UPI Fraud Red Flags in 2026—QR, Screen-Share, and “Payment Requests” Scams: What Borrowers Should (And Shouldn’t) Do

UPI has changed the way Indians do their financial transactions. As an instant payment system, UPI allows users to send money, request money and transfer funds across multiple bank accounts using just a mobile number or UPI ID. These transactions are done through various UPI apps like PhonePe, Google Pay and BHIM app which provide instant and secure payment solutions. The digital payments industry has grown rapidly with industry leaders and innovators driving the adoption of UPI and related technologies. In June alone, UPI processed over ₹24.03 lakh crore in transactions, for everything from utility bills to loan EMIs. But with increased usage comes increased risk of UPI fraud which has gone up significantly in recent times.

In fact, UPI scam cases rose by 85% in 2024 and India lost ₹1,087 crore to these frauds. These frauds range from QR code tampering to payment requests and screen-sharing scams. Each UPI app has security features to protect users from scams. Understanding these risks and recognizing the red flags is crucial for anyone using UPI to protect their bank accounts and funds from theft or unauthorized debits. Let’s see the latest UPI frauds in 2026 and how to protect your money.

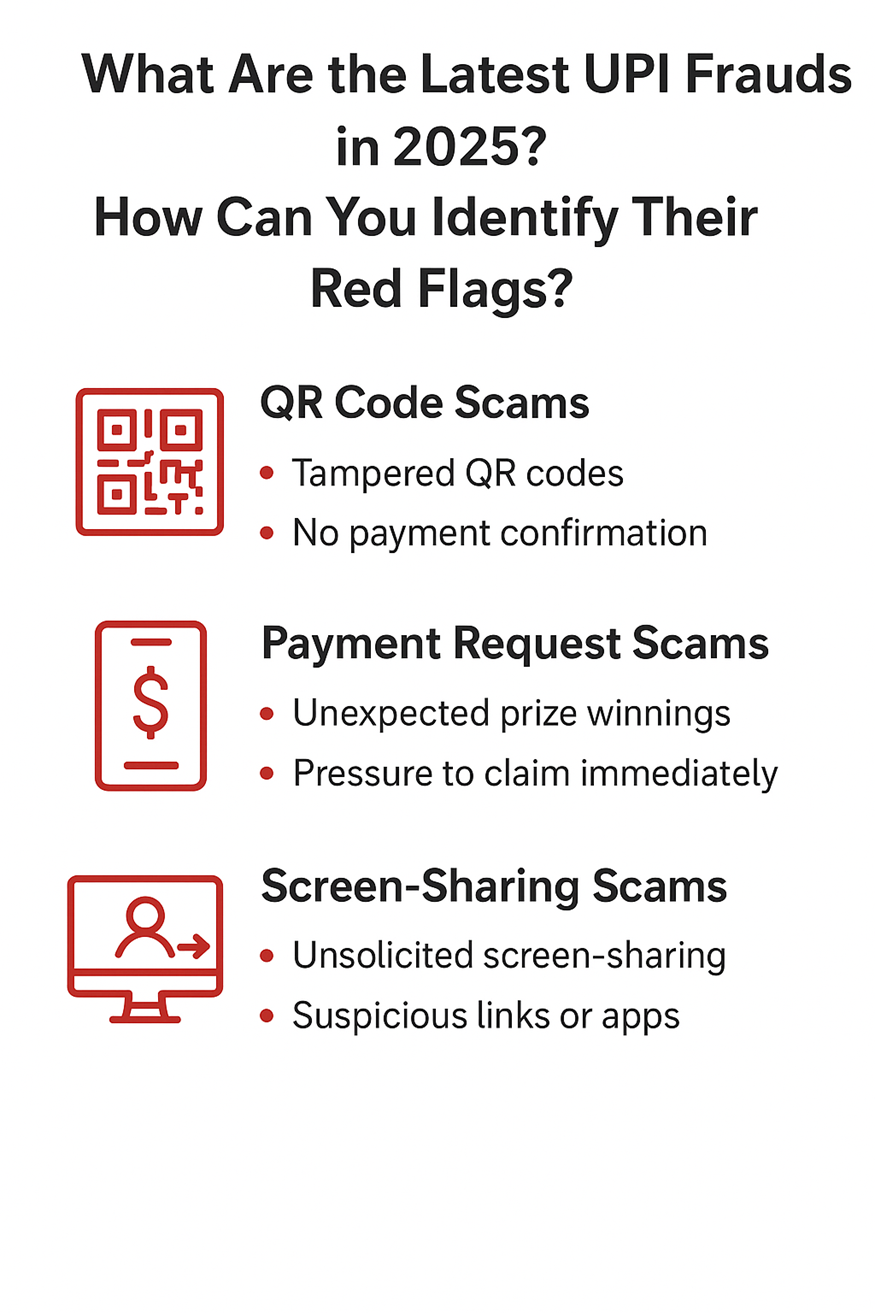

What Are the Latest UPI Frauds in 2026? How Can You Identify Their Red Flags?

