Understand the Process and Benefits of Cash Withdrawal Using UPI at ATM

You urgently need cash, rush to the nearest ATM, and only then realise you’ve forgotten your wallet. Not long ago, this meant heading back home, retrieving your card, and retracing your steps to the ATM.

Today, things are different. With UPI-enabled ATMs, you can simply take out your smartphone, select the UPI cash withdrawal option, and get the cash you need—no card, no PIN entry on the machine, no hassle.

But how exactly does a UPI cash withdrawal work? Is it available at all ATMs? What about limits and charges? This post breaks it all down. Read on!

Understanding UPI ATM Cash Withdrawal

UPI ATM Cash Withdrawal is exactly what it sounds like: a way to withdraw cash from an ATM using UPI. All you need is your smartphone with a UPI app, and you can withdraw cash from any bank's atm, regardless of which bank is linked to your app.

However, to do that, the ATM has to be UPI-enabled. The first units of this kind were launched in 2023. The service is officially called India's Interoperable Cardless Cash Withdrawal (ICCW), another brainchild of the NCPI.

How Does UPI ATM Cash Withdrawal Work?

The UPI Cash Withdrawal from an ATM works as follows:

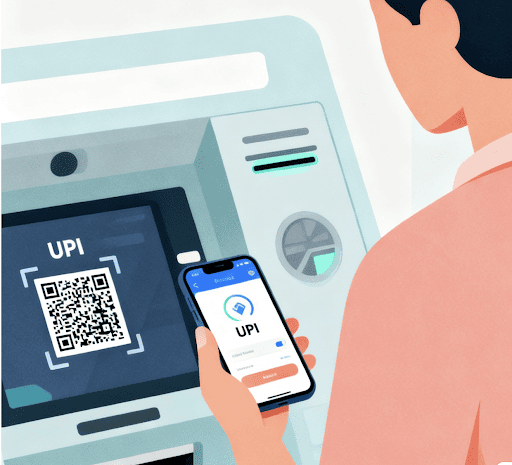

Step 1: At a UPI-enabled ATM, check the UPI cash withdrawal option. Some ATMs may list these options as "Interoperable Cardless Cash Withdrawal (ICCW)", while others may simply list it as "Cardless Withdrawal".

Step 2: You will then be directed to a screen that asks you to enter the amount you want to withdraw or select from a list of predefined options. The moment you do that, a QR code will appear on the ATM's screen.

Step 3: Scan the QR code with your UPI app, enter your UPI pin to authenticate the transaction, and voila, the cash comes out of the ATM.

And don't worry, the QR code becomes invalid the moment the transaction is complete, so there is no worry of anyone misusing it.

Benefits of Cash Withdrawal Using UPI at ATMs

UPI ATM cash withdrawals actually provide a wide range of benefits to anyone who uses them, such as:

Cardless Cash Withdrawals

Today, the possibility of stepping out of your home without a smartphone is minimal compared to the likelihood of leaving your wallet behind. The ability to withdraw cash with a debit card is perhaps the biggest benefit of this new system.

Better Security

With UPI-based cash withdrawals, the days of your Debit Card being scanned by card readers on compromised ATMs are now a thing of the past. Plus, you enter your secure PIN on your smartphone and not on the machine itself, another plus of this system. And since almost everyone sets a PIN or a biometric lock on their smartphone, that acts as an additional layer of security.

Convenience

With this system, you can walk up and withdraw cash from any bank's ATM, regardless of the one linked to your UPI account. In addition, since most UPI apps allow you to link multiple bank accounts to them, you don't have to shuffle between ATMs to withdraw cash from specific bank ATMs to avoid the additional fee.

Financial Inclusion

This system opens the door to withdrawing funds for those without debit cards. It also proves invaluable during transit, such as when awaiting a replacement card or waiting for a new debit card to arrive after opening a new account.

Short on cash? Download our instant loan app and apply within minutes!

UPI ATM Cash Withdrawal Limits and Charges

According to NPCI's guidelines, the per-transaction limit for UPI ATM cash withdrawals is ₹10,000. The daily transaction limit is the same as for standard UPI transactions, i.e., ₹1,00,000.

That said, individual banks do impose their own transaction limits and daily withdrawal caps. You must also know that withdrawing cash via UPI counts towards your daily UPI transaction limit.

As far as the charges go, the standard ATM rules apply here:

- 5 free withdrawals at own-bank ATMs (financial + non-financial)

- 3-5 free withdrawals at other-bank ATMs

- Post this limit is a charge of ₹23 + GST per transaction.

So, since you can link multiple bank accounts to a UPI app:

- Using the same bank's ATM as the one linked to your UPI will count against the 5 free ATM withdrawal quota.

- Using an ATM outside the bank linked to your UPI app will count against the free 3-5 quota for other bank transactions.

The Future Of UPI ATM Cash Withdrawal In India

The NPCI has rolled out an exciting new proposal that allows UPI Cash Withdrawals at Business Correspondent (BC) outlets. In layman's terms, this means that every local Kirana store can now function like an ATM, letting anyone pop in to withdraw cash.

The best part? This initiative will really benefit folks in rural and semi-urban areas who often have to trek quite a distance just to find an ATM.

Summing It Up

UPI ATM Cash Withdrawals is the next step forward in India's move towards digitisation. It adds an extra layer of convenience to an otherwise simple process while providing additional security.

As more ATMs become UPI-enabled and if the plans to introduce BCs come to fruition, easy access to funds will become universal in the country.

If you need funds urgently without visiting an ATM, you can apply for a personal loan through the Hero FinCorp app. The process is fully digital, approvals take just minutes, and the money is credited to your account the same day.

So why wait? Install our app now and apply for instant funds whenever you need them!

Frequently Asked Questions

Can I withdraw cash using UPI without a debit card?

Yes, with the new UPI ATM Cash withdrawal system, you don't need a debit card to withdraw cash anymore.

Are UPI ATM withdrawals available at all ATMs in India?

At the moment, there are very few ATMs in India that are UPI-enabled. Most of them are deployed by big banks like HDFC, AXIS, ICICI, SBI, and PNB at select ATMs within their networks.

What happens if my UPI ATM withdrawal transaction fails?

If a transaction at a UPI ATM fails, the amount will get credited back into your account within 24 hours.

Can I choose which bank account to withdraw from using UPI?

Yes, you can choose any of your linked bank accounts to withdraw funds from a UPI-enabled ATM. That said, please note that each withdrawal counts against the standard free withdrawal quotas.

Is there a transaction fee for UPI ATM cash withdrawals?

As with standard ATM withdrawals, you are allowed five free withdrawals from the same bank and 3 to 5 from other banks' ATMs. Post that, there is a fee of ₹23 + GST per transaction

How secure is withdrawing cash using UPI at ATMs?

Withdrawing cash via UPI is, in fact, safer than withdrawing cash via debit card, as you avoid the chance of your card getting skimmed.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.