What Is an Income Tax Return (ITR) in India?

- Understanding Income Tax Return (ITR)

- Importance of Filing Income Tax Returns in India

- Who Should File Income Tax Returns? Eligibility Criteria

- Types of Income Tax Return (ITR) Forms in India

- Documents Required for Filing Income Tax Return

- Step-by-Step Guide: How to File Income Tax Return Online in India

- Important Dates and Deadlines for Income Tax Return Filing (FY 2024-25)

- Penalties for Late Filing or Non-Filing of ITR

- How to Check Income Tax Return (ITR) Status Online?

- What to Do If You Miss the ITR Filing Deadline?

- Who Is Exempted from Filing an Income Tax Return in India?

- Filing ITR on Time Builds Financial Confidence

- Frequently Asked Questions

Rohit received his first salary credit and felt proud. A few months later, a colleague casually asked him, “Have you filed your ITR yet?” That single question created instant confusion. He had tax deducted from his salary, so what else was left to do?

This moment is common. Many people assume their tax responsibility ends once deductions appear on their payslip. The problem starts when they realise that missing or delaying an income tax return can affect refunds, loans, and even future financial plans.

An income tax return exists to close this gap. It helps you officially report your income for the year and stay in control of your financial records, rather than reacting to notices or last-minute confusion.

Rohit received his first salary credit and felt proud. A few months later, a colleague casually asked him, “Have you filed your ITR yet?” That single question created instant confusion. He had tax deducted from his salary, so what else was left to do?

This moment is common. Many people assume their tax responsibility ends once deductions appear on their payslip. The problem starts when they realise that missing or delaying an income tax return can affect refunds, loans, and even future financial plans.

An income tax return exists to close this gap. It helps you officially report your income for the year and stay in control of your financial records, rather than reacting to notices or last-minute confusion.

Understanding Income Tax Return (ITR)

To clearly understand what an income tax return is, imagine a common situation. You receive a monthly salary; your employer deducts some tax, and a small amount of interest is added to your savings account.

At the end of the year, all these income sources need to be reported together. An ITR is the format used for that reporting.

The ITR is about more than just paying tax. It is a declaration in which you inform the Income Tax Department of your income, claimed deductions, and taxes paid. Based on this information, the department checks whether your tax calculation is correct.

An income tax return is also a government-mandated document under Indian tax laws. Individuals, businesses, and other entities must file it if eligible. Over time, your ITR becomes an official financial record that banks, lenders, and authorities rely on.

Also Read: Old vs. New Tax Regime Simplified: Which One Should You Pick?

Importance of Filing Income Tax Returns in India

Many people wonder why filing matters when taxes are already deducted from their salaries. This question usually comes from first-time taxpayers and young professionals. The answer lies in the importance of ITR filing.

Filing an ITR helps you stay legally compliant and protects you financially. When your income details are properly recorded, future financial processes become easier and faster.

Here is why filing an ITR is important:

• It acts as valid proof of income for personal loans, home loans, and credit cards

• It allows you to claim refunds if excess tax was deducted

• It helps carry forward certain losses to reduce future tax burden

• It improves financial credibility for visa and travel applications

• It keeps a clean income record for long-term financial planning

• In simple terms, filing an ITR gives your income an official identity.

Who Should File Income Tax Returns? Eligibility Criteria

Understanding who is eligible to file an income tax return helps avoid penalties and confusion. Eligibility depends on income level and specific conditions.

Filing becomes mandatory when total income exceeds the basic exemption limit. However, filing is also required in several cases, even when income is low.

