UPI Transaction Limits: What Borrowers Should Know Before Paying EMIs

- Understanding UPI Transaction Limits in India

- Types of UPI Transaction Limits: Old vs New UPI Users

- UPI Limits for Specific Transactions and Sectors

- EMIs and Loan Repayments via UPI: What Borrowers Should Know

- How to Check and Manage Your UPI Transaction Limits

- Tips to Optimise UPI Transactions Within Limits

- Important Regulatory Guidelines Affecting UPI Transaction Limits

- Pay Loan EMIs Easily With UPI

- Frequently Asked Questions

When you pay monthly EMIs, using UPI is like second nature. But what if you reach the transaction limit and the payment fails?

This is why it is important to understand UPI transaction limits per day and per transaction. This helps you plan and manage your payments seamlessly without interruptions.

In this blog, we will help you understand UPI transaction limits, along with tips to manage and optimise UPI transactions.

Understanding UPI Transaction Limits in India

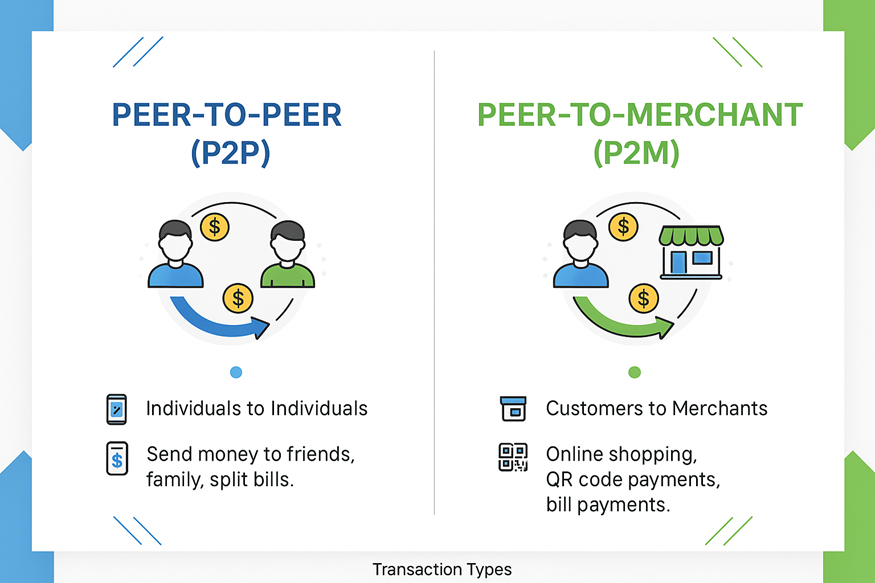

UPI transaction limit is the maximum amount you can transfer in a day using UPI. These limits are set by NPCI to maintain financial security, reduce the risk of fraud, and encourage responsible financial behaviour.

UPI Daily Transaction Limit

The daily UPI transaction limit for standard transactions is ₹1 lakh. Additionally, the UPI transaction limit per day to split the amount is up to 20 individual transactions per day.

Banks may set a different cap within the framework.

Also Read: How UPI Is Redefining Instant Loan Repayments in India

UPI Transaction Limit Per Transaction

The UPI limit per transaction varies by the transaction type:

- Regular payments: Up to ₹1,00,000 per transaction

- UPI 123Pay for feature phones: ₹10,000 per transaction

- Collect requests: ₹2,000 per transaction

UPI Transaction Limit Per Month

NPCI has not set UPI transaction limits, but banks may impose their own monthly transaction limit restrictions.

UPI Transaction Limit Per Year

There are no yearly transaction limits set by NPCI. Some banks may limit the transaction amount to manage high-value transactions.

Types of UPI Transaction Limits: Old vs New UPI Users

To ensure secure transactions, the UPI policy limitations for new users are as follows:

- Lower transaction limits for the first few transactions. The limits vary by bank

- For high-value transactions, you might need additional KYC verification

- The banks may increase the transaction limit as your UPI transaction history builds

