How to Use Your UPI Transaction History as Supporting Income Evidence for a Personal Loan Application

If you're a freelancer, consultant, or someone running a side hustle, most of your income lands directly through UPI transfers, not on a company letterhead. That often leaves you frustrated when applying for a personal loan; lenders still want proof of steady earnings.

The good news: your UPI transaction history can work as supporting income evidence.

Hearing sounds of opportunities knocking? This quick guide helps you open those doors, covering how to use your UPI history effectively, plus smart tips to boost your chances of approval.

Why Lenders Care About Income Proof

How much you earn shows financial institutions how much you can repay. That also means that with more inflow comes higher loan amounts.

Here are a few ways lenders verify your income proof -

- Salary slips are the most preferred form of income proof as they are credit statements by the employer

- Bank statements are also accepted, but often need additional verification

- ITR statements reflect declared annual income and tax and are a go-to for freelancers and self-employed professionals

- UPI transaction history is accepted by many lenders, including Hero FinCorp, given that digital transactions are on the rise

How UPI Transactions Strengthen Your Impression

Look closely enough, and UPI history will become proof of your financial rhythm. For lenders, a healthy rhythm builds confidence in your repayment capacity.

Here are a few ways UPI works as a pro and not just a payslip proxy -

- Consistent Inflows - Regular transfers from clients, employers, or family show income stability. Steady credits say you have dependable earnings to cover EMIs.

- Spending Patterns - Timely bill payments and controlled expenses are all mapped well on UPI, covering how it's responsibly managed. That's a sign that you can handle debt without defaults.

- Transparency - Digital records reduce the chances of misreporting income. UPI is a clear trail that makes your finances more trustworthy and easier for lenders to assess.

