Personal Loan vs Line of Credit: What's Better?

- Personal Loan vs Line of Credit: What is the Difference?

- Difference Between Line of Credit and Loans: Key Points

- Personal Loans and LOC: Advantages and Disadvantages

- How to Choose Between a Personal Loan and a Line of Credit?

- What Are the Interest Charges for Personal Loans and Lines of Credit?

- Personal Loans: Your Best Financial Move

- Frequently Asked Questions

Unsure if a line of credit (LOC) or a personal loan would be better for you? You're not alone. Both are common ways to borrow money, although they have rather distinct uses. You may save time, money, and needless stress by being aware of how each operates.

To help you make an informed choice, this guide explains the differences between a line of credit and a personal loan. Continue reading!

Personal Loan vs Line of Credit: What is the Difference?

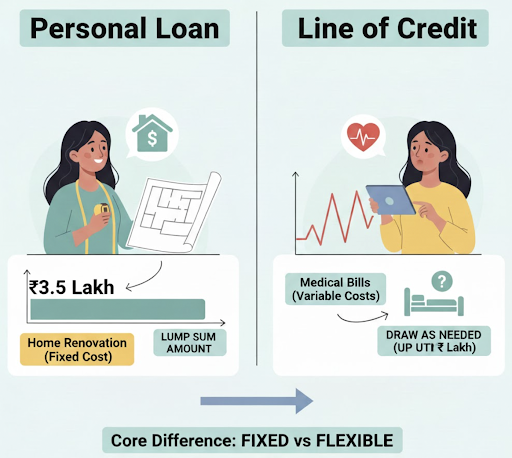

Consider Riya’s situation.

Her father's medical care may result in unpredictable hospital costs, but she still wants to remodel her house. The medical bills are unpredictable, but the renovation cost is clear at about ₹3.5 lakh.

To manage this:

- Riya takes a personal loan for the fixed renovation expense.

- She opens a ₹1 lakh line of credit to handle medical costs as they arise.

This example clearly shows the core difference:

- A personal loan is best when you know exactly how much money you need and want a structured repayment plan.

- A line of credit works better when expenses are uncertain, giving you ongoing access to funds and charging interest only on what you use.

Difference Between Line of Credit and Loans: Key Points

1. Disbursement

- The full amount is disbursed when you avail of a personal loan.

- Flexible withdrawals on a revolving basis when you choose the LOC.

2. Interest Rates

- Fixed interest rates throughout the personal loan term.

- Interest rates are subject to change based on lender or market policy, so your interest costs may vary over time.

3. Repayment Terms

- You repay the loan in equal monthly instalments (EMIs) over a fixed period. The repayment plan is structured and predictable.

- LOC offers flexible repayment options. You generally owe interest only on what you borrow. You can repay the principal any time, and there is no EMI.

4. Eligibility

- Salaried and self-employed individuals are eligible for personal loans if they meet the income and credit score criteria.

- Since LOC offers high flexibility, lenders require clients with a perfect credit score, steady income, and low risk.

5. Ideal Use Case

- Personal loans are best for one-off, large purchases where you know how much you need to borrow in advance.

- LOC works well for emergency or uncertain needs. It's ideal for irregular or ongoing expenses.

Read More: What is Personal Loan?

Personal Loans and LOC: Advantages and Disadvantages

Knowing the pros and cons of personal loans and credit lines will help you determine which best suits your circumstances.

Personal Loan Advantages and Disadvantages

| Pros | Cons |

|---|---|

| Lump-sum funding | Less flexibility |

| Predictable EMIs | Interest is charged on the full loan amount |

| For planned, one-time purchases | Prepayment charges or lock-in periods |

Line of Credit Benefits and Issues

| Pros | Cons |

|---|---|

| Flexible withdrawals anytime | Variable interest rates |

| Pay interest only on the amount you use | Risk of overspending |

| One-time loan application | Requires high income and credit history |

How to Choose Between a Personal Loan and a Line of Credit?

