Is It Safe to Share Your UPI ID? HeroFinCorp Guide to UPI ID Safety

Whenever someone asks for your UPI ID, your mind suddenly fills with questions. You start thinking about whether sharing it is safe and whether something could go wrong with your bank account later. Even though you use UPI almost every day, that small fear still shows up because money is involved, and no one wants to make a mistake.

Most people feel this way because they hear mixed advice from everywhere. Some say sharing a UPI ID is completely fine, while others warn against giving any details at all.

This blog breaks that confusion. You will understand when it is safe to share your UPI ID, what information you should never give to anyone, and how to protect yourself from common UPI-related scams.

Understanding UPI: The Backbone of Digital Payments in India

UPI allows people to move money directly between bank accounts using a mobile phone. Instead of sharing long account numbers, users rely on a simple ID that links their bank and payment app together.

Across India, the UPI system works because users retain control over approvals. Money never moves automatically, and every transaction depends on confirmation from the account holder.

How Does UPI Facilitate Easy and Instant Payments?

- A UPI ID works as a payment address linked to your bank account.

- Transfers happen instantly between banks without waiting periods.

- Each payment needs approval within the registered app.

- A personal PIN confirms every outgoing transaction.

- Alerts appear immediately after completion or failure.

These steps make payments fast while keeping authority with the user.

UPI fraud cases online.

In practice, sharing a UPI ID is safe when it is used only to receive money. A UPI ID by itself cannot withdraw funds or trigger a debit. Risk appears only when sensitive details are shared along with it.

The Receive Money Principle: Why Your UPI ID Alone Isn’t Enough for Debits

UPI follows a clear rule that protects users. Money can leave your account only when you approve a transaction inside your own app.

Even if someone knows your UPI ID, they cannot complete a payment without your confirmation and PIN. This design forms the core of UPI ID security.

When Is It Safe to Share Your UPI ID?

Sharing a UPI ID becomes necessary in many everyday situations. Receiving money quickly often depends on it.

Safety depends on keeping boundaries clear and avoiding unnecessary information exchange.

Legitimate Scenarios for Sharing Your UPI ID

- Receiving refunds from online sellers or delivery partners

- Accepting money from friends or relatives

- Getting freelance or salary payments

- Collecting payments from verified businesses

- Receiving money during personal sales

- In all these cases, sharing only the UPI ID is enough.

Critical Information to NEVER Share with Anyone

Most fraud incidents occur not because of UPI itself, but because users unknowingly share private details.

Knowing what to protect keeps your account safe.

The Golden Rule: Your UPI PIN is Private

Your UPI PIN authorises every payment. No genuine bank employee or merchant ever needs this number.

Once shared, the PIN gives full transaction access. Protecting it ensures strong UPI PIN security.

Beyond the PIN: Other Sensitive Information to Protect

- One-time passwords sent to your phone

- Debit card details linked to your account

- Screen sharing access during calls

- Unknown links received through messages

Avoiding these protects secure UPI transactions.

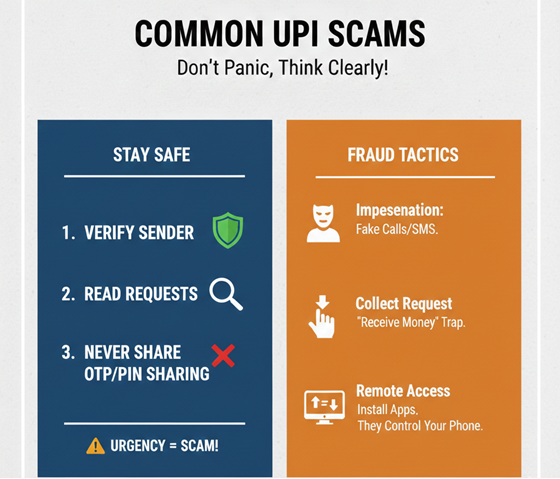

Common UPI Scams and How They Exploit User Trust

Fraudsters usually rely on urgency rather than technology. They pressure users into acting before thinking clearly.

Understanding common UPI scams helps reduce panic.

Impersonation and Phishing Scams

Scammers pretend to be bank or support staff and claim problems such as blocked accounts or failed refunds. Their goal is to create fear and rush decisions.

The Collect Request Deception

Some fraudsters send payment requests and say that approval will credit money. Approving such requests actually sends money out.

Remote Access and Screen Sharing Frauds

Fraudsters ask users to install remote apps to fix issues. Once access is given, they monitor actions and complete transactions.

HeroFinCorp’s Essential Tips for Maximizing UPI Security

HeroFinCorp encourages users to follow safe digital habits.

- Read every payment message carefully before approving

- Avoid acting under pressure or panic

- Never install apps suggested during calls

- Keep transaction limits active

- Contact support immediately if something feels unusual

- These steps help users stay confident while paying digitally.

What to Do if You Suspect UPI Fraud?

- Taking quick action can limit losses.

- Inform your bank or payment app immediately

- Block your UPI temporarily if required

- Report the issue through official channels

- Register a complaint on the cybercrime portal

- Early reporting improves recovery chances.

Make UPI Payments Without Overthinking

UPI is part of daily life now. You use it to pay bills, send money, or handle small expenses without giving it much thought. The key is not to fear it, but to understand where caution actually matters. Once you know what to share and what to keep strictly private, UPI feels far less confusing and much more dependable.

There may also be times when an important payment comes up, and your balance falls short. In moments like these, a quick solution helps you stay on track. With an instant loan application through the Hero FinCorp personal loan app, you can access funds digitally and manage your financial plans without unnecessary delays.

Frequently Asked Question

Is it safe to share my UPI ID with someone I do not know?

Sharing a UPI ID is generally safe for receiving money, as long as no PIN, OTP, or additional details are shared.

Can anyone take money from my account using only my UPI ID?

Money cannot be withdrawn without your approval and personal PIN inside your UPI app.

How is a UPI ID different from a UPI PIN?

A UPI ID identifies your account, while the PIN authorises payments and must always remain private.

Is it safe to share my QR code for receiving money?

Sharing a QR code is usually safe when used privately, since it only helps others send money.

How can I identify a fake payment request?

Requests that create urgency or ask you to approve a payment to receive money often indicate fraud.

Does HeroFinCorp guide customers on digital payment safety?

HeroFinCorp encourages awareness, careful verification, and prompt reporting to support safer digital transactions.