How to Increase Your UPI Transaction Limit

UPI has changed how money moves in India. It's used to pay for everything from rent and EMIs to the smallest of transactions at local vendors. That said, if you are a frequent UPI user, you may have noticed that your transactions no longer go through after a certain point.

This is because there are daily limits on how much you can transact via UPI. These limits are primarily put in place to safeguard users against fraud. While it is a good thing, it can be a hindrance when you really need to make an urgent, large payment.

At this point, you may wonder whether it’s possible to increase your UPI limit. The good news is: it is. Read on to find out how.

What Is The Standard UPI Limit Set Per Day?

The National Payments Corporation of India (NCPI) has set the upper limit for daily transactions (for normal users and transactions) at ₹1 lakh per day for UPI.

There are, however, a few categories that have higher limits, like the following:

● ₹2 lakh: Jewellery Purchases or the initial funding for opening a new account.

● ₹5 lakh: Education fees, healthcare and insurance payments, credit card repayments, travel-related transactions, capital markets, and government e-marketplace payments.

While these are the upper limits set by the NCPI, banks can set lower internal caps to limit their risk.

How to Increase UPI Limit: Step-by-Step Methods

Now, to be clear, your UPI limits cannot go beyond either the bank's internal or NCPI limits.

However, there still may be room to increase it depending on which UPI app you are using and the limits set within it.

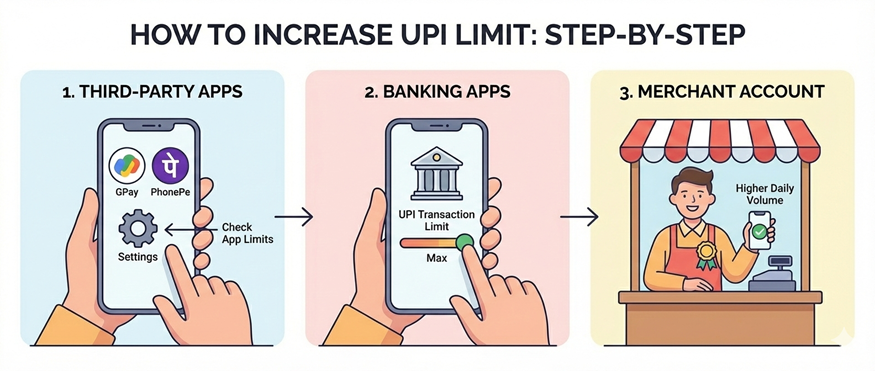

When Using Third-Party UPI Apps

Apps like Google Pay, PhonePe, and BHIM have their own internal caps. These cannot exceed your bank’s limit. If the app limit is lower, transactions may fail even when the bank allows more.

Check the app settings to ensure the app-side limit matches the bank-side limit.

When Using UPI-Enabled Banking Apps

Banking apps often allow you to set individual limits on various types of transactions, like transfers, debit card transactions, and UPI transactions. Check these settings to make sure that the limit for UPI transactions is at the max that your bank allows.

Upgrade to a Merchant Account

In case you run a business and need to send or receive higher sums of money via UPI. Consider upgrading your account to a merchant account. Each transaction on a merchant is capped at ₹5 lakh; however, there is no cumulative upper limit to how many such transactions you can do in 24 hours.

The Role of Virtual Payment Address (VPA) In Transaction Limits

The good news for you is that each VPA is linked to a specific bank account. So if you enable UPI on multiple bank accounts, you can distribute your payments across multiple VPAs and make full use of the upper limit set by the NCPI.

Are There Charges for High-Volume UPI Transactions?

If you are a regular user, there are no charges for person-to-person UPI transactions, regardless of value, as long as they stay within permitted limits.

There are, however, specific cases in which charges may apply, such as:

● Wallet-based payments using Prepaid Payment Instruments

● Merchant payments above ₹2,000 via wallets

In such cases, there is usually a small interchange fee charged.

Why You Might Face a Temporary UPI Limit Decrease

There are certain cases in which you may face a temporary decrease in your UPI limit. These are again to protect you and come into force when:

● You change your smartphone.

● You change your SIM.

● When you register a new UPI.

Your limits will be back to normal after a 24-hour cooling period.

Also Read: UPI Not Working? Here’s How to Fix It Fast

Use Your UPI Smartly

While these limits on UPI transactions can seem restrictive at times, they are there for a reason, i.e., to protect you financially.

The simplest way to increase your UPI limit is to understand how it is set and work smartly to utilise the full daily limit if needed. Keeping all your apps updated will also ensure that they reflect the latest changes to them, if any.

There may be instances where you reach your daily UPI limit but need access to instant funds for an emergency. For such cases, Hero FinCorp offers instant personal loans that are approved in under 10 minutes. With a quick digital application process and minimal documentation, you can get timely financial support when you need it most, without disrupting your daily transactions.

Frequently Asked Questions

Can I increase my UPI limit to ₹5 lakh for all transactions?

No. The ₹5 lakh limit applies only to very specific categories.

Does resetting my UPI PIN affect my limit?

Depending on the app you are using, you may face a temporary dip in your UPI limits as a precaution. The limit is usually restored after a 24-hour cool-off period.

Why is my GPay limit lower than my bank’s limit?

Gpay usually allows you to utilise NCPI's full ₹1 lakh limit per day unless you are a new user or have just reinstalled the app. In that case, your limit is set to ₹5000 for the next 24 hours.

Is there a limit on the number of UPI transactions one can make per day?

Most banks allow up to 20 UPI transactions per day.

How to increase the UPI payment limit in SBI or HDFC?

Use the bank’s official app or net banking portal to manage limits.

Does the VPA type affect the transaction cap?

No, your VPA doesn't affect transaction caps unless it's a merchant VPA.

Is there a charge for increasing the limit?

No. Banks do not charge you for changing UPI limits.