Advantages of Using UPI for Everyday Transactions

India’s love for UPI is undeniable. With an average exceeding 650 million transactions per day, it is clearly the crowd favourite. A quick scan and a beep can settle payments for anything and everything.

From buying vegetables at the local market to splitting a dinner bill with friends, it covers it all.

What started as a government-backed initiative has become a national habit. UPI has ushered in a new era of convenience. And as a result, it’s now an integral part of how we live, shop, and move through the day.

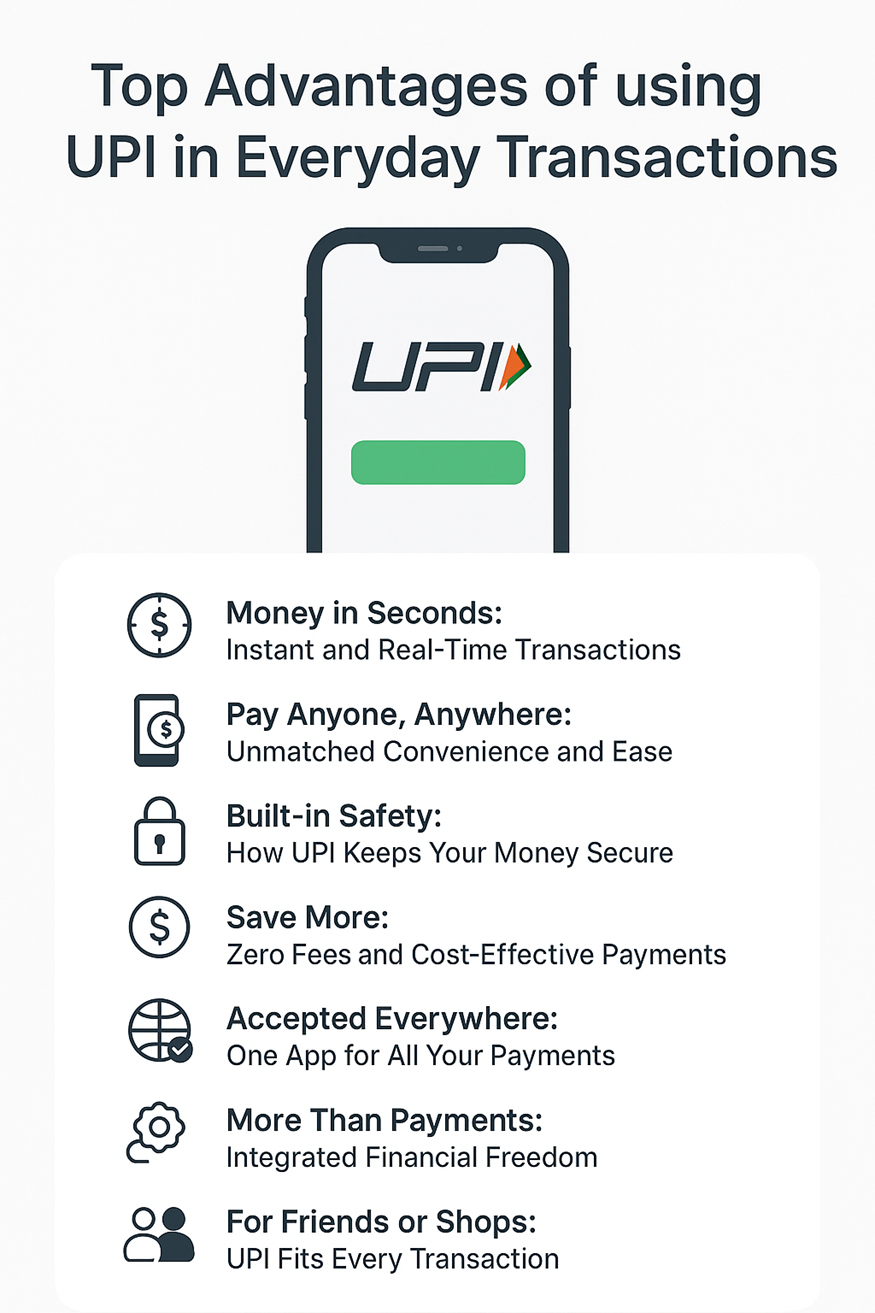

Key Advantages of Using UPI for Everyday Transactions

UPI changed how Indians move money. It is almost a habit at this point. Below are the real, practical advantages of UPI that make it the default choice for daily payments.