UPI frauds have evolved with new tactics to exploit users’ trust and lack of awareness. These scams often rely on deception and perversion of truth to trick users. Fraudsters are motivated by the money or benefits they can get through these unfair means. Here are three common scams to watch out for, along with their warning signs—the value at risk in each fraudulent transaction can be huge, so users should be careful:

UPI frauds have evolved with new tactics to exploit users’ trust and lack of awareness. These scams often rely on deception and perversion of truth to trick users. Fraudsters are motivated by the money or benefits they can get through these unfair means. Here are three common scams to watch out for, along with their warning signs—the value at risk in each fraudulent transaction can be huge, so users should be careful:

QR Code Scams

One of the most common frauds is tampering with QR codes displayed at shops, parking lots or public places. Fraudsters replace the legitimate QR code with their own and when you scan and pay, the money goes to the criminal’s account instead of the intended recipient’s. These fraudulent QR codes are made to look like the original, misleading users into thinking they are paying the correct recipient.

Red flags to watch out for:

• QR code stickers that look tampered, peeling or suspiciously placed.

• No payment confirmation notification on the receiver’s device which means the payment may not have gone through correctly.

Always verify the QR code before scanning and ensure you get an in-app confirmation after making a payment.

Payment Request Scams

Fraudsters exploit the “request money” feature of UPI by sending fake payment requests. For example, you might receive a call or message saying you’ve won a prize and need to pay a small fee or enter credentials to claim it. These scammers often lie about their identity or the prize to trick the customer into authorizing a payment. The customer is the primary target of these payment requests and must be careful when responding to such messages. When you comply, money gets debited from your bank account instead of being credited.

Red flags to watch out for:

• Unexpected calls or messages from unknown numbers saying you’ve won money.

• High pressure tactics to claim the prize or complete the payment immediately.

Never share your UPI PIN or OTP in response to such requests and verify the payment request with the concerned organization or bank.

Screen-Sharing Scams

A new and sophisticated scam involves fraudsters posing as bank officials or trusted entities offering help with UPI transactions or loan payments. They ask you to download a screen-sharing app to “help” you with the transaction. Once you give access, they manipulate your screen to steal sensitive information like OTPs, UPI PINs or bank account details. These scams may also try to bypass secure identification methods like biometric authentication to access your account.

Red flags to watch out for:

• Unsolicited requests to share your screen or download unknown apps.

• Suspicious links or apps asking for screen-sharing without any reason. Remember, banks or organizations will never ask you to share your screen or UPI PIN over calls or messages. It is the user’s responsibility to protect their credentials and never allow unauthorized access to their device.

Note: Fraudulent activities can drain your bank account fast. To manage your finances securely, consider a quick, collateral-free personal loan from Hero FinCorp which offers hassle-free loan payments through UPI and funds up to ₹5 lakh.

What Should You Do (And Not Do) to Protect Yourself from UPI Frauds?

Preventing UPI fraud requires awareness and following safety practices. Prevention strategies like benchmarking your efforts and conducting regular risk assessments are must to prevent occupational fraud. Customers should be extra cautious while setting up recurring payments through UPI as these can be targeted by fraudsters. Here’s a quick list of dos and don’ts to keep your accounts safe:

Dos | Don’ts |

Ensure your bank records reflect your updated mobile number | Forward SMS/open unknown links when asked by anyone posing as bank/government officials |

Remember that the UPI PIN is entered for making payments, not receiving them | Share your UPI PIN/debit card PIN with any unknown person |

Check for in-app notifications/pop-ups while making a UPI payment | Use or give access to third-party tools/screen sharing software to anyone while making a UPI payment |

Find a bank’s contact details on its official website only | Post transactional details on social media handles |

Only report a UPI fraud/complaint to the bank or the police | Carry out a UPI transaction in public while distracted |

By being alert and following these guidelines you can reduce the risk of becoming a UPI fraud victim. Always verify payment requests and never disclose sensitive information no matter how trustworthy the person looks.

