What Is the RRN Number in UPI Transactions?

Every digital payment leaves behind a trail. Transaction IDs, reference numbers, and tracking codes. These trackers quietly ensure that money moves securely from one account to another.

When something goes wrong, be it a payment failure or a transaction dispute, these identifiers become crucial. In UPI transactions, one such critical identifier is the RRN number.

While most users focus on the UPI transaction ID, the RRN number plays an equally important role. It acts behind the scenes to verify and track transactions and resolve disputes.

What Is An RRN Number?

RRN stands for Retrieval Reference Number. In banking, the RRN meaning refers to a unique 12-digit identifier assigned to every digital transaction processed through NPCI. In simple terms, the RRN number is a behind-the-scenes tracking code that helps banks and payment networks trace a specific transaction.

Unlike the UPI transaction ID that you see in your app, the RRN number is primarily used for inter-bank reconciliation, dispute handling, and settlement tracking. It helps identify specific payments, even if multiple transactions of the same amount occur around the same time.

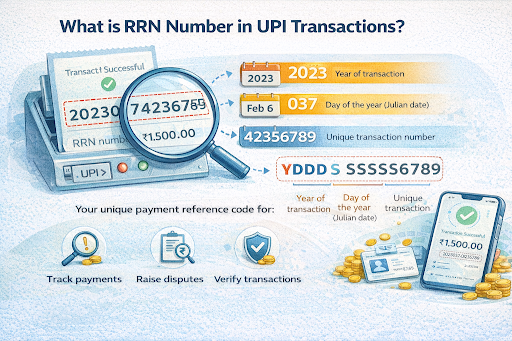

Here’s a simplified breakdown of the 12-digit RRN number structure:

- Y (1 digit): This represents the year of the transaction

- DDD (3 digits): This represents the Julian day, that is, the day of the year from 001 to 365/366

- SSSSSSSS (8 digits): This is the System Trace Audit Number (STAN) that banks generate to uniquely identify the transaction

Also Read: How to Check UPI Transaction Status?

The Significance of RRN in UPI Transactions

RRN helps maintain reliability, transparency, and accountability in digital payments. Here’s why RRN is important:

- Enables precise transaction tracking across banks, NPCI, and payment gateways

- Helps banks quickly identify failed, pending, or reversed transactions

- Serves as a strong reference when raising complaints or disputes

- Reduces resolution time by eliminating manual transaction searches

- Prevents misidentification of similar transactions made around the same time

- Supports reconciliation between the sender bank, the receiver bank, and NPCI

- Acts as proof of payment in case of settlement disputes

- Strengthens fraud detection by linking transactions to a verifiable trail

- Helps merchants validate successful payments in case of delayed confirmation

- Ensures smoother refunds when payments are reversed or disputed

Also Read: Payee Meaning in Banking and Finance Explained

When Do You Need Your RRN Number?

You may need your RRN number in several real-world payment situations. This includes:

- Tracking a failed or pending UPI payment that has debited your account

- Raising a formal complaint with your bank or UPI app support

- Requesting a refund from a merchant who claims non-receipt of payment

- Providing proof of transaction during disputes or chargeback cases

- Following up with NPCI or bank escalation teams for delayed settlements

- Verifying a reversed transaction that did not reflect instantly

- Resolving duplicate debit cases where money was deducted twice

- Assisting customer support in pinpointing your exact transaction

In all the above cases, the use of RRN in UPI complaints speeds up and improves the accuracy of resolution.

How to Find Your RRN Number for UPI Transactions?

If you want to locate your UPI RRN, follow these steps.

- Open your UPI app (Google Pay, PhonePe, Paytm, or BHIM).

- Go to your transaction history or “Payments” section.

- Tap on the specific transaction you want to review.

- Scroll to “Transaction Details” or “Bank Reference.”

- Look for “RRN,” “Retrieval Reference Number,” or “Bank Reference ID.”

If the RRN is not visible in the app:

- Check the SMS sent by your bank after the transaction.

- Download your bank statement and search for the transaction reference.

- Contact your bank’s customer support with the date, amount, and beneficiary details.

A Safer Way to Think About Digital Payments

RRN numbers may look technical, but they exist to protect you. They make every UPI transaction traceable, verifiable, and resolvable. Understanding your UPI transaction ID along with the RRN number gives you greater control when payments don’t go as planned.

Knowing where your money goes is the first step toward stronger financial control. When the next requirement calls for extra funds, Hero FinCorp’s personal loan solutions offer a straightforward, digital way to move forward with confidence. Explore Hero FinCorp’s personal loan options today!

Frequently Asked Questions

Is RRN the same as a Transaction ID or UTR number?

No. RRN is used by banks and NPCI for reconciliation, while the UPI transaction ID is user-facing. UTR is mainly used in NEFT/RTGS.

How long is an RRN number?

It is typically a 12-digit numeric code.

Can I find an RRN for an old UPI transaction?

Yes, through your bank statement or customer support.

Is the RRN number unique for every transaction?

Yes. Every UPI payment has a unique RRN.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.