How UPI Is Redefining Instant Loan Repayments in India

How often do you use UPI (Unified Payments Interface) without a second thought?

Maybe it’s a quick QR scan at the grocery counter, paying bills online, sending money home in seconds, or splitting a dinner tab with friends. For most of us, it’s a reflex now. Fast, simple, and always just a tap away. Using UPI enables seamless, instant payments for a wide range of everyday scenarios, from peer-to-peer transfers to merchant payments and even cross-border remittances. UPI is also being introduced in international markets, with acceptance for both domestic and international transactions, expanding its reach to countries like the UAE, Nepal, France, and regions in the Gulf, Europe, and Asia-Pacific.

That ease has turned UPI into the financial heartbeat of India. Today, it powers more than 20 billion transactions every month, making up nearly 85% of the country’s digital payments. Data on transaction volumes, user engagement, and system performance clearly demonstrates UPI’s success and scalability. The surge in low value transactions, especially after the removal of MDR charges, has significantly contributed to UPI's rapid growth and high transaction volumes. The growing number of users and customers relying on UPI highlights its widespread acceptance and the trust placed in it for daily financial needs. UPI has fundamentally transformed the way financial transactions are conducted in India, making digital payments more accessible and efficient for everyone. The introduction of new features, such as voice-based payments and international access, continues to enhance the UPI user experience and expand its capabilities.

And it’s not stopping there. UPI is now stepping into a bigger role, turning instant loan repayments into a seamless, automatic, and stress-free experience.

Let’s explore how.

Why Loan Repayments Needed a Change

Missing an EMI happens more often than we admit. A delayed salary. A week so hectic you missed the date. An expense that threw your budget off balance. That’s all it takes. Suddenly, you’re facing late fees, lender calls, and the fear of your credit score taking a hit.

For years, loan repayments were stuck in an outdated system. You had to:

• Log in to clunky net banking portals or stand in queues

• Track multiple due dates and manage obligations across different bank accounts with reminders and sticky notes

• Wait days for cheques or transfers to clear

• Pay penalties for even a single missed EMI

And it wasn’t just borrowers under pressure. Lenders struggled too with delays, defaults, and the cost of chasing repayments month after month. Handling repayments and financial responsibilities across several accounts made the process even more complex.

Sounds exhausting, right? UPI is bringing a much-needed shift, turning EMIs into something seamless and transparent.

Also Read: Net Banking vs UPI: Which is Better for Paying Personal Loan EMIs?

How UPI Is Reinventing Loan Repayments

What sets UPI apart is not just speed, but the way it builds repayment around transparency, control, and trust. The robust support provided by the UPI ecosystem—including the active participation of banks—enables seamless loan repayments and ensures reliable, secure transactions. It’s raising the bar for both borrowers and lenders.

1. Automated Repayments with UPI Autopay

One of the biggest wins UPI brings to loan repayments is automation. With UPI AutoPay, your EMIs take care of themselves after a quick one-time setup.

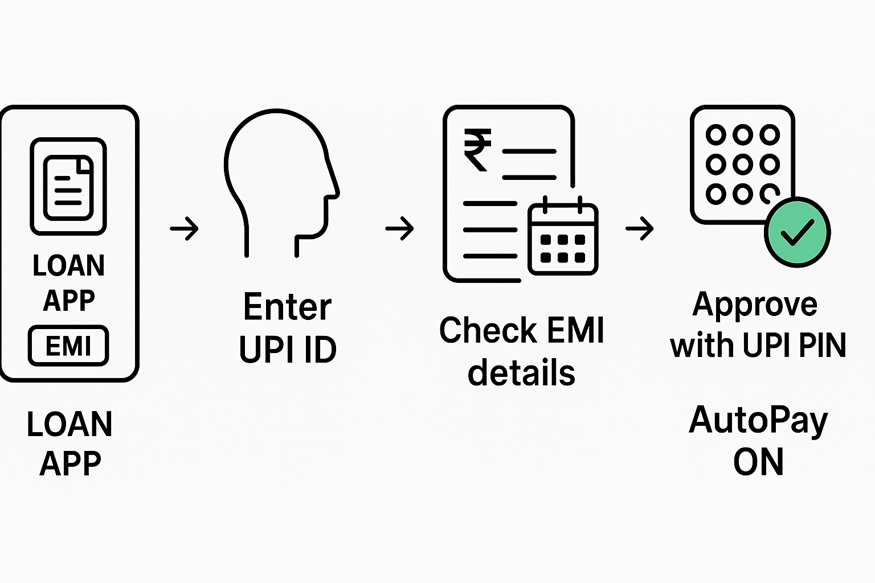

Here’s how it works:

• Open your personal loan app and head to the EMI payment section

• Opt for the UPI AutoPay option and type in your UPI ID

• You can use any UPI application or UPI enabled apps to set up AutoPay

• Confirm the EMI amount and due date before you proceed

• Approve the mandate instantly with your UPI PIN

That’s it. From then on, your EMIs are paid automatically each month. No logins. No reminders. No last-minute panic.

