Everything You Need to Know About New UPI Rules

The National Payments Corporation of India (NPCI) has recently introduced new UPI rules effective August 1, 2025. This means that using UPI for your daily transactions may result in subtle but important changes.

The key aim of these rules is to enhance security and improve the overall customer experience when executing UPI transactions.

In this post, we will cover the essential new UPI rules and how they will affect balance checks, payment statuses, account verification, and more. Read on to better understand these changes and use your UPI apps more confidently.

New UPI Payment Rules Effective from August 2025

On 21-5-2025, the NPCI notified the ‘Guidelines on usage of Unified Payments Interface (‘UPI’) and Application Programming Interface (‘API’)’.

These guidelines aim to transform digital transactions by implementing new technical and operational controls to improve overall performance and reduce server congestion.

The rules apply to all banks and UPI app providers from 1-8-2025.

Key Changes for Users Under New UPI Payment Rules

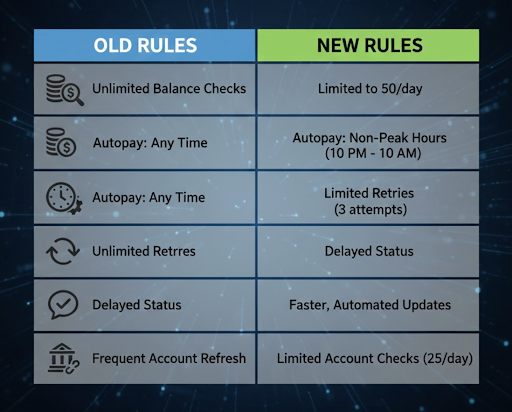

Here is a list of the main UPI changes from August 1 you need to keep in mind:

- Balance Check Limit: Under the new rules, the limit is 50 checks per UPI app per day.

- Modified Autopay Transactions: UPI Autopay set for recurring transactions related to EMI payments shall be conducted only during non-peak hours (1 pm to 5 pm and 9:30 pm to 10 am)

- Account View Limit: A user can view the list of bank accounts linked with the mobile number for UPI transactions only up to 25 times within 24 hours. This limit is capped per UPI app a user operates.

- Transaction Status: Users receive an immediate 'success' or 'failure' status, with limited retries (3 with a 90s gap) for pending status checks.

- Recipient Name: The name of the recipient now shows before payment confirmation to prevent errors.

How Do the New UPI Rules Affect Daily Users?

The new UPI rules aim to reduce overall system overload and make digital payments much more reliable for everyday users.

Under the UPI payment new rules, balance checks are now capped. This means repeatedly refreshing your bank balance in apps like Google Pay or PhonePe may show temporary restrictions.

Likewise, autopay subscriptions such as EMIs, OTT platforms, or utility bills are now processed in staggered time windows instead of all at once. This is to reduce the chances of failed debits during peak hours.

In real-world use cases, this means

- Fewer sudden autopay failures and clearer UPI transaction alerts.

- Apps will show updated status messages if a payment is delayed or pending.

- Refunds can also take a while to show up, particularly if there are multiple attempts.

- To guarantee more seamless UPI transactions overall, users should keep an eye out for in-app messages regarding retry limits, autopay timing, and balance-check warnings.

Understanding the Changes in UPI Autopay and Mandate Execution

The new UPI rules introduce better and clearer controls on how UPI Autopay mandates are executed. The aim of this change is to improve reliability and reduce transaction failures.

Under the new rules, autopay transactions such as EMIs, insurance premiums, OTT subscriptions, and utility bills are now processed during a defined non-peak window, from 12:00 AM to 7:00 AM, to avoid congestion during high-traffic hours.

Below is a quick snapshot of key changes that you need to know:

| Aspects | Old Rules | New Rules |

|---|---|---|

| Execution Timing | Any time of the day | Only between 12 AM and 7 AM |

| Retry Attempts | Multiple/unlimited retries | Limited retry attempts |

| Peak Hour Impact | High failure risk | Minimal peak-hour failures |

| User Experience | Unpredictable delays | More stable and reliable payments |

Key Benefits of the New UPI Rules

The new UPI regulations are intended to improve the speed, security, and dependability of digital payments. The new UPI rules greatly reduce system load by optimising autopay and retry mechanisms, eliminating pointless API calls, and streamlining features like balance checks.

Key Advantages for Consumers

- Faster payment confirmations

- Improved app performance during peak hours

- Enhanced security through controlled retries and timed balance checks

- Clearer transaction status updates, reducing confusion

Key Advantages for Businesses & Fintech Apps

- Higher success rates in transactions

- Reduced infrastructure strain and operational costs

- More predictable payment flows for subscriptions and autopay

The overall goal of the new UPI regulations is to improve the payment ecosystem by striking a balance between system stability and consumer convenience.

Looking for a personal loan but unsure where to begin? Download our instant loan app, explore your options, and apply for a personal loan in just minutes!

Summary of UPI New Rules: What Has Changed?

The new UPI rules are summarised below:

| Feature | Old Rules | New UPI Rules |

|---|---|---|

| Balance Checks | Unlimited balance inquiries allowed | Limited balance checks per day to reduce server load |

| AutoPay Timings | Any time during the day | Restricted to non-peak hours (before 10 AM & after 9:30 PM) |

| Retry Limits | Multiple retries without a cap | Retry attempts capped for failed transactions |

| Transaction Status Updates | Delayed or manual refresh needed | Faster, automated status updates with defined timelines |

| Linked Account Checks | Frequent auto-refresh of accounts | Account list refresh is limited to fewer checks per day |

Leverage the New UPI Rules for Smoother Transactions

The NPCI's most recent UPI regulations are a big step in the direction of developing a digital payment ecosystem that is more borrower-friendly, safe, and transparent. Although there may be some initial adjustment difficulties, the overall goal of these adjustments is to improve market stability and consumer safety.

If you are someone seeking financial assistance during this transition period, we've got you covered. At Hero FinCorp, we offer quick, transparent, and hassle-free personal loans with a fully digital application process.

So why wait? Explore our loan options today and experience a seamless borrowing journey designed to keep pace with India’s evolving digital payment ecosystem!

Frequently Asked Questions

What are the restrictions on linked bank account views with UPI now?

The main restriction on viewing linked bank accounts with UPI is a new limit of 25 views per app, per day, effective from August 1, 2025

Does the new UPI rule affect instant payment confirmation?

Yes. The new UPI rules are designed to improve instant payment confirmation by reducing system load and ensuring faster, more reliable transactions, especially during peak hours.

Can businesses customise autopay timing under the new regulations?

No. The businesses cannot customise the exact autopay timing. Instead, all auto-debit requests must be processed during specific, mandated non-peak hours to reduce system load.

Are all UPI apps subject to the same new regulations?

Indeed, all UPI apps—including Google Pay, PhonePe, Paytm, BHIM, and others—are subject to the new regulations in an equal and consistent manner.

If UPI apps don't follow these guidelines, what consequences will they face?

Financial fines, limitations on API access, and a halt to the onboarding of new clients are some of the consequences.

How will these rules impact failures during high transaction volumes?

The new UPI rules are designed to reduce transaction failures during high-volume periods by easing the strain on the system's infrastructure.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.