You are required to file an ITR if you belong to any of these categories:

• Individuals whose income exceeds the basic exemption limit

• Hindu Undivided Families with taxable income

• Companies and partnership firms, regardless of profit or loss

• Senior citizens based on age and income sources

• Non-resident Indians earning income in India

• Individuals claiming tax refunds

• Taxpayers involved in specified high-value financial transactions

Types of Income Tax Return (ITR) Forms in India

There are different types of income tax return forms because income patterns differ. Choosing the correct form answers the question of which ITR form to file.

| ITR Form | Applicable To | Income Covered |

| ITR 1 | Resident individuals | Salary, interest, one house property |

| ITR 2 | Individuals and HUFs | Income other than business |

| ITR 3 | Individuals and HUFs | Business or professional income |

| ITR 4 | Presumptive taxpayers | Presumptive business income |

| ITR 5 | Firms and LLPs | Business and other income |

| ITR 6 | Companies | Income excluding exemptions |

| ITR 7 | Trusts and institutions | Income under specific sections |

The ITR form types are updated regularly to improve disclosure and accuracy. Selecting the wrong form can delay processing or invite clarification notices.

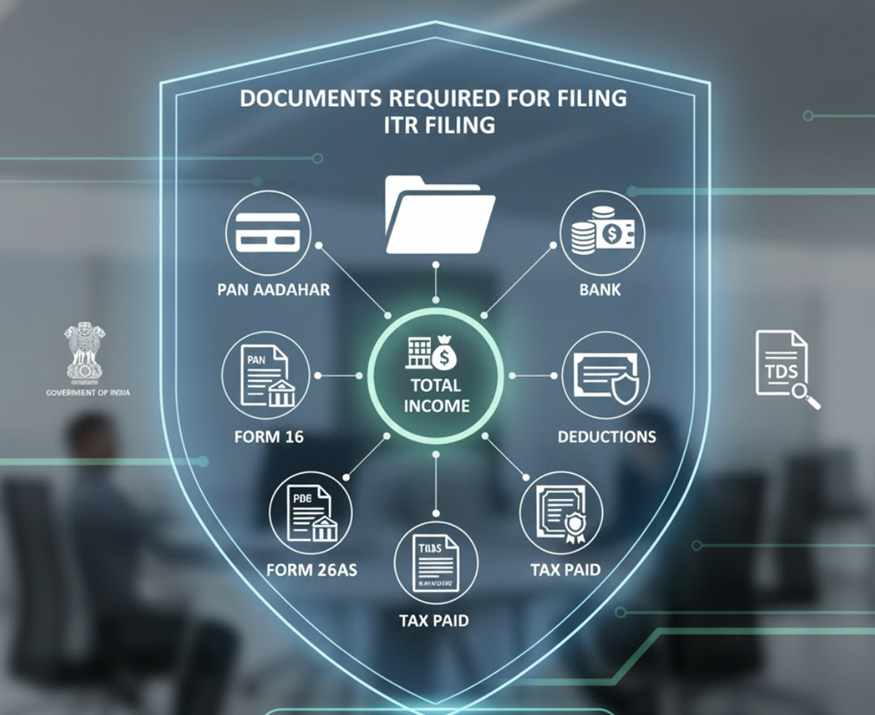

Documents Required for Filing Income Tax Return

Preparing documents early reduces filing errors. Knowing the documents for income tax return filing makes the process smoother.

Documents needed for ITR include:

• PAN card and Aadhaar number

• Form 16 from the employer

• Form 26AS and Annual Information Statement

• Bank account statements

• Investment and deduction proofs

• TDS certificates from other income sources

Keeping these records ready helps ensure the filing is completed without last-minute pressure.

Need funds urgently? We’ve got you covered. Download our personal loan app to explore flexible options and apply in just a few minutes!

Step-by-Step Guide: How to File Income Tax Return Online in India

This is usually the part where people pause with the cursor hovering over the screen. You have logged in, selected the year, and then the questions start. Did I choose the right form? Should this number be rounded off? Is it okay to submit now, or should I check once more?

That hesitation is normal. Filing your return is not difficult, but it feels important. Once you see how the process actually works, it becomes far more straightforward than it looks at first glance.