Money in Seconds: Instant and Real-Time Transactions

Speed is one of the biggest advantages of UPI payment. Transfers happen in real time. The day or time doesn’t matter. That means you can pay a vendor at midnight, split a dinner bill instantly, or send an urgent transfer to family without waiting hours.

Instant settlement reduces cash dependency and helps small businesses manage receipts quickly. For consumers, instant payments mean fewer follow-ups and no waiting for bank cutoffs.

Also Read: How to Check UPI Transaction Status?

Pay Anyone, Anywhere: Unmatched Convenience and Ease

UPI keeps things simple. You don’t need long account numbers or IFSC codes. A virtual payment address (VPA) works like an email for money. Link multiple bank accounts to one app. Use a single interface for transfers, bill payments, and even in-store scans.

This convenience is a core reason people prefer UPI. The app replaces multiple banking steps with a single tap. That’s one of the plainest advantages of UPI in daily life.

Built-in Safety: How UPI Keeps Your Money Secure

Security is central to UPI’s design. You need to enter your UPI PIN to sanction each transfer. Apart from the multi-factor checks, most UPI apps also use end-to-end encryption.

They also mask bank details for added protection. That reduces risk compared with sharing card numbers or handing over cash.

For suspicious activity, you get immediate notifications. In short, UPI blends ease with layers of protection, which is a key security advantage of UPI payment methods.

Also Read: Split Payments: What is it, Methods, How Does it Work & Uses

Save More: Zero Fees and Cost-Effective Payments

Cost matters. UPI is highly cost-effective. Many transactions are free or carry negligible charges. Compared with NEFT/IMPS fees or merchant card swipe fees, UPI keeps micro-payments and small business margins healthier.

For heavy users, such as delivery businesses, kirana shops, and small restaurants, low transaction costs translate to better savings. Consumers benefit too: everyday payments don’t quietly eat into your budget.

Accepted Everywhere: One App for All Your Payments

UPI’s interoperability is powerful. A single UPI app works across banks, billers, and merchants. From big retail chains to roadside stalls, you can scan or enter a VPA and complete payment.

This wide acceptance reduces the need to carry cash or multiple wallets. For frequent travellers and urban commuters, it simplifies life. That broad reach is a core advantage of UPI versus fragmented digital options.

More Than Payments: Integrated Financial Freedom

Modern UPI apps are not just for transfers. They integrate bill payments, merchant offers, small-ticket lending, insurance premiums, and even investments. You can schedule recurring payments, check payment history, and see spending patterns.

This convergence of services makes UPI a practical financial hub on your phone. The integration helps users manage money smartly.

For Friends or Shops: UPI Fits Every Transaction

UPI works equally well for person-to-person (P2P) and person-to-merchant (P2M) use. Need to split a cab? P2P is instant. Paying for groceries? Scan a merchant QR.

This flexibility supports both social and business payments, reducing friction in everyday interactions. Because it’s adaptable, UPI increasingly replaces cash for both small daily spends and larger merchant transactions.

Also Read: UPI Transaction Limit Per Month

The Future of Payments Lies with UPI

With a blend of speed, simplicity, and safety, UPI has changed how India transacts. As digital adoption deepens, UPI will only grow stronger, driving a cashless, connected economy. If you’re still on the fence, now’s the time to embrace it and experience the future of payments in your hands.

That's a wrap on the advantages of UPI. Facing issues with your UPI app? Or experiencing a financial crunch? Hero FinCorp's personal loan can cover your expenses until you're on your feet.

Frequently Asked Questions

1. How secure are UPI transactions in India?

UPI follows RBI and NPCI security guidelines. The guidelines mandate the use of multi-layer authentication and encryption to protect every transaction. This makes them highly secure.

2. Are there any charges for using UPI payments?

UPI transactions are normally free. That said, some banks and apps may apply nominal fees for high-value transfers.

3. Can I link multiple bank accounts with one UPI app?

Yes, you can link several accounts under one app.

4. What happens if a UPI transaction fails?

If a transaction fails, the amount is usually automatically reversed to your account within 2–3 working days.

5. Is UPI accepted by all merchants in India?

Almost all major merchants, local shops, and service providers accept UPI payments through QR codes or UPI IDs.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.