Difference Between IMPS and UPI Fund Transfer

Anushree needed to make an urgent payment to a vendor. The vendor said, “You can send it via IMPS or UPI, whichever suits you.” Anushree paused. Until that moment, she thought IMPS and UPI were the same thing. Clearly not. Both help you transfer money instantly, but in very different ways.

So, in this guide, we break down the difference between UPI and IMPS. Choose the right method with confidence.

Introduction to UPI and IMPS

India’s digital payments landscape has grown at lightning speed. From net banking transfers to real-time payment systems, sending money has become simpler than ever. Two of the most widely used instant transfer modes today are UPI and IMPS.

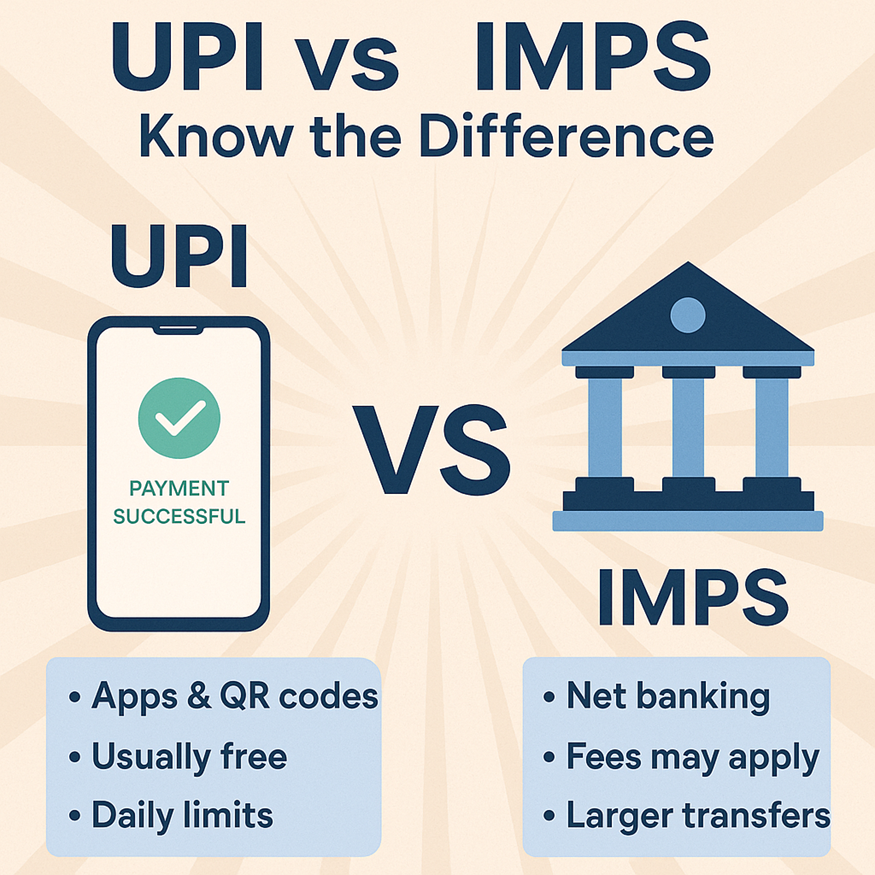

UPI is an app-based payment system that lets you transfer money using a VPA, QR code, or mobile number. IMPS is a real-time bank-to-bank transfer using account details or MMID.

Both are fast, secure, and available round-the-clock. But they’re not the same. This is why it’s crucial to highlight the difference between UPI and IMPS.

IMPS vs UPI: Detailed Comparison

Let’s break down IMPS vs UPI through a table -

| Feature | UPI | IMPS |

| Transaction Process | Transfer via UPI apps using VPA, QR code, mobile number, or bank account | Transfer via bank apps/net banking using account number and IFSC or MMID |

| User Experience/Interface | App-driven, simple, beginner-friendly | Traditional interface; requires familiarity with bank portals |

| Transaction Speed | Near-instant; usually under a few seconds | Real-time; equally fast, but may take slightly longer during peak load |

| Transaction Limits | Usually up to ₹1 lakh/day (depending on bank); some allow higher | Higher limits (typically up to ₹5 lakh or more, depending on bank) |

| Fees & Charges | Typically free for users | Some banks may charge a small fee, depending on the amount slab. |

| Security & Privacy | Encrypted; doesn’t require sharing bank details | Encrypted; requires direct bank details for transfer |

| Device/Accessibility Requirements | Smartphone with UPI app and internet connection | Works on net banking, bank apps, or feature phones (via MMID) |

| Supported Use Cases | P2P payments, merchant QR payments, and online purchases | Higher-value P2P transfers, banking transactions, and account-to-account transfers |

It all boils down to convenience and use case, which highlight the difference between IMPS and UPI.

🏆 Winner - UPI wins on usability and everyday payments. IMPS shines for larger, more formal transfers through traditional banking channels. Both are secure, instant, and reliable, just suitable for different scenarios.

Also Read: Net Banking vs UPI: Which is Better for Paying Personal Loan EMIs?

When to Use IMPS and When to Use UPI?

Here’s a rule of thumb you can follow if you’re unsure whether to pick IMPS or UPI.

Use IMPS when -

● Transferring higher-value amounts

● Using net banking instead of apps

● Dealing with formal or traditional banking transfers

Use UPI when -

● Sending small or mid-value amounts daily

● Paying merchants through QR codes

● Splitting bills, paying friends, or doing quick P2P transfers

Also Read - Advantages of Using UPI for Everyday Transactions

Common Myths About UPI and IMPS

There are several myths about UPI and IMPS that confuse users. Let’s clear a few misconceptions.

1. Myth - UPI runs on IMPS.

Fact - That’s not entirely true. UPI uses IMPS infrastructure at times, but it is a separate payment layer designed for app-based transfers.

2. Myth - IMPS doesn’t work at night.

Fact - That’s incorrect. IMPS is available 24/7. This includes weekends, public holidays, and late nights.

3. Myth - UPI is unsafe.

Fact - UPI is encrypted end-to-end. You are only susceptible to fraud through user error, not by the system.

4. Myth - IMPS is slower than UPI.

Fact - Both are real-time. Minor lags may occur due to bank load, not the method itself.

Future of Digital Payments in India: Role of UPI and IMPS

Digital payments in India continue to expand at a rapid pace. IMPS remains crucial for high-value transactions and for users who rely on traditional banking channels. But, UPI is growing with innovations like UPI 2.0, autopay, and credit-on-UPI. Plus, there’s increasing global acceptance of UPI, which will propel it further.

Today, repayment is as easy as a tap, and lenders like Hero FinCorp make it even simpler by allowing you to pay your EMIs through UPI. So if you're considering a personal loan, you can enjoy the ease of quick, secure UPI payments every month.

Apply for a Hero FinCorp personal loan now and manage your entire loan journey digitally with complete peace of mind.

Frequently Asked Questions

1. Is UPI faster than IMPS?

Both are real-time; the difference is usually negligible.

Which is cheaper, IMPS or UPI?

UPI is usually free. Some banks may charge for IMPS.

3. Does UPI require a smartphone?

Yes, unless you use UPI via USSD (*99#) or UPI 123PAY, which supports feature phones.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.