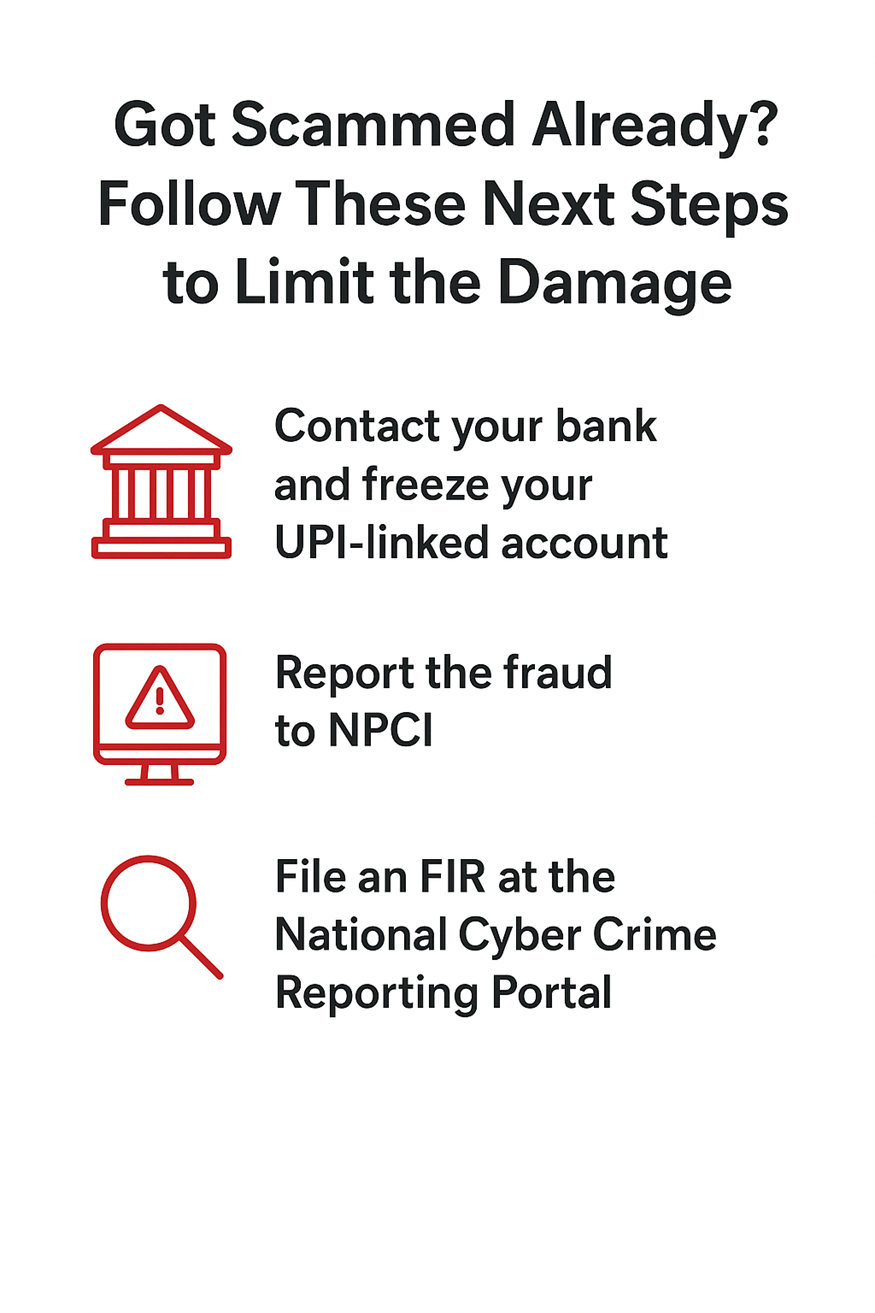

Already Scammed? Follow These Steps to Limit the Damage

If you suspect you have been scammed, acting fast can help minimize the loss and increase the chances of getting your money back. Here’s what to do immediately:

If you suspect you have been scammed, acting fast can help minimize the loss and increase the chances of getting your money back. Here’s what to do immediately:

1. Contact your bank to freeze your UPI-linked account and stop further unauthorized transactions.2. Report the fraud to National Payments Corporation of India (NPCI) on their official website (https://www.npci.org.in/).

2. File a First Information Report (FIR) at National Cyber Crime Reporting Portal (https://cybercrime.gov.in/)to initiate a legal investigation.

Acting fast is important as the law gives you the right to seek refunds and hold the culprits accountable. Legal proceedings will establish the guilt of the perpetrators and provide justice to the victims. Once fraud is proved through investigation, victims may be eligible for compensation or refunds. If you need urgent funds due to financial loss from fraud, consider using trusted Instant Loan App like Hero FinCorp’s which offers safe and quick access to money.

Conclusion: Use UPI Wisely, Stay Scam-Free

UPI has made payments in India faster and more convenient than ever. But UPI frauds are a reminder to be cautious while using this powerful payment system. Protecting your money is simple and effective by verifying payment requests, not using screen-sharing apps and never sharing UPI PIN or OTP with anyone.

For those looking for secure and reliable financing options, Hero FinCorp offers personal loans that suits your needs without exposing you to fraud risks. With quick access to funds and safe borrowing process, you can manage your finances safely.

Don’t wait until it’s too late—Apply for a personal loan with Hero FinCorp today and enjoy hassle-free financial support.

Frequently Asked Questions

1. Can fraudsters withdraw money from my account if I don’t have my UPI PIN?

No. Without access to your confidential information like UPI PIN, passwords or OTPs, scammers can’t debit money from your bank account. Protect these credentials is key.

2. Is sharing UPI ID risky?

Sharing UPI ID is generally safe as it’s used to receive payments. But never share sensitive information like UPI PIN or OTP which can compromise your account security.

3. Can UPI fraud money be recovered?

Yes, recovery is possible if you report the fraud to your bank and NPCI within 3 days of the incident. While refunds are not guaranteed, reporting fast increases the chances of getting your money back.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented Here is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.