UPI Risk Policy: Navigating New Rules and Staying Secure in 2026

The Unified Payments Interface (UPI) risk policy by National Payments Corporation of India (NPCI) is designed to protect users from online fraud and failed transactions. The policy ensures safe and secure UPI transactions for banks, service providers and users alike.

Apart from setting transaction limits and monitoring rules, the policy outlines various fraud-prevention checks that all banks and UPI applications must follow.

In this post, we will delve into the UPI risk policy in more detail. We will also discuss how the policy controls risks and helps protect users from unauthorised activity.

The Convenience and Challenges of UPI Transactions

While the UPI system has completely transformed digital transactions through convenience and speed, significant challenges remain. Some of these benefits and challenges are-

Benefits of UPI

- Instant, real-time payments available 24/7

- Quick and easy transactions

- Zero or minimal transaction costs

- Supports multiple bank accounts in one single app

UPI Challenges

- Rising cases of UPI-related fraud and scams

- High dependency on internet connectivity

Also Read:UPI Fraud Red Flags - QR, Screen-Share, and “Payment Requests” Scam

Understanding the Evolving UPI Risk Policy by NPCI

The UPI risk policy primarily focuses on identifying, monitoring, and reducing risks associated with UPI transactions. Among these are fraud, unauthorised access, and system misuse.

Why a Robust UPI Risk Policy is Crucial?

The primary aim of the UPI risk policy is to ensure the security of digital transactions. A robust risk policy framework keeps users safe from financial losses while also maintaining their trust and confidence in the system.

Strong risk rules in place enable quick fraud prevention by identifying suspicious patterns early and limiting transaction exposure.

Also Read: Is UPI Safe? Security Features Every User Should Know

Key Changes and Recent Updates in UPI Risk Management

The UPI ecosystem has recently seen significant policy changes. These changes are designed to strengthen overall security and reduce fraud.

One of these key changes requires all banks and payment apps to discontinue peer-to-peer (P2P)collect requests, starting October 1, 2025.

This means that users cannot request money from other individuals using the Collect feature. This type of transaction needs to be initiated by the payer to enhance user control and minimise fraud risk.

Decoding "Risk Threshold Exceeded UPI": What It Means for You

The UPI risk threshold is exceeded when a user has hit a daily/per-transaction limit of ₹1 lakh total or 10 transactions.

Once this limit is reached, the system triggers a security alert for high-risk activity. In general, this gets fixed automatically within 24 hours.

Also Read: UPI Transaction Limits: What Borrowers Should Know Before Paying EMIs

Common Scenarios Leading to a "Risk Threshold Exceeded" Alert

If you’re wondering why the UPI risk threshold exceeded, see the transaction patterns that trigger such risk checks. Common scenarios include:

- Making multiple transactions in a short time

- Hitting the daily UPI limit of ₹1 lakh or exceeding the allowed transaction counts

- Repeated failed transactions or incorrect UPI PIN attempts

How to Resolve or Prevent "Risk Threshold Exceeded" Issues

- Wait for the cooldown period: UPI limits reset every 24 hours, pausing transactions helps fix the issue automatically.

- Check daily and per-transaction limits: Keep a check on the prescribed transaction limits.

- Complete KYC verification: Fully verified UPI accounts usually have higher transaction limits.

HeroFinCorp's Guide to Secure UPI Transactions

UPI security is essentially designed to support secure UPI payments by aligning with NPCI guidelines and strong internal risk controls.

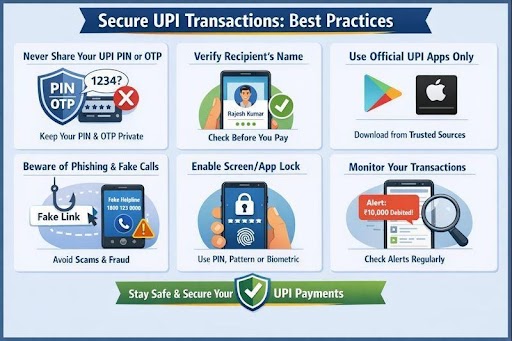

Best Practices for Users to Avoid UPI Fraud

To keep your money safe, you must actively follow essential UPI safety tips and take preventive measures to avoid UPI fraud. Some of these best practices you can implement are-

- Never share UPI PIN or OTP with anyone

- Verify collected requests carefully, especially from unknown contacts

- Avoid clicking suspicious links received via SMS or email asking for UPI details.

- Enable app-level security, such as biometric locks and phone screen locks.

How HeroFinCorp Prioritises Your Digital Safety

The key focus of HeroFinCorp’s UPI fraud prevention measures is on proactive digital safety through robust security systems and continuous monitoring.

At Hero FinCorp, we use advanced risk assessment tools and strong compliance to detect anomalies early and minimise fraud exposure.

One of our other focus areas is user education to help customers understand safe digital practices.

The Future of UPI: Balancing Innovation with Security

The success of UPI in India largely depends on maintaining the right balance between innovation and robust security. As UPI evolves further to support advanced features, the focus on innovation and security will become more.

A large part of UPI's growth in future will also be defined by its ability to deliver smarter, faster payments while keeping safety at the centre.

The digital-first approach at Hero Fincorp makes UPI security much easier. With our seamless interface, you get an instant personal loan, can set up Autopay and track every payment easily to keep your money safe.

Also Read: What Is the RRN Number in UPI Transactions?

Frequently Asked Questions

What is NPCI's role in setting UPI risk policies?

The NPCI is the central authority that operates and governs the UPI ecosystem in India.

Can banks put additional restrictions on UPI transactions beyond NPCI guidelines?

Yes. Banks can apply stricter restrictions and controls than NPCI’s baseline rules based on their own internal risk assessments.

What should I do if my UPI transaction gets flagged as "risk threshold exceeded"?

Start by checking your bank balance and transaction history, followed by contacting your bank’s customer care with the transaction ID and screenshots.

How do UPI apps detect and prevent fraudulent transactions?

UPI apps use multiple layers of checks to keep your money safe. These include real-time risk scoring, device & SIM Binding, two-factor authentication and more.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.