Also Read: Know Types of UPI Frauds

UPI Limits for Specific Transactions and Sectors

To ensure a smooth payment process, it's essential to be aware of the UPI limits for specific sectors. Here's a quick breakdown of UPI transaction limits:

| Category | UPI Limit Per Transaction | New 24-Hour Aggregate Limit |

|---|---|---|

| Capital Markets | ₹5 lakh | ₹10 lakh |

| Insurance Payments | ₹5 lakh | ₹10 lakh |

| Government e-Marketplace ( EMD, Tax) | ₹5 lakh | ₹10 lakh |

| Travel | ₹5 lakh | ₹10 lakh |

| Credit Card Bill Payments | ₹5 lakh | ₹6 lakh |

| Collections (EMI, B2B, loan, etc.) | ₹5 lakh | ₹10 lakh |

| Business / Merchant | ₹5 lakh | — |

| Jewellery Purchases | ₹2 lakh | ₹6 lakh |

| FX Retail via BBPS | ₹5 lakh | ₹5 lakh |

| Digital Account Opening | ₹5 lakh | ₹5 lakh |

| Initial Funding for Digital Account | ₹2 lakh | ₹2 lakh |

| Education and Healthcare | - | 5 lakh |

EMIs and Loan Repayments via UPI: What Borrowers Should Know

The NPCI has recently increased UPI transaction limits, which makes it convenient to pay EMIs. You can pay a large sum at a time, eliminating the need to split larger payments. Plus, transactions will settle faster.

To ensure secure and convenient payments, here's what you should do:

- Review transaction details before authorising the payment

- Do not click on suspicious links or provide your personal information

- Use a secure network when you are paying

- Set up auto payment using the instant loan app so you don't miss any EMI

- The particular policies for EMI and loan repayments via UPI differ by bank, so make sure to check the bank policies

How to Check and Manage Your UPI Transaction Limits

To ensure security and frictionless payments, here's how you can check your transaction limits, change your PIN, request a higher limit, and monitor transactions.

Check Transaction Limits

- Open UPI app and visit the profile section

- Look for UPI transaction limit option

Change Pin

- Open your UPI app and look for the profile section

- Search for an option to manage UPI PIN

- You will be prompted to add debit card details

- Choose the option to create a UPI PIN

- Create a strong PIN and re-enter it to confirm

Request For Higher Limit

Contact your bank and request a higher UPI transaction limit. Follow all the verification steps, and if the bank deems it fit, you will get an increase.

Note: You cannot get an increase beyond the limits set by the NPCI.

Monitor Transactions

Check the transaction history through the UPI app or request your bank to get an updated statement.

Tips to Optimise UPI Transactions Within Limits

Here's how you can optimise UPI transactions to ensure payments within limits:

- Split large payments across multiple days

- Verify UPI transaction limits beforehand

- Use multiple UPI apps for different bank accounts

- Schedule payments through the personal loan app and keep a track of regular transaction count

- Monitor transaction patterns to optimise limits

- If you are a new user, start with small transactions to build a transaction history

Important Regulatory Guidelines Affecting UPI Transaction Limits

RBI sets the overall policy while NPCI sets the transaction cap and manages the system.

One major change that the NPCI has announced is to segregate the settlement cycles for both authorised and dispute transactions from November 2025. As a result, transactions will reflect faster in the bank systems.

Additional authentication methods will also be introduced to enhance the customer experience.

Pay Loan EMIs Easily With UPI

With the increased limits, making EMI payments via UPI is now faster and more convenient. Make sure that you check the limits and keep a tab on your transactions to ensure frictionless payments.

The digital-first approach at Hero Fincorp makes it even easier. You get an instant personal loan with their seamless web journey. Plus, you can set up Autopay and track every payment easily.

Visit Hero Fincorp now and manage your personal loan easily.

Frequently Asked Questions

1. How much transaction limit do you get in a UPI transaction per day in 2025?

The maximum UPI transaction limit per day for 2025 is ₹1 lakh.

2. Can I increase my UPI transaction limit if needed?

You cannot increase the UPI transaction limit beyond the one set by NPCI. But if your bank offers a lower cap, you can ask for an increase.

3. Does UPI have monthly or yearly transaction limits?

NPCI has not set monthly or yearly transaction limits, but your bank may set these limits.

4. Are there different UPI limits for new vs existing users?

Yes, banks often increase the transaction limits gradually as the new user completes verification and builds a transaction history.

5. Are merchant transactions subject to different UPI limits than personal transfers?

Yes, merchant transactions for specific categories have different UPI limits than personal transfers.

6. What happens if you exceed UPI transaction limit?

If you go over your UPI transaction limit, transactions will be declined until the cycle resets.

Also Read: How to Increase Your UPI Transaction Limit