How Tier 3 Borrowers Can Keep Loan Repayments Affordable and Stress-Free

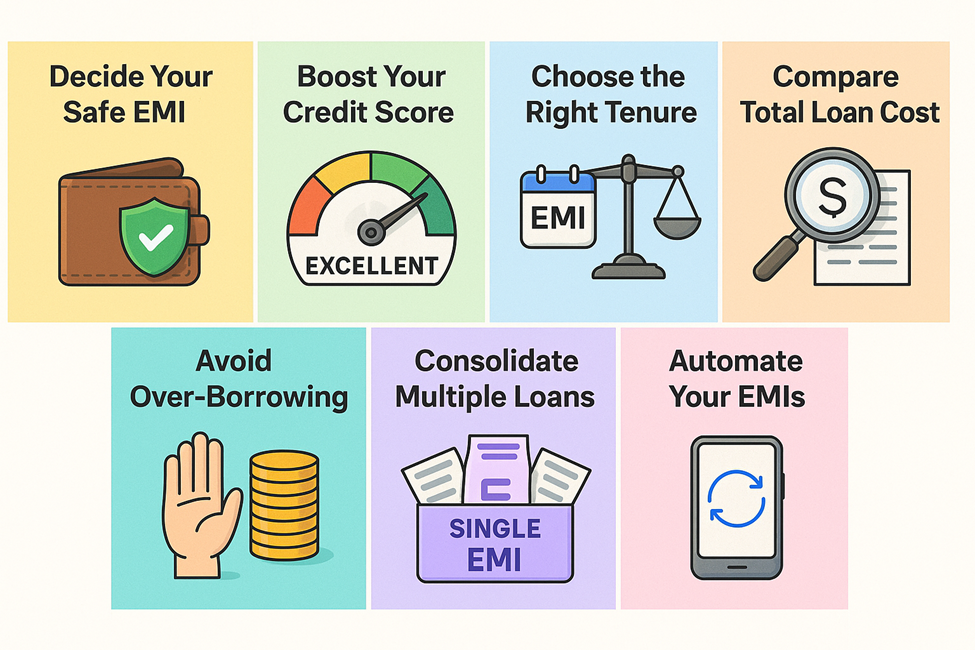

- Decide Your 'Safe EMI' Before the Loan Amount

- Boost Your Credit Score

- Find the Right Tenure to Balance EMI and Interest

- Compare the Total Cost, Not Just the Interest Rate

- Avoid Over-Borrowing (and Keep a Safety Net)

- Combine Multiple Loans Into One Manageable EMI

- Automate EMIs the Easy Way

- Turn Every EMI Into a Smart Move

- Frequently Asked Questions

Do you think personal loans are just for big-city borrowers? Well, not anymore.

In 2024, residents from small towns and Tier 3 cities took 58% of all new loans. It's proof instant credit has gone mainstream, helping more people start their businesses, cover medical expenses, upgrade skills, and tackle life's surprises.

But with this rise comes a common challenge: keeping EMIs affordable month after month.

The fix? A few wise choices before and after you apply can make all the difference.

1. Decide Your 'Safe EMI' Before the Loan Amount

Yes, you read that right. Many borrowers pick the loan amount first, then worry about the EMI, and that's where budgets go off track.

It's time to flip the approach. First, fix how much you can pay each month without touching essentials or savings. That's your starting point. From there, look for a loan setup that stays within that comfort zone.

Quick rule: Keep total EMIs (including all loans) under 30–40% of your monthly income.

Know your safe EMI yet? Use Hero FinCorp's personal loan EMI calculator to find it before you borrow.

2. Boost Your Credit Score

The first thing lenders inspect is your credit score. A higher number often gets you lower interest rates and better terms, which means smaller EMIs for the same loan.

Before you apply, give your score a boost:

● Clear small outstanding dues so your credit usage looks lighter

● Pay every instalment or card bill on time

● Review your credit report and fix any errors you spot

Even a slight boost in your score could trim the interest rate and make your repayments easier.

Also Read: All About Penal Charges

3. Find the Right Tenure to Balance EMI and Interest

Tenure isn't just a number on your loan papers. It shapes your monthly breathing room and the total interest you'll pay.

● Longer tenure: Lower EMIs, easier on your monthly budget, but more interest paid over time

● Shorter tenure: Higher EMIs, heavier load, but you save on interest

The sweet spot? Go for a tenure where your EMI is manageable even in a slow month. That way, you're protected if expenses spike or income dips temporarily.

Not sure which tenure to pick? Use the Hero FinCorp digital lending App to find your perfect repayment plan (12–36 months) and keep EMIs easy on your pocket.

4. Compare the Total Cost, Not Just the Interest Rate

A low interest rate sounds great until you add processing fees, insurance, and penalties that push up the real cost. Before you finalise, ask for a complete cost breakdown.

As per RBI rules, lenders must give you a Key Fact Statement (KFS) showing the Annual Percentage Rate (APR). This number combines the interest rate with all lender charges, so you can compare offers fairly and avoid hidden surprises.

If your credit score is solid and your DTI ratio is low, you could negotiate better terms. Check your personal loan eligibility in minutes.

5. Avoid Over-Borrowing (and Keep a Safety Net)

It's tempting to take a bigger loan "just in case," but a larger amount means a bigger EMI and more pressure on your budget from day one.

Only borrow what's necessary. If you need more later, you can always explore a top-up or a short-term loan. Even better? Keep 2–3 months of EMIs in savings as a safety net. It'll help you sail through emergencies without missing payments or hurting your credit score.

6. Combine Multiple Loans Into One Manageable EMI

Got two, three, or more EMIs at different interest rates? That's stressful and often more expensive.

The better choice? Take a new instant personal loan at a better interest rate and pay off all your existing ones in one go. This debt consolidation can simplify your life while lowering your monthly outflow.

When to consider it:

● You're stuck with high-interest credit cards or multiple loans

● You want one fixed due date (preferably aligning with your salary credits)

● Your credit score is still strong enough to land a lower rate

Need funds fast? Get up to ₹5 lakhs with Hero FinCorp's quick personal loan.

7. Automate EMIs the Easy Way

Often on the move or juggling a packed schedule? Missing an EMI deadline is easier than you think, and even small late fees can sting.

The RBI mandates a fair lending practice by capping such penalties as a flat fee instead of compounding "penal interest." Still, the best way to avoid charges is to never miss a payment in the first place.

Set up UPI EMI AutoPay or e-mandate and let the payments run on autopilot. It's quick to start, easy to pause, and lets you pick flexible payment dates.

The bonus? A spotless repayment record that works in your favour when you apply for credit again..

Also Read: What is NACH Mandate? Meaning, Full Form & How It Works

Turn Every EMI Into a Smart Move

There you have it, your playbook for keeping EMIs stress-free. Plan smart before you borrow, stick to a few good habits after, and you'll stay in control month after month.

With the right partner and the right approach, every EMI can become a step towards financial confidence and long-term peace of mind.

And with Hero FinCorp by your side, you get the flexibility, transparency, and speed to make it happen. Connect with us today and choose a plan that works for you.

Also Read: what is penal charges

Frequently Asked Questions

1. How can I get a lower interest rate in a Tier 3 city?

Keep your credit score high, show steady income, and maintain a low debt-to-income ratio.

2. Are interest rates higher in smaller towns?

Not always! Many lenders now use the same digital checks for all locations.

3. Can I get a personal loan if I'm self-employed in a Tier 3 city?

Yes, but you'll need to show stable income through ITRs, bank statements, or business proof.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented Here is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.