This step-by-step approach can help you decide between a personal loan and a line of credit:

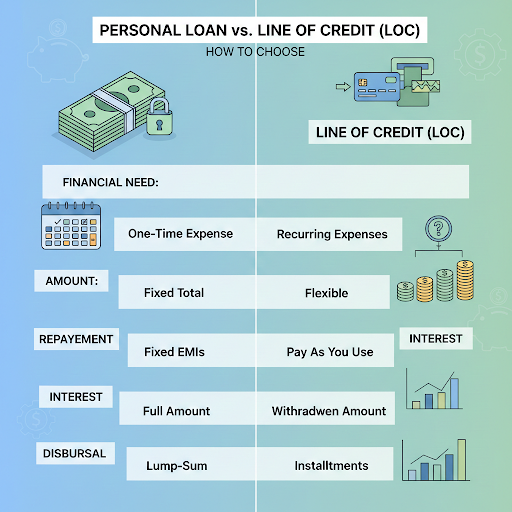

Step 1: Know Your Financial Need

- One-Time Expense: Personal Loan

- Unpredictable or recurring expenses : LOC

Step 2: Estimate How Much Money You Actually Need

- Fixed total amount: Personal Loan

- Unsure about the exact amount: LOC

Step 3: Check Your Repayment Ability

- Fixed EMI:Personal Loan

- Pay for What You Use:LOC

Step 4: Compare Interest Rates

- Interest is charged on the complete amount:Personal Loan

- Charged only for the withdrawn amount: LOC

Step 5: Consider Speed of Disbursement

- Lump-sum disbursal: Personal Loan

- Can be withdrawn in instalments:LOC

Also Read: Top-Up Loan Vs. Personal Loan: Which Is Better for You?

Real-Life Scenarios

Here are some scenarios and the financing type that works well for them.

| Use Case | Best Option |

|---|---|

You know the exact amount that you require | Personal Loan |

You don't know the exact amount of funds you require | Line of Credit (LOC) |

Read More: Find Best Personal Loan for You: A Comprehensive Guide

What Are the Interest Charges for Personal Loans and Lines of Credit?

- In India, interest rates on personal loans depend on your credit score, income stability, and tenure.

- Meanwhile, line-of-credit interest rates usually fluctuate because they are often linked to market rates.

- Fixed interest rates in personal loans provide predictable EMIs, while this is not the case with a LOC.

- Personal Loan Interest Rates in India: 19% – 30%

- Line of Credit Interest Rates in India: Varies from 10% and can be different for secured and unsecured line of credit

Get an estimate of your personal loan EMI here.

Personal Loans: Your Best Financial Move

The choice between a line of credit and a personal loan depends on your financial needs and how predictable your expenses are.

For the majority of customers, a personal loan is typically the simpler and more dependable choice. It gives you total control over your money with fixed interest rates and predictable EMIs, something that an open-ended line of credit cannot promise.

Hero FinCorp makes applying for a personal loan quick and easy if you're searching for speedy approvals, a completely digital and paperless process, and a smooth borrowing experience.

Check your eligibility for a Hero FinCorp Personal Loan and apply today. You can also download the instant loan app for smooth, stress-free financing!

Frequently Asked Questions

1. Is it possible to convert my personal loan to a line of credit later?

Most lenders don't permit you to change a personal loan into a line of credit. You have to close the loan and apply separately.

2. Is there a way to prepay my personal loan and save on interest?

Yes. Prepayment helps reduce interest by lowering the outstanding principal.

3. Is interest on a line of credit charged daily?

Most lines of credit have a daily interest rate on the amount you’ve withdrawn and not the entire approved amount.

4. Can I take out a personal loan and a line of credit at the same time?

Yes. You can avail yourself of both simultaneously, provided you meet the lender’s eligibility criteria for each, including income, credit score, and repayment capacity.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.