How to Set up a UPI PIN Without a Debit Card in 2025?

You wake up to an urgent payment request. Your rent is due, a taxi is waiting, or a friend needs money immediately, and suddenly you realise your debit card is nowhere to be found. This is no longer unusual in India’s fast-moving digital economy.

In 2025, over 75% of retail digital payments are processed through UPI, and millions rely on UPI without debit card access every day. Banks now support alternative verification methods, helping you stay financially active without physical cards.

Read on as we explain whether you can set up a UPI PIN without a debit card, the eligibility requirements, step-by-step methods using Aadhaar-based verification, alternate options if Aadhaar is unavailable, and key points to keep your UPI access secure and uninterrupted.

Understanding UPI and UPI PIN

When you use UPI, you are tapPINg into a real-time payment system that links your bank account directly to your mobile phone.

To understand how to set a UPI PIN without a debit card, it helps to first understand why the UPI PIN is so important. This confidential numeric code authorises every transaction you make.

NPCI data shows that more than 99% of UPI payments rely on PIN-based authentication, making it central to security. If you regularly manage repayments or disbursements through a Personal Loan App, a secure PIN becomes even more essential. Without it, you cannot send money, approve requests, or pay merchants. As usage grows, UPI without debit card access supports continuity and safer digital banking.

Can You Set Up a UPI PIN Without a Debit Card?

If your bank account is eligible, you can definitely create a UPI PIN without a debit card in 2025. A majority of top banks are presently facilitating Aadhaar-based verification that does not require debit card details.

A lot of new UPI users who have set their PINs choose to do so without the use of a debit card. This shift reflects how quickly cardless banking is becoming the norm, especially for users of an Instant Loan App who value speed and convenience.

Also Read: How to Withdraw Cash Without an ATM Card

Prerequisites to Set Up UPI PIN Without a Debit Card

Before you begin learning how to set a UPI PIN without a debit card, make sure these essentials are in place to enable UPI without debit card access smoothly:

- Aadhaar card linked with your bank account for identity verification

- Registered mobile number linked with both your bank account and Aadhaar

- UPI-enabled bank account supporting Aadhaar verification, useful when repayments are linked through a dependable Loan App

- Access to a UPI app such as Google Pay, PhonePe, Paytm, or BHIM

- A reliable mobile network to receive OTPs without delay

Step-by-Step Guide to Set UPI PIN Without a Debit Card Using Aadhaar

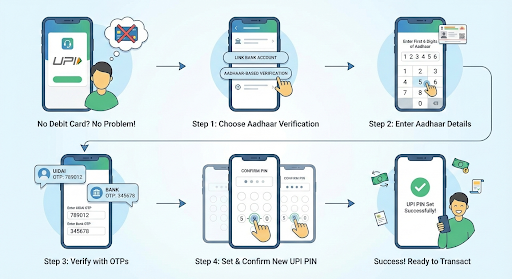

Carry out these steps one by one to know the method of setting a UPI PIN without a debit card and to effectively set a UPI PIN without a debit card by means of Aadhaar verification:

- Launch the UPI app of your choice, for example, Google Pay, PhonePe, Paytm, or BHIM

- Log in using your registered mobile number and let the app find your bank account that is linked

- Choose the bank account through which you want to make a new UPI PIN

- Choose Aadhaar-based verification instead of debit card details

- Asks for the first six digits of your Aadhaar number

- Key in the OTP that has been sent to the mobile number linked with your Aadhaar

- Make a UPI PIN for the new one, and then confirm the new UPI PIN

- Get a message about the successful setting up of the PIN

Typically, the whole operation takes under five minutes to complete. Such a pace is a strong benchmark for the efficiency of the digital banking systems in India. And this also comes in handy for entrepreneurs who cannot do without a Business Loan App for their recurrent payments.

Also Read: Advantages of Using UPI for Everyday Transactions

Alternate Methods to Set UPI PIN Without a Debit Card

If Aadhaar-based verification is unavailable, you still have practical ways to use UPI without debit card services.

- You can contact your bank’s customer service to set a UPI PIN without a debit card after completing identity checks.

- Visiting a bank branch or ATM may also help generate or reset your PIN using Aadhaar credentials. Some banks allow UPI PIN setup through net banking as well.

These options offer flexibility, particularly in areas where card delivery is delayed. Quick access to UPI is equally helpful when using a Quick Loan App during urgent situations.

Also Read: Are UPI PIN and ATM PIN the Same?

Wrapping Up

Setting up a UPI PIN without a debit card in 2025 is no longer a workaround—it is a mainstream, bank-supported process designed for a digital-first India.

With Aadhaar-based verification and alternative authentication methods, users can continue making payments, approving requests, and managing everyday finances even when a physical card is unavailable.

At Hero FinCorp, we recognise how important uninterrupted digital access is in everyday financial decisions. Our digital lending solutions are designed to work seamlessly with UPI-based payments, helping you manage repayments, emergencies, and planned expenses with confidence.

Explore our personal loan options through a simple digital process and stay financially prepared, even when life moves faster than expected!

Frequently Asked Questions

Can you set up a UPI PIN without a debit card on all UPI apps?

Most large UPI applications offer this option, but availability depends on the bank.

Is Aadhaar linking mandatory to set a UPI PIN without a debit card?

In the majority of cases, Aadhaar linking is mandatory for verification.

How long does it take to set or reset the UPI PIN using Aadhaar?

The entire operation is very quick and usually takes only a few minutes.

What should you do if you do not receive an OTP during setup?

You should verify your internet connection. If it is still not working, kindly wait and try again later.

Can you change your UPI PIN later without a debit card?

Yes. Many banks allow you to reset or change your UPI PIN using Aadhaar-based verification, without needing a debit card.

Are there charges for setting up a UPI PIN without a debit card?

No. Banks do not charge for setting up or resetting a UPI PIN.