What is UPI ID and How to Create UPI ID?

If you use digital payments every day, you already know how fast India is moving toward a cashless life. But there is one small detail that still confuses many people: what is a UPI ID, and why do apps keep asking for it?

Think of all the times you paid at a local kirana store, split a dinner bill, or sent funds home. Behind every tap lies a simple digital address that keeps your money flowing safely. Once you understand it, UPI starts feeling effortless.

What Is a UPI ID?

A UPI ID is your Virtual Payment Address (VPA) on the Unified Payments Interface. It works like a digital username for payments. Instead of sharing your bank account number and IFSC, you share this simple ID so money can move safely between accounts.

When someone asks what the UPI ID is, it usually looks like this -

name@bankname

mobile@bank

emailprefix@upi

Different apps may show it differently, but the meaning of the UPI ID stays the same. It is your personal payment address that makes UPI safe, quick, and effortless.

Also Read - How UPI Is Redefining Instant Loan Repayments in India

What Is My UPI ID? How to Find It

Finding your UPI ID takes just a moment. Use this quick table to spot yours in seconds.

App | Where to Tap | What You Will See |

Google Pay | Open app → tap profile photo (top right) → Bank Accounts → select your bank → Manage UPI IDs | A list of all UPI IDs linked to that bank account |

PhonePe | Open app → tap profile picture (top left) → QR codes of your linked accounts appear → tap "View UPI Details" for the bank you want | Your active UPI ID for that specific bank account |

Paytm | Open app → tap profile icon → go to "UPI & Payment Settings" | Your primary UPI ID next to the linked bank |

BHIM | Open app → tap profile | Your default UPI ID and any additional VPAs |

Pro Tip - If you use your bank's mobile app, many of them also show your UPI ID under UPI Services, Profile, or Manage UPI. So you can check it even without a third-party app.

Also Read: What is a UPI Address? Meaning and How It Works

How to Create a UPI ID? Step-by-Step Process

UPI now handles over 20 billion payments per month. That is almost 85% of India's digital transactions. And each of these transfers starts with a simple step: creating your UPI ID.

But before you begin, make sure -

- You have an active bank account

- Your mobile number is linked to that bank account

- Your phone has an active SIM for that number

With these basics sorted, you are all set. Now, let's create your UPI ID on the app you use.

1. How to Create a UPI ID on the BHIM App

- Install the app and select your language.

- Verify your mobile number through SMS.

- Select your bank. BHIM will automatically fetch your linked account details.

- Create your UPI PIN using your debit card.

- Your UPI ID is active and ready for use.

BHIM usually gives a clean format like yourname@upi or mobilenumber@upi.

Also Read: How to Create Your UPI Number Using a Mobile Banking App

2. How to Create a UPI ID on Google Pay

- Open Google Pay and tap your profile picture.

- Under Payment Methods, select Bank Account.

- Choose the bank you want to create an ID for.

- Tap Manage UPI IDs.

- Select Add (+) next to the ID you want to create.

- Follow the onscreen steps to activate it.

Google Pay suggests simple formats like yourmobile@okhdfcbank or yourname@okaxis. You can enable up to four UPI IDs per bank account.

3. How to Create a UPI ID on PhonePe

- Install PhonePe and verify your mobile number.

- Tap your profile picture and go to Bank Accounts.

- Add your account if needed.

- Set your UPI PIN.

- PhonePe automatically creates a UPI ID for you.

- Tap "View UPI Details" to see or copy it.

PhonePe formats usually look like yourname@ybl or mobilenumber@ybl.

Also Read: Using Two Bank Accounts with One Mobile Number for UPI

4. How to Create a UPI ID on Paytm

- Install Paytm and log in with your mobile number.

- Go to your profile.

- Tap "UPI and Payment Settings."

- Add your bank account.

- Set your UPI PIN.

- Paytm instantly assigns your UPI ID.

Most Paytm IDs appear as yourname@paytm or mobilenumber@paytm.

Pro Tip - No smartphone? No worries. UPI works even on a basic phone. Dial *99#, choose Registration, pick your bank, enter your debit card details, and set your UPI PIN. Your UPI ID goes live instantly, even without internet. Perfect for low network areas or older phones.

Also Read: How to Set up a UPI PIN Without a Debit Card in 2025?

How to Use UPI ID for Sending and Receiving Money

Once your UPI ID is ready, using it is simple. You can send or receive money in just a few taps, no matter which app you use.

How to Send Money Using a UPI ID

- Open any UPI app.

- Select Pay or Send.

- Enter the receiver's UPI ID.

- Type the amount you want to send.

- Authorise the payment with your UPI PIN.

Also Read: A Simple Guide to Scanning and Paying with QR Codes via Mobile Banking

How to Receive Money Using Your UPI ID

- Share your UPI ID with the person who needs to pay you.

- They enter it in their app and complete the transfer.

- You get the money instantly.

You can also ask for money directly from your app. It works well when splitting bills or collecting shared expenses.

- Open Request Money.

- Enter the person's UPI ID.

- Add the amount and send the request.

Pro Tip - Don't want to enter a UPI ID? Just scan a QR code or use the person's UPI-linked mobile number to pay or receive money instantly.

Also Read: UPI for Business: Key Benefits, Usage, and Tips

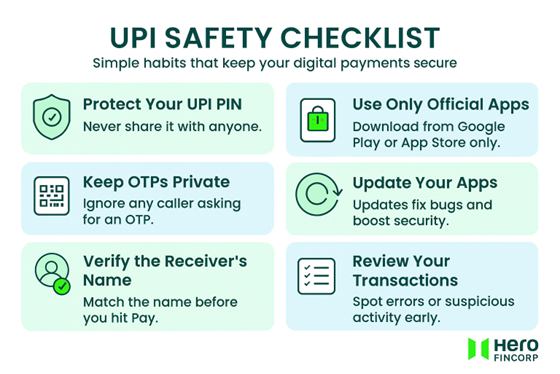

Security Tips While Using Your UPI ID

UPI is already secure but staying alert with a few basics keeps every transaction safer. Follow this quick checklist -

- Never share your UPI PIN with anyone.

- Avoid unknown payment links or requests.

- Check the receiver's name before confirming a payment.

- Scan QR codes only from verified sources.

- Keep your UPI app updated for the latest security features.

- Download only official apps from the Play Store or App Store.

Level Up Your Payment Game

UPI keeps your payments quick and effortless. Hero FinCorp brings that same energy to borrowing with simple online applications and easy AutoPay. The best part? Your everyday UPI history can also boost your personal loan eligibility.

Start your journey now and discover a smarter, no-fuss way to borrow.

Frequently Asked Questions

1. What does a UPI ID look like, and how is it formed?

It looks like name@bank or mobile@upi. It is formed when you link your bank account with a UPI app.

2. Can I create multiple UPI IDs from one bank account?

Yes. Many apps allow more than one UPI ID for the same account.

3. What should I do if my UPI transaction fails but money is debited?

Banks usually auto-reverse the amount within a few hours. If not, raise a dispute in your app.

4. Can a UPI ID be used for merchant and bill payments?

Yes, you can pay bills, recharge, and shop using the same UPI ID.