Third party application providers also offer UPI AutoPay features, giving you even more options to manage your repayments.

No wonder UPI AutoPay is booming across India. Its share of recurring payments rose from 33% in January 2024 to over 53% by January 2025. It’s clear from the surge that borrowers prefer the simplicity and certainty UPI brings to loan repayments.

With Hero FinCorp, borrowing and repayment go hand in hand. Apply online for a personal loan up to ₹5 lakhs and set your EMIs on AutoPay right away.

2. Flexibility and Customisation at Your Fingertips

Not everyone earns the same way each month. A salaried professional may prefer EMIs around payday, while a freelancer with irregular income might need more breathing room.

With UPI, you’re not locked into rigid repayment structures. Each user can customize their repayment schedule based on their user account preferences, ensuring that EMIs align with their unique financial situation. You can:

• Set your own pace for EMIs: monthly, quarterly, or tailored to your cash flow

• Modify or pause revocable mandates when circumstances change

This way, your EMIs adapt to your reality, keeping you consistent without feeling stretched. But flexibility only works when paired with discipline, which is where UPI’s safeguard of non-revocable mandates steps in.

3. Non-Revocable Mandates for Timely Payments

Flexibility is perfect for things like subscriptions or gym memberships. Pause when you’re away, cancel if you’re not using it, restart whenever you like.

But loans work differently. Missing even one EMI can trigger penalties and hurt your credit score. To prevent that, NPCI rolled out non-revocable mandates. Once set, a loan mandate cannot be paused or cancelled without lender approval. When setting up or modifying a non-revocable mandate, a request is sent through the UPI system for authorization and processing.

The result? Borrowers stay disciplined, lenders get steady inflows, and defaults drop.

Want to plan smarter? Try Hero FinCorp’s EMI Calculator to test your numbers and lock in a repayment amount that keeps your monthly budget comfortable.

4. Security and Transparency You Can Rely On

When it comes to your money, speed alone isn’t enough. You also want assurance that every payment is both safe and trackable. That’s where UPI shines.

Every EMI is protected with multi-factor authentication, keeping your mandate secure. And because payments reflect instantly in your bank account and UPI app, you always have a clear view of what’s paid and what’s pending. Transaction data is used to provide transparent records for both borrowers and lenders, making it easy to track and verify every payment.

For borrowers, that means confidence and zero second-guessing. For lenders, it means fewer issues and smoother reconciliations. UPI’s system also allows for quick refund processing in case of failed or disputed payments, ensuring customer satisfaction. Refunds are handled efficiently within the UPI ecosystem, contributing to trust and reliability. In the end, both sides benefit from repayments that are secure, transparent, and always on schedule.

5. Affordable and Accessible for All

One of UPI’s biggest strengths is how universal it is, and that extends to loan repayments too. It doesn’t just make them faster, it makes them fairer.

You don’t have to worry about extra charges or long forms. With just a mobile phone and a bank account, you can access and manage EMIs from anywhere. To use UPI services, a registered mobile number is required for secure transactions.

This accessibility opens the door for first-time borrowers or people in Tier-3 cities, making digital repayments truly inclusive and within everyone’s reach. UPI has helped onboard new customers, including those with multiple bank accounts, further expanding access to digital repayments.

Conclusion: Borrow Smart, Repay Smarter with Hero FinCorp

As you can see, paying EMIs doesn’t have to mean juggling dates or stressing over late fees. With UPI AutoPay, repayments slip seamlessly into your routine, giving you one less thing to think about. UPI also allows you to send money, transfer money, and perform money transfer operations easily, making it a versatile tool for all your digital payment needs. The platform ensures the seamless movement of funds for various financial needs, including loan repayments.

At Hero FinCorp, we make the journey even simpler. From instant loan applications to easy AutoPay setup and real-time tracking, everything is digital, transparent, and built for your convenience.

So why wait? Switch to a smarter way of borrowing and repay your loans with confidence.

Frequently Asked Questions

1. Can I repay instant personal loans through UPI?

Yes. Most lenders allow EMI repayment through UPI apps. It’s quick and secure. Repayments can be made using UPI IDs, and features like UPI Lite account, on device wallet, and offline mode provide additional flexibility for users.

2. Are UPI loan repayments safe?

Definitely. UPI is regulated by the National Payments Corporation of India (NPCI), which ensures robust support and security for all transactions. UPI uses multi-factor authentication, so every repayment is safe and verified.

3. Can my UPI transaction history improve my chances of getting a personal loan?

In many cases, yes. Lenders are starting to factor in alternative signals like UPI payments, rent, or utility bills. They may analyze data from your UPI transactions and the linked accounts to assess your creditworthiness and financial behavior. If you’re new to credit, this can boost your loan approval chances.