How to Use Your UPI History for Your Personal Loan Application

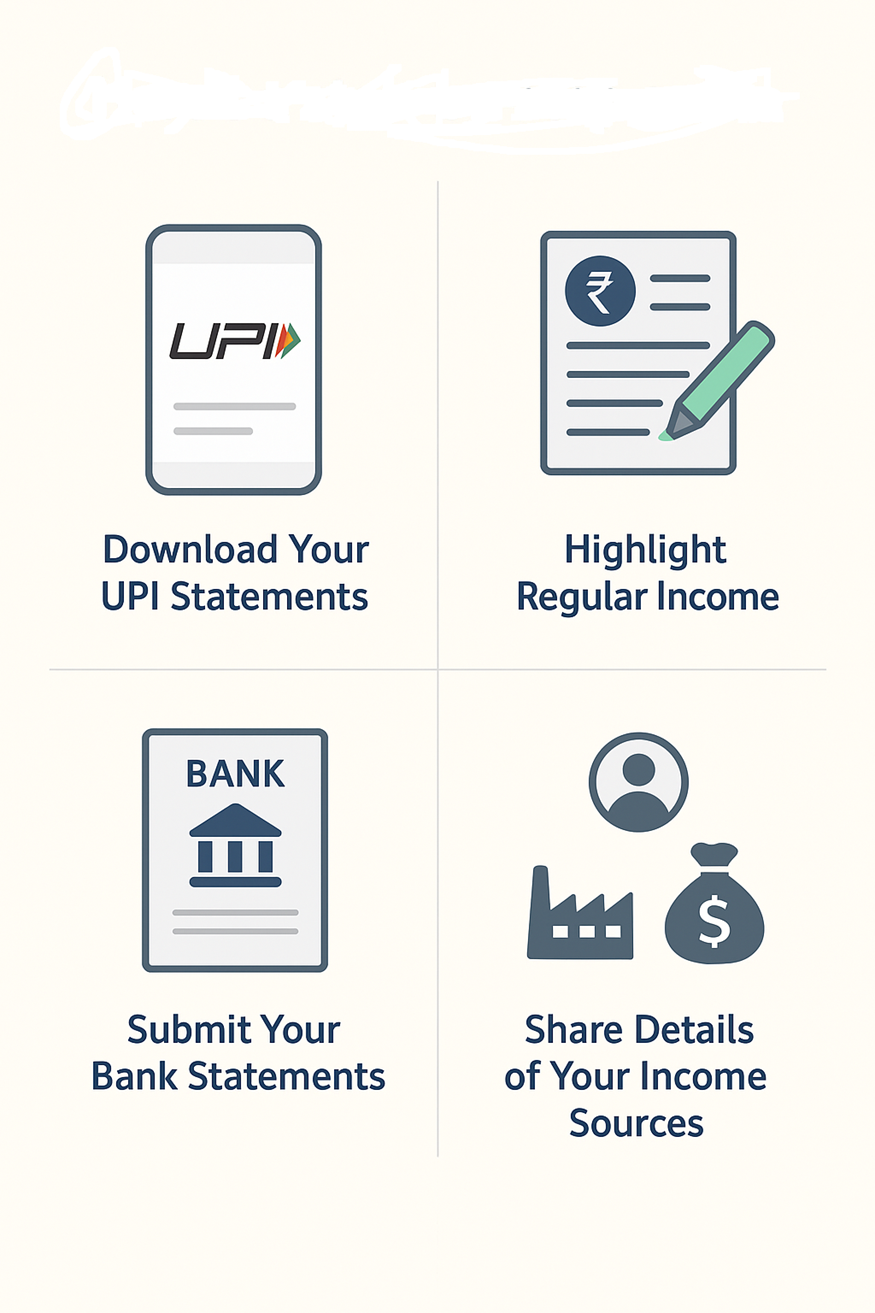

Finally, with all the concepts and advantages laid out, let's get to making the most of it. Here are four steps to turn your UPI transaction history into your personal loan's income proof -

Step 1: Download Your UPI Statements

Exporting 3–6 months of UPI transaction history from your payment app. Most apps allow you to download statements in PDF or Excel formats.

Submitting the latest records is often a must for large personal loans.

Step 2: Highlight Regular Income

Scan your statements and mark recurring credits. Identify them as client payments, project retainers, or family allowances.

With clearly segmented incomes, lenders quickly separate genuine income from one-time transfers. This step also helps move your personal loan application along faster.

Step 3: Pair It with Your Bank Statements

Your UPI credits eventually reflect in your bank account. Submitting both together creates a clear trail of money movement.

With verified statements, you prove that inflows are genuine and not just casual transfers.

Step 4: Be Transparent About Income Sources

If your UPI account is a mix of personal and business transactions, clarify the difference upfront. This saves time and shows that you're financially organised.

If you need quick funds, it's best to use the Hero Digital Lending App. With a strong credit profile, you can get up to ₹5 lakhs in minutes.

4 Quick Tips to Strengthen Your Application

A few simple habits can make your UPI history look more professional and credible. Follow these tips to fine-tune your records before applying for a personal loan -

- Keep your UPI records clean - Limit unnecessary peer-to-peer transfers like splitting dinner bills or gifting money, as they can clutter your statement.

- Maintain consistency - If possible, request clients or customers to pay on fixed dates (like the 1st or 15th of every month) to mirror a salary-like pattern.

- Use a dedicated UPI account - Using a single account for business or freelance payments clears professional income from personal spending.

- Check before submission - Review your statements to ensure client names, amounts, and dates are correct and visible.

Turn UPI Transactions Into Loan-Ready Proof

UPI history is a snapshot of your earning power and financial discipline. For freelancers, consultants, and side hustlers, it bridges the gap when traditional salary slips fall short, giving lenders the confidence to approve your loan.

When life throws bigger financial needs your way, that digital proof can get you quick access to the funds you need. All that's left is a trusted platform like Hero FinCorp. With your real income story clear, you get instant personal loans, flexible repayment options, and approvals.

Ready to unlock new opportunities? Use Hero FinCorp's personal loan eligibility checker to see how much you qualify for and apply for your personal loan today!

Frequently Asked Questions

1. Can I get a personal loan if my salary slips are low but UPI credits are high?

Yes. Lenders may consider UPI inflows as supporting income proof, especially when evaluating your repayment capacity.

2. How many months of UPI history should I submit?

At least 6 months is ideal. It helps lenders see consistent inflows.

3. Do all lenders accept UPI history?

Not all, but many NBFCs like Hero FinCorp are open to digital transaction data as part of their assessment.

4. Will UPI transactions alone be enough?

Usually, they work best as supporting evidence along with bank statements and ID proofs.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented Here is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.