• Step 1: Log in to the Income Tax Department e-filing portal using PAN credentials

• Step 2: Select the correct assessment year and applicable ITR form.

• Step 3: Enter income details, deductions, and tax payments carefully.

• Step 4: Upload required documents and review calculations.

• Step 5: Submit the return after confirming all information.

• Step 6: Complete e-verification using an Aadhaar OTP, net banking, or another approved method.

Without e-verification, the return remains incomplete.

Important Dates and Deadlines for Income Tax Return Filing (FY 2024-25)

Deadlines are where most penalties begin. Knowing the income tax return deadline and the ITR filing due date in India helps you plan.

| Category | Due Date |

| Individuals without an audit | 31 July 2025 |

| Businesses requiring an audit | 31 October 2025 |

| Transfer pricing cases | 30 November 2025 |

| Revised returns | 31 December 2025 |

| Belated returns | 31 December 2025 |

These deadlines ensure smooth processing of returns and refunds. Filing within time keeps your financial record clean and prevents avoidable follow-ups. Planning early also reduces errors caused by rushed filing.

Penalties for Late Filing or Non-Filing of ITR

Most people search for this only after realising they are late. The penalty for not filing an income tax return exists to encourage timely compliance, but it often catches taxpayers off guard. The ITR late-filing penalty can apply even when the tax amount is small.

Late filing may lead to:

• Additional late fees

• Interest on unpaid tax

• Delays in receiving refunds

• A weaker financial record

Filing on time helps you avoid these outcomes and keeps your financial profile clean.

How to Check Income Tax Return (ITR) Status Online?

You can easily check the ITR status online through the Income Tax Department portal. Income tax return tracking starts by logging in with your PAN and password.

Once logged in, navigate to the “View Filed Returns” section. Enter the acknowledgement number linked to your submitted return. The system then displays the current status, such as submitted, verified, processed, or refunded.

Each status message explains the stage of your return. Regular tracking helps you stay informed without visiting any tax office or relying on third-party updates.

What to Do If You Miss the ITR Filing Deadline?

If you missed the income tax return deadline, corrective steps are available. Filing a belated ITR allows compliance within the permitted timeline.

Corrective steps include:

• File a belated return with applicable penalties

• Submit a revised return if errors exist

• Pay outstanding tax and interest

• Complete e-verification promptly

Taking action early reduces financial and legal impact.

Who Is Exempted from Filing an Income Tax Return in India?

Some taxpayers qualify for income tax return exemptions in India. Knowing who is exempt from ITR filing avoids unnecessary compliance.

Exemptions include:

• Very senior citizens under Section 194P

• Individuals earning only a pension and interest under specific conditions

• Certain notified taxpayers as per government rules

Eligibility should be reviewed every year.

Filing ITR on Time Builds Financial Confidence

Filing an income tax return on time keeps your financial records clean and reliable. It prevents penalties and supports long-term goals. A small yearly effort protects your financial stability.

Need Support with Financial Planning?

When unexpected expenses arise, reliable financial options matter. Hero FinCorp offers practical solutions tailored to your real income needs, helping you stay prepared. We also help you access funds quickly and responsibly, so you can stay focused on your financial goals.

Frequently Asked Questions

What is the difference between ITR and income tax?

Income tax is the tax charged on earnings. An ITR is the form used to report income and taxes paid.

Can I file ITR without Form 16?

Indeed. If Form 16 is not accessible, you may file using bank statements, salary slips, and Form 26AS.

What happens if I file the wrong ITR form?

The return may be marked defective and must be corrected within the allowed time.

Is it mandatory to file ITR if my income is below the exemption limit?

Not always. Filing becomes mandatory under specific conditions, such as refunds or high-value transactions.

How long does it take to get an income tax refund after filing the ITR?

Refunds are generally processed within a few weeks after successful e-verification.

Can an NRI file ITR online in India?

Yes. NRIs can file ITR online for income earned or accrued in India.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.