BHIM App vs UPI: Meaning, Differences, and How to Choose

You’re paying your electricity bill during a lunch break. Later, you split a cab fare with friends. At night, you send money home, all from the same app. That’s how common digital payments have become in India.

With smartphones in everyone’s hands and strong government support, UPI has become the go-to option for every payment, with transactions crossing ₹27,96,712.73 crores.

However, such regular use has led people to consider terms like UPI and BHIM synonymously. But they aren't.

Let's learn how BHIM and UPI are different to make smarter decisions about how you pay.

What Is UPI?

The full form of UPI is Unified Payments Interface, which is a real-time system that allows you to send money from one bank account to another. You don't need to enter lengthy account numbers or IFSC codes; you can make payments using a mobile number or UPI ID.

UPI makes digital payments simpler and faster. It supports -

- Money transfers between individuals

- Merchant and bill payments

- Recurring transactions

Also Read - Advantages of Using UPI for Everyday Transactions

The Backbone of UPI: National Payments Corporation of India (NPCI)

UPI is owned and operated by NPCI, the organisation that regulates India’s retail payment systems. NPCI ensures-

- UPI is functioning properly between banks and across different apps.

- It is secure and reliable.

- Interoperability among banks, apps, and users through shared protocols and technical standards.

How UPI Makes Digital Transactions So Effortless?

The way UPI works is surprisingly simple.

- When you initiate a transaction, the system securely connects your bank with the recipient’s bank in real time.

- Once you enter your UPI PIN to authorise the payment, the funds are transferred instantly.

- Without intermediaries, transactions are fast and simple, making UPI a popular choice for digital payments.

While UPI powers these instant transactions, BHIM is a popular app built on this platform.

What Is BHIM?

The full form of BHIM is Bharat Interface for Money, a UPI-based app developed by the National Informatics Centre (NIC) for cashless payments.

BHIM: A Government of India UPI App

The BHIM App, backed by the Government of India, offers a secure, easy way for digital transactions of all kinds. With a few steps, you can link your bank account, create a UPI ID, and start making transactions.

Features and Benefits of the BHIM App

- Easy-to-use interface: The app is user-friendly, making payments easy even if you are using it for the first time.

- Strict Security and Regulatory Compliance: Your payments are protected by industry-standard security protocols, so you can transact with confidence and peace of mind.

- Multi-language support: Access the app in the language you feel most comfortable using.

- Direct bank-to-bank transfers: The cash moves directly from the sender’s bank account to the recipient’s bank account.

- QR code payments for quick checkouts: Just scan and pay, perfect for faster transactions at shops.

- No reliance on third-party wallets: Since payments are linked directly to your bank account, there’s no need to manage extra wallets or balances.

BHIM vs UPI: Key Differences

The difference between BHIM and UPI is what most people find confusing. Here are the clear differences between them.

| Aspect | UPI | BHIM |

|---|---|---|

| What it is | The underlying technology for digital payments | An app that uses the technology |

| What it does | Enables instant bank-to-bank transfers | Let's users make payments using UPI |

| Usage | Cannot be used directly by users | Can be used directly for transactions |

| Flexibility | Works across multiple banks and apps | Limited to features within the BHIM app |

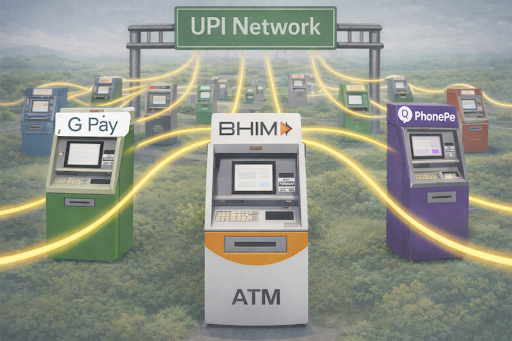

Here is an analogy to clarify BHIM vs UPI

UPI is the ATM network, and BHIM is one ATM in the network. There are many ATMs, but they all use the same system.

One of UPI’s main selling points is interoperability. This means that money can be sent or received through any UPI app based on user preferences.

Security in BHIM and UPI Transactions

When it comes to digital payments, security is crucial, and that’s something BHIM and UPI take very seriously.

Multi-factor Authentication

Users must set up a UPI PIN, which acts as the password for transactions. You need to enter your UPI PIN for each transaction, and no one else can transact on your phone without it.

Encrypted Data

All transaction data is encrypted, meaning that sensitive information such as bank account details and payment credentials is converted into a secure code that cannot be intercepted or read by unauthorized parties.

NPCI-regulated Systems

Another reason these apps are trustworthy is that they’re regulated by NPCI, which monitors all transactions and regularly updates security measures to prevent fraud before it happens.

How HeroFincorp Uses UPI For EMI Payments?

HeroFincorp makes loan repayment management simple and hassle-free by enabling UPI AutoPay for its customers. With this, borrowers can set up automatic EMI payments directly from their bank accounts, ensuring payments are made on time, every time.

This not only saves customers from the stress of remembering due dates but also helps them maintain a healthy credit score.

Also Read - How UPI Is Redefining Instant Loan Repayments in India

Choose Your Digital Payment with Confidence

Once you understand how UPI and BHIM work, transferring money, paying bills, or monitoring your expenses is much simpler and hassle-free. However, life is unpredictable, and you may face sudden expenses. In such situations, having the right financial support is important.

Hero FinCorp offers a fully digital, paperless loan application process to ensure you meet your emergencies with peace of mind.

Get a personal loan and put yourself in control even in emergencies.

Frequently Asked Questions

Do I need to have a bank account for BHIM and UPI transactions?

Yes, as UPI enables direct bank-to-bank transfers.

What are the normal transaction limits on BHIM and other UPI apps?

Most UPI apps allow transactions of up to ₹1 lakh per day, although limits may differ by bank and transaction type.

Is it safe to link my bank account to UPI-enabled apps?

Yes, UPI apps use encrypted systems and require a UPI PIN for each transaction.

How does HeroFincorp support EMI payments through UPI apps?

HeroFincorp customers can use UPI apps for quick, secure, and convenient EMI repayments.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.