UPI Transaction Chargeback Rules: Your Guide to New NPCI Norms

You spotted an unknown transaction on your credit card, or a payment was deducted from your account, but the app shows payment failed. What should you do?

The National Payments Corporation of India (NPCI) has introduced UPI transaction chargeback rules to help users recover money from failed, unauthorised, or fraudulent transactions. But what exactly are these rules, and how can you raise a dispute?

Let’s break down the reasons for UPI chargebacks, the latest NPCI updates, and a step-by-step guide to raising a chargeback.

Understanding UPI Chargebacks: A Complete Overview

To protect users from fraud, technical failures, or incorrect debits, NPCI introduced UPI chargeback. UPI chargeback is a dispute resolution process where you can request the reversal of unauthorised, failed, or fraudulent transactions.

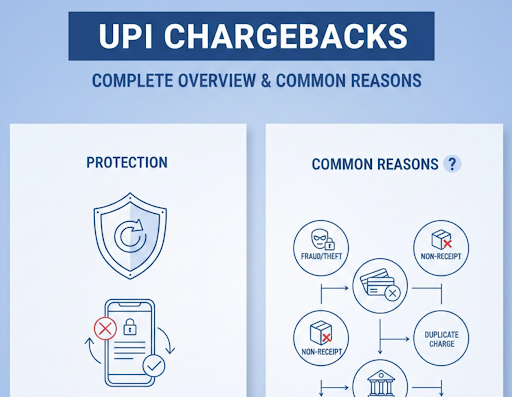

Common Reasons for UPI Chargebacks

A UPI chargeback happens due to a failed or fraudulent transaction. Here are the common reasons for a UPI chargeback:

- Transactions without the consent of the cardholder due to identity theft or stolen card details

- The customer did not receive the goods or services for which they made the payment because of shipping or delivery issues

- When the customer is charged for the same transaction more than once due to merchant errors

- Incorrect or mismatched account details that lead to errors in processing

- Technical glitches in processing, such as duplicate charges or website errors

- User authorises the purchase, but later forgets about it and claims it as unauthorised

- The customer is unhappy with the product or service, and may file a chargeback if the issue is unresolved

Read More: Fake UPI Payment: How to Identify Fake UPI Payments?

New NPCI Rules for UPI Chargebacks: What's Changed in 2026?

NPCI issued new UPI chargeback rules that went into effect on July 15, 2025. NPCI rolled out RGNB, or the remitting bank raising a good-faith negative chargeback.

As per the rule, the issuing/remitting bank can raise a chargeback that was rejected due to the negative chargeback rule. The new rule ensures that users receive refunds quickly and that issues are resolved faster and more efficiently by the bank or app provider.

How Users Benefit from the Updated UPI Chargeback Rules

As a HeroFincorp user, these UPI updates will benefit you with:

- Quick dispute resolution through direct bank action

- Reduced waiting time for refunds in case of failed or fraudulent transactions

- Improved trust and security in UPI transactions

Step-by-Step Guide: How to Raise a UPI Chargeback or Dispute

You can raise a chargeback issue with the UPI app, bank, or NPCI’s dispute resolution mechanism.

Through The App

- Open the app

- Locate transaction history and find the problematic transaction

- Click on the option to report the issue

Through Your Bank

Connect with the customer support at your bank to raise a dispute.

NPCI’s Dispute Resolution System

- Visit the NPCI Dispute Redressal Mechanism

- Fill in the details and submit the form

- Your complaint will be forwarded to the bank. You will get status updates via email

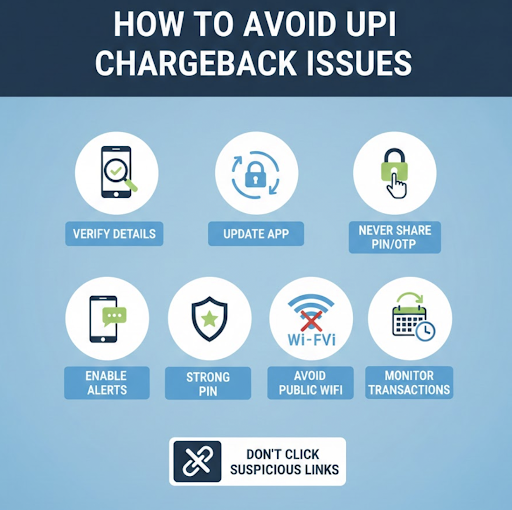

How to Avoid UPI Chargeback Issues

Dispute resolution helps you get your money back, but it’s always better to be careful.

Here’s what to do to avoid UPI chargeback issues:

- Verify the mobile number or UPI ID before confirming

- Update your UPI app regularly to get the latest bug fixes and security features

- Never share your UPI pin, OTP, or passwords with anyone

- Enable SMS or email transaction alerts to monitor in real time

- Use a strong pin for payment

- Avoid transactions using public wi-fi

- Never click on any suspicious links you receive on SMS, social media, or email

- Regularly monitor transaction history and bank statements to spot unusual activity and report fraud in a timely manner

Read More: UPI Not Working? Here’s How to Fix It Fast

Stay Informed to Avoid UPI Chargebacks

UPI chargeback rules by the NPCI offer a strong safety net against failed, fraudulent, or unauthorised transactions. With the new rules, dispute resolution has become faster and more efficient.

And when you are waiting for the dispute resolution and need funds immediately for an emergency, get a personal loan from Hero Fincorp. The paperless process and quick approval offer financial support when you need it.

Install the personal loan app, apply for a personal loan, and avoid draining your savings; be secure even in emergencies!

Frequently Asked Questions

How long does it take to get a refund for a failed UPI transaction under the new rules?

Resolution time varies depending on the complexity of the transaction.

What evidence do I need to support a UPI chargeback request?

You will need the UPI transaction ID, the beneficiary UPI ID or account number, and the date and time of the transaction to support a chargeback request. After submitting a dispute, note the complaint reference number.

Can I raise a chargeback if I sent money to the wrong person?

Yes, if you sent money to the wrong person, you can raise a chargeback request.

What is the role of NPCI in UPI chargeback resolutions?

NPCI is the governing authority behind UPI. It creates and maintains the framework for chargeback resolutions.

Are there any charges for raising a UPI dispute?

There are no charges for raising a UPI dispute.

What happens if my chargeback request is rejected?

You can escalate the issue to the bank’s customer support or to the NPCI if your chargeback request is rejected.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.