Personal Line Of Credit (PLOC) In India: Definition, Benefits, Types & Common Uses

Financial emergencies do not arise on a schedule and, unfortunately, are rarely a one-time occurrence. In these situations, you may need access to money in parts and over a fixed period of time. Here, a fresh loan application each time is not really convenient.

A personal line of credit is designed precisely for such situations. So what is it, how does it work, and when should you use it? Read on to find out.

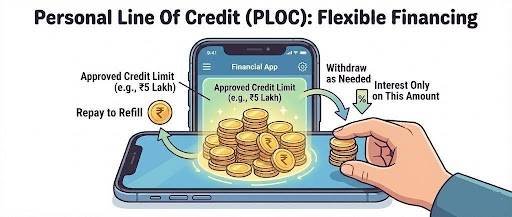

What Is A Personal Line Of Credit (PLOC)?

A personal line of credit (PLOC) is a type of pre-approved credit facility. Here, you have instant access to a fixed amount of funds, which you can withdraw as and when needed. You only pay interest on the amount withdrawn.

Key Characteristics of a Personal Line of Credit

A personal line of credit functions as revolving credit. Once you repay what you have used, the same amount becomes available again. The account stays active until the end of the agreed tenure.

Here are the Key features of a Personal Line of Credit:

- Flexible withdrawals.

- Interest is charged only on used funds.

- Reusable credit limit.

- Ongoing access during the approved period.

Also Read: What is a Personal Loan? Meaning, Benefits & Uses

How Does a Personal Line Of Credit Works In India?

In India, the process of working with a Personal line of Credit works like this:

- A lender approves a credit limit.

- You withdraw funds as needed.

- Interest applies only to the withdrawn amount.

- You repay as per the agreed terms.

- The repaid amount becomes available again.

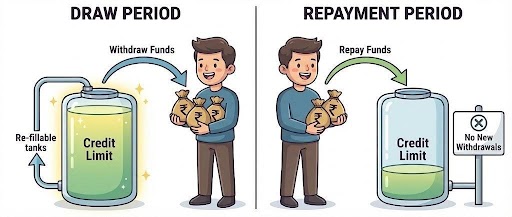

Draw Period vs. Repayment Period

When you opt for a personal line of credit, it essentially works with two primary stages:

- The draw period: During the draw phase, users can withdraw funds up to the approved credit limit.

- The repayment period: This stage begins the moment the draw period ends. No new withdrawals are allowed here.

However, in most cases, a personal line of credit in India is flexible. Funds can be withdrawn perpetually as long as the minimum repayment criteria are met.

Types of Line of Credit Loans Available in India

There are several different lines of credit available in India. They differ based on their purpose and security.

The common options include:

- Personal line of credit

- Business line of credit

These can be either secured or unsecured facilities. The former does not require collateral. Approval depends on income, credit profile, and repayment history. The latter (secured line of credit) is backed by assets, offers higher limits, but introduces asset-related risks to the equation.

Need quick funds? Download Hero FinCorp’s instant loan app and apply in just minutes.

Common Uses for a Personal Line of Credit

A personal line of credit suits all forms of expenses that need to be spread out. These can include, but are not limited to:

- Medical expenses

- Education-related costs

- Short-term business needs

- Home repairs

- Planned travel or lifestyle spending

Pros and Cons of a Personal Line of Credit

A personal line of credit, just like any other form of borrowing, has its pros and cons. Its advantages are that:

- You withdraw only what you need and pay interest only on that amount.

- It's revolving credit, so the funds are reusable.

- It's perfect for when you need recurring funds.

That said, PLOCs also have their downsides.

- Interest rates are not fixed here.

- There are additional fees involved, even if you don't use the funds.

- This form of credit is not suitable for one-time use due to high costs.

- Most importantly, it requires absolute financial discipline, as interest is accrued daily post the repayment date.

Personal Line of Credit vs Personal Loan vs Credit Card

So how does a PLOC stack up against a personal loan and credit cards?

| Personal Line of Credit | Personal Loan | Credit Cards | |

|---|---|---|---|

| Best Suited for | Variable Needs | One time spends | Small spends |

| Access to funds | Can be withdrawn as needed. | Full amount upfront | Limited to purchases or cash withdrawals |

| Repayment Schedule | Flexible: can repay the minimum due or outstanding | Fixed EMIs | Flexible: can repay the minimum due or outstanding |

| Interest | Only on the used amount | On the full amount | On the outstanding amount |

Also Read: Personal Loan vs Line of Credit: What's Better?

How to Apply for a Personal Line of Credit in India

The usual steps to apply for a personal line of credit in India are as follows:

- You perform an eligibility check.

- If eligible, you submit basic details as required.

- If your PLOC is approved (which usually takes 2-7 days), you can access funds within your limit.

To apply for a Personal line of credit, you must be between 21 and 60 years old. You need a minimum monthly income of ₹20,000 to ₹30,000, and your credit score should be 700 or higher for better approval chances.

The documentation required is similar to a loan application and includes a PAN card or Aadhaar, address proof, salary slips or ITR for three months, and bank statements for six months.

Note: A personal line of credit influences your credit score like any other credit product. Using it wisely and paying on time will improve your credit score and vice versa.

Get The Funds You Need With Hero Fincorp

A personal line of credit offers flexibility when your expenses are spread over time. It works best when used with planning and repayment discipline. However, if you are in need of a lump sum for an emergency, a personal loan is always the best option.

Hero Fincorp offers instant personal loans that are usually approved in under a day. The process is entirely digital, and you can apply for one via an instant loan web app or via the mobile apps available for Android or iOS.

Frequently Asked Questions

What is the maximum credit limit I can expect with a Personal Line of Credit from Hero Fincorp?

The limit of your PLOC depends on your income, credit profile, and repayment capacity. It is assessed individually.

Is a good CIBIL score mandatory to apply for a Line of Credit with HeroFincorp?

A strong score definitely helps your application, but lenders usually consider several other factors to give you a line of credit.

What happens if I don’t utilise my approved Personal Line of Credit?

Interest is not charged on unused limits; however, you may still have to pay annual/maintenance fees.

How quickly can funds be disbursed after approval?

Once approved, funds are generally available quickly through digital access.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.