Payee Meaning in Banking and Finance Explained

You’re filling out a bank form. Or setting up a UPI payment. Or writing a cheque. Suddenly, you see the word payee. And pause. Who exactly is the payee? Is it you, the bank, or the person receiving the money?

If that sounds familiar, you’re not alone.

Terms like "payee" appear everywhere in banking and finance. Yet their meaning is often taken for granted. In this guide, we simplify the meaning of 'payee' in banking. We also explain how payees operate in everyday transactions.

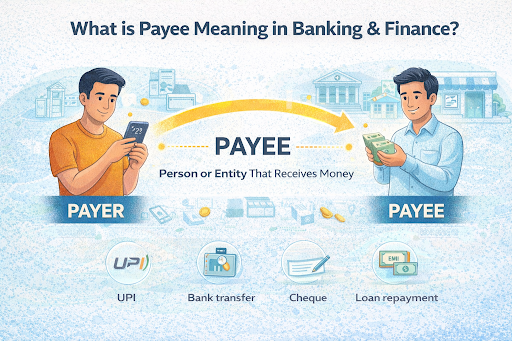

What Is a Payee?

A payee is the one receiving money in a financial transaction. They are the recipient in all situations, whether you’re transferring funds online, writing a cheque, repaying a loan, or making a bill payment.

The meaning of "payee" is not restricted to individuals alone. It could be a person, business, or organisation. That’s why companies, government departments, merchants, and financial institutions can also act as payees.

The key characteristics of a payee are

- Receives funds in a financial transaction

- Can be an individual, business, or institution

- Must have accurate banking or payment details

- Identified by name, account number, and bank credentials

- Plays a central role in fund routing and transaction settlement

Payee vs Payer: What is the Difference?

Every financial transaction involves two parties: the sender and the receiver. This is where the difference between payer and payee becomes apparent. The payer is the party making the payment, while the payee is the one receiving it.

| Basis | Payer | Payee |

|---|---|---|

| Role | Sends money | Receives money |

| Direction of funds | Outgoing | Incoming |

| Example | You're paying rent | Your landlord receiving rent |

| In banking | Account debited | Account credited |

| Legal position | Payment obligation holder | Payment beneficiary |

Payee Name: Importance and Verification

The payee name is the official name under which the recipient receives funds. An accurate payee name ensures:

- Funds reach the intended recipient

- Faster processing of transactions

- Reduced disputes and reversals

- Stronger transaction security

Proper payee verification is vital since it influences fund deliverability. You can verify payee details in the following ways:

- Confirm name and account number directly with the recipient

- Use bank-provided payee verification tools

- Match the IFSC and the bank branch details

- Check UPI ID name previews before confirming payments

How Payees Operate in Various Financial Scenarios

The role of a payee in transactions changes slightly depending on the payment mode and purpose.

Understanding common payee examples clarifies how this works in daily banking:

- Payee on cheque: The individual or entity named on the cheque receives the funds after clearing.

- Payee in NEFT/RTGS/IMPS: The recipient whose bank account is credited through electronic transfer.

- Payee in UPI: The receiver of funds identified through a UPI ID or mobile-linked bank account.

- Merchant payee: A business receiving customer payments through cards, QR codes, or online gateways.

- Loan payee: The borrower who receives the loan amount at disbursement.

- Repayment payee: The bank or NBFC receiving EMI payments.

- Investment payee: The investor receiving redemption proceeds, dividends, or interest payouts.

Also Read: What is an Electronic Payment System & How Does It Work?

What is a ‘Representative Payee’?

A representative payee is a person or entity authorised to receive and manage funds on behalf of someone else. They typically assist minors, the elderly, or persons with disabilities. Essentially, those who cannot handle finances independently.

Representative payees are responsible for:

- Receiving funds on behalf of the beneficiary

- Using money strictly for beneficiary needs

- Maintaining accurate financial records

- Ensuring responsible and ethical fund usage

- Protecting beneficiary interests at all times

Understanding Payees in Everyday Banking

Understanding the concepts of payee and payer lends clarity to money movement. You’ll be more aware while making cheque payments, digital transfers, loan repayments, and investment payouts.

At Hero FinCorp, transparent digital transactions and accurate beneficiary handling remain central to our financial systems. Explore Hero FinCorp’s digital finance solutions for safe, simple, and seamless money management.

Frequently Asked Questions

Can a payee and payer be the same person?

Yes. This can happen during internal account transfers or investment movements between your own accounts.

What happens if the payee's name is incorrect on a cheque?

The bank may reject, delay payment, or request reissuance, depending on the policy.

Are there any legal implications related to the payee’s identity?

Yes. Incorrect or misleading payee information can lead to disputes, payment reversals, or legal complications.

What type of documentation might a payee need to provide?

Typically, bank account proof, identity verification, and transaction reference details.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.