Are UPI PIN and ATM PIN the Same?

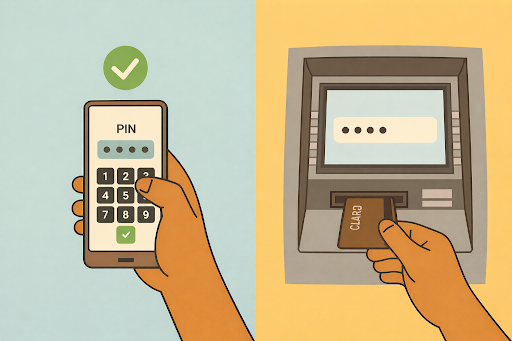

UPI has made sending money quick and straightforward. UPI payments end with a PIN to approve the transfer. ATMs ask for a PIN too before dispensing cash. Because both steps involve your bank account and a numeric code, the distinction is often missed.

However, the UPI PIN and ATM PIN exist for separate uses and follow different security processes. Each is designed around how the transaction happens and the risks involved.

Let’s take a closer look at how these two PINs differ and why banks keep them separate.

What is a UPI PIN?

When you set up UPI for your bank account, you’re asked to choose a numeric PIN. That PIN comes into play each time you approve a transfer or confirm a payment in your UPI app.

Think of it as your final approval step. Even though the PIN is tied to your bank account, you only enter it inside the app when a transaction is being processed.

Since this single code allows money to move out of your account, it needs to stay private. If someone else gets hold of your UPI PIN, they could approve payments without your consent.

What is an ATM PIN?

ATM access depends on a PIN linked to your debit card. It’s set during card activation and is needed for routine actions such as withdrawing cash or viewing your balance.

Most ATM transactions still involve inserting the physical card before entering the PIN. Some banks have also introduced limited cardless withdrawals, but the ATM PIN still remains central to most ATM transactions.

Banks rely on the ATM PIN as a key security layer to ensure only the authorised account holder can access funds. It should always be kept confidential and updated periodically.

UPI PIN vs ATM PIN: Key Differences

Even though both PINs connect to your bank account, they are not meant for the same transactions. The differences are easier to see when compared side by side.

| Aspect | UPI PIN | ATM PIN |

| Usage and transaction type | Used to approve digital payments through UPI apps | Used for ATM services such as cash withdrawal and balance enquiry |

| Security mechanisms | Works within the NPCI-regulated UPI system with app and device checks | Depends on debit card verification within ATM networks |

| Generation and reset process | Created and changed inside a UPI app | Issued and reset through debit card channels |

| Accessibility and convenience | App-based and does not require a physical card | Card-based, with limited cardless options |

The table gives a broad comparison, but the distinction becomes clearer when you look at how each PIN is actually used.

Usage and Transaction Type

A UPI PIN is entered when approving payments through an app. ATM PINs are used in physical banking settings, where access to cash or debit card services is required.

Security Mechanisms

UPI transactions are approved only after multiple checks. Along with the PIN, the app verifies the registered device and confirms the request with the bank. This means payments cannot go through from an unrecognised phone.

ATM PINs work differently. Access depends on the physical debit card and the correct PIN being entered, which is why losing the card can be just as risky as sharing the PIN.

Generation and Reset Process

UPI PINs are managed inside the UPI app itself. You can create or change them using your debit card details and the mobile number registered with the bank. ATM PINs follow a separate process.

They are set when the debit card is issued and can later be changed at an ATM, through net banking, or with assistance from the bank.

Accessibility and Convenience

UPI PINs make everyday payments easy as long as you have a smartphone and internet access. ATM PINs are still essential for withdrawing cash and using most ATM services, even though some banks now offer limited cardless transactions.

Why Separate PINs for UPI and ATM?

Banks and payment authorities keep UPI PINs and ATM PINs separate to reduce risk and limit the spread of fraud. UPI payments and ATM transactions work through different systems and face different types of misuse.

If one common PIN were used everywhere, a breach in one channel could expose the entire account. Using separate PINs helps contain risk. If a debit card is lost or an ATM PIN is exposed, UPI payments are not automatically affected.

Being informed also matters when handling money. Taking time to review borrowing options can help avoid repayment stress later.

How to Set, Change, and Secure Your UPI PIN and ATM PIN?

Keeping your UPI and ATM PINs updated and secure makes everyday banking smoother and lowers the risk of misuse. Here is how you can manage both.

Steps to Set and Change UPI PIN

- In the UPI app, navigate to the bank account or PIN settings section

- Select whether to generate or change your UPI PIN

- Enter your debit card details if the app asks for verification

- Confirm your identity using the OTP sent to your registered mobile number

- Create a new four or six-digit UPI PIN and confirm it

Managing payments securely on your phone becomes easier when your financial tools are easy to access.

Steps to Reset and Change ATM PIN

- Use an ATM or sign in to your bank’s net banking or mobile app

- Select the option to generate or reset your ATM PIN

- Verify your details through OTP or card information

- Set a new four-digit ATM PIN and confirm it

If online options are not available, banks also offer PIN reset support at branches.

Best Practices for PIN Security

- Use different PINs for UPI and ATM transactions

- Avoid simple combinations like repeated digits or dates

- Do not share your PIN with anyone, even if they claim to be from the bank

- Change your PIN if you suspect unauthorised access

Impact of Using the Same PIN for UPI and ATM: Is It Safe?

Using the same PIN for both UPI and ATM transactions is not recommended. Banks advise against it because the risks are higher. ATM PINs can be exposed if a debit card is lost, stolen, or observed during use at an ATM.

If that same PIN is also used for UPI, digital payments may be at risk too. A similar risk exists if a phone is compromised and the same PIN is used again. Using different PINs helps ensure that an issue in one place does not automatically affect everything else.

Managing money also benefits from this kind of clarity. Having a clear view of your finances helps when expenses come up.

Keep Your PINs Safe and Your Finances on Track

UPI PINs and ATM PINs are used in different situations. Keeping them separate helps limit risk and prevents avoidable problems during daily transactions.

This kind of clarity helps beyond routine banking, especially when planning expenses or repayments.

Check your personal loan eligibility with Hero FinCorp today. Hero FinCorp supports this approach with straightforward personal loan options and a simple digital application process. Apply today and move forward with confidence and control.

Frequently Asked questions

Can I use my ATM PIN as my UPI PIN?

ATM PINs work within card-based networks, whereas UPI payments are approved separately.

What should I do if I forget my UPI PIN?

You can reset it within your UPI app. Identity verification happens through debit card information and an OTP received on the linked mobile number.

How many times can I enter the wrong UPI PIN before it gets blocked?

UPI systems place a cap on repeated wrong PIN entries. Crossing that limit may lead to a temporary block to safeguard the account.

Is it compulsory to have both UPI PIN and ATM PIN?

Yes, if you use both services. A UPI PIN is needed for digital payments, while an ATM PIN is required for cash withdrawals and other ATM services.

Can someone hack my bank account if they get my UPI PIN?

The PIN alone is not enough to access your account. UPI also checks your registered device and app security. Even so, sharing your PIN increases risk, and you should never share it.

Are UPI PIN transactions reversible if fraudulent?

UPI transfers happen instantly, so there isn’t an automatic way to reverse them after the payment is done. If a transaction looks suspicious, reach out to your bank immediately.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.