPI PIN?

Instantly reset your UPI PIN from your UPI app with the updated card details.

4. Is UPI safe for online shopping?

Yes. UPI is protected by multi-level authentication and encrypted transactions.

5. Can I link multiple bank accounts to a single UPI ID?

Absolutely. You can manage several bank accounts through one UPI app for convenience.