What Is a UPI Reference Number & How to Track It Online?

Have you ever paid someone via UPI, but the receiver didn't get the money? Or has someone ever said they paid you via UPI, but it didn’t reflect in your bank statement? Yes, these are some common UPI scam techniques these days.

The UPI payment system is doing better than ever, with its transaction failure rate below 1%. Yet, some users fall prey to such purported UPI issues due to a lack of awareness.

Here’s the thing: A UPI app has everything one needs, not just to send and receive money but to keep themselves protected against fraud. Let's discuss one such element, the UPI reference number, and explain how you can use it to dodge scams.

What Is a UPI Reference Number?

A UPI reference number, also called a Unique Transaction Reference (UTR) number or Reference ID, is a special 12-digit code for every UPI payment. For example, on Google Pay, it might look like this: 123452621485.

This number helps you track your payments, make sure they went through, and sort out any problems to prevent fraud.

Keep in mind that a UPI reference number isn't the same as a UPI transaction ID. The bank assigns a reference number for official checks or to resolve issues, while the app makes the transaction ID to track things on its end.

Also Read: How to Get Phone Number from UPI ID?

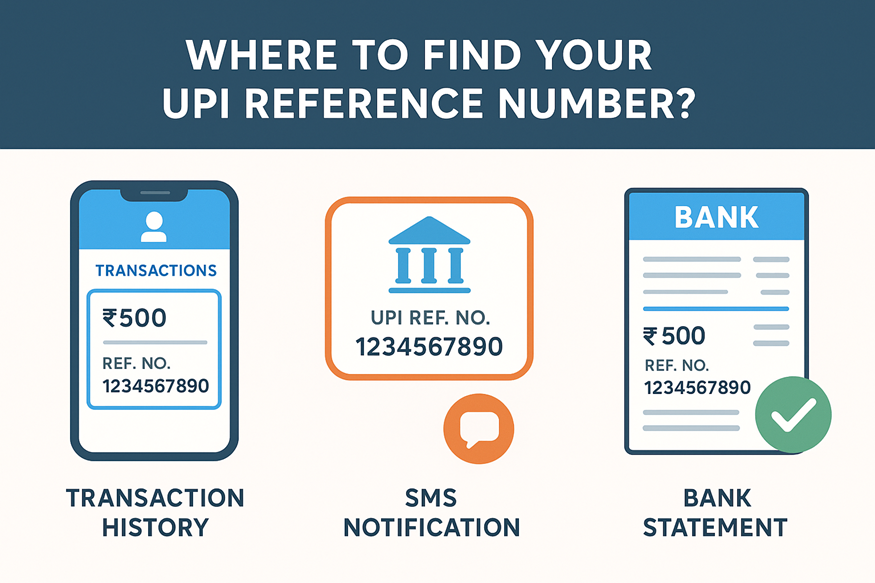

Where to Find Your UPI Reference Number?

After completing a UPI transaction, you can check your UPI reference number in the transaction history in your UPI app (Google Pay, PhonePe, Paytm, or BHIM). Each payment generates a unique numeric code, visible when you tap on the transaction to view its details. The number appears alongside the payment amount, status, and timestamp.

You can also find the same UPI reference number in the SMS notification sent by your bank after the transaction. It is also recorded in your bank statement under the corresponding debit or credit entry, allowing you to verify and track your payments whenever needed.

How to Track the UPI Reference Number Online?

Tracking your UPI reference number is easy. You can use the UPI app you have used to make/receive the payment, or directly check it in your bank statements online. Here's how to track the UPI Reference Number online on UPI apps and bank websites.

1. Open your UPI app (Google Pay, PhonePe, Paytm, etc.). Alternatively, open your bank app or visit the official website.

2. Go to the “Transaction History” section and pick the transaction you want to track.

3. You’ll find a 12-digit code called Unique Transaction Reference (UTR). This is your UPI reference number.

Apart from bank websites/apps and UPI apps, you can track the UPI Reference number via -

• SMS/Email - Look for confirmation messages from your bank or the UPI app.

• Bank Statement - The reference number appears next to the transaction in your downloaded bank statement.

Note - Google Pay uses different terms. The UPI Transaction ID in Google Pay is actually the bank-generated Unique Transaction Reference (UTR), while the Google Transaction ID is the app-generated UPI transaction ID.

How to Use the UPI Reference Number for Dispute Resolution?

You need your UPI reference number details anytime a payment fails, gets stuck, gets debited twice, or doesn’t show up for the receiver. They help your bank or UPI app trace the payment and confirm what actually happened.

How to file a complaint

• Open your UPI app → head to Help or Support.

• Select the transaction to start UPI transaction reference number tracking.

• Enter the reference number, add a short note, and submit.

• Keep the number handy if support needs verification.

What to do if the problem persists?

• Contact your bank’s customer care and share the reference number for quicker tracking.

• If it still isn’t fixed, raise a complaint on NPCI’s official portal using the same number.

Also Read: How to Check UPI Transaction Status?

Common Myths About a UPI Reference Number

UPI is now the world’s top real-time payment system. Despite this, many people don’t have a clue about the UPI reference number or what it entails. So, here’s a myth vs fact check -

1. Myth: Sharing your UPI reference number is unsafe.

Fact: You can share your UPI reference number with bank officials or the payment recipient without any worry. It’s totally safe to do so.

2. Myth: A UPI reference number and a UPI ID are the same.

Fact: A UPI reference number is a 12-digit numeric code that’s generated after a transaction. A UPI ID is your UPI account’s address that you use to send and receive money.

3. Myth: You need the UPI reference number to send or receive a payment.

Fact: A UPI reference number is auto-generated after a payment is completed. It’s not needed to send or receive a payment.

Track Every UPI Payment Without Stress

UPI has basically become the default way to pay, and it’s only going to grow from here. So it makes total sense to understand the small but important stuff like the UPI reference number. Once you know how to track it and use it, you’re way less likely to get caught in scams or payment drama.

If you’re working toward a major goal and need quick financial support, apply for a personal loan with Hero FinCorp and move forward with confidence.

Frequently Asked Questions

1. Can one UPI reference number be used for multiple transactions?

No, because each UPI transaction has a unique reference number.

2. What to do if the UPI reference number is lost?

Check your UPI app’s transaction history to find your UPI reference number. You can also check your bank statement.

3. Is a UPI reference number the same as a UPI ID or a transaction ID?

No, a UPI reference number isn’t the same as a UPI ID. However, it is similar to a transaction ID.

4. Can I share my UPI reference number with others safely?

Yes, you can safely share your UPI reference number with others.

5. How long are UPI reference numbers valid for tracking?

A UPI reference number doesn’t expire, so it’s always valid for tracking.