Find Best Personal Loan for You: A Comprehensive Guide

Big plans often need a financial backup. Whether you're renovating your home, paying for education, or planning that long-overdue trip, a personal loan can make it happen, without draining your savings.

The tricky part? Choosing the right one for your needs. With every lender promising the "best deal," it's easy to feel lost in the options. This guide helps you cut through the clutter, find the best personal loan for you, and move ahead with confidence.

Why It's Important to Find the Best Personal Loan for You

Taking time to find the best personal loan goes beyond quick approval or low EMIs. It's about choosing a plan that supports your goals without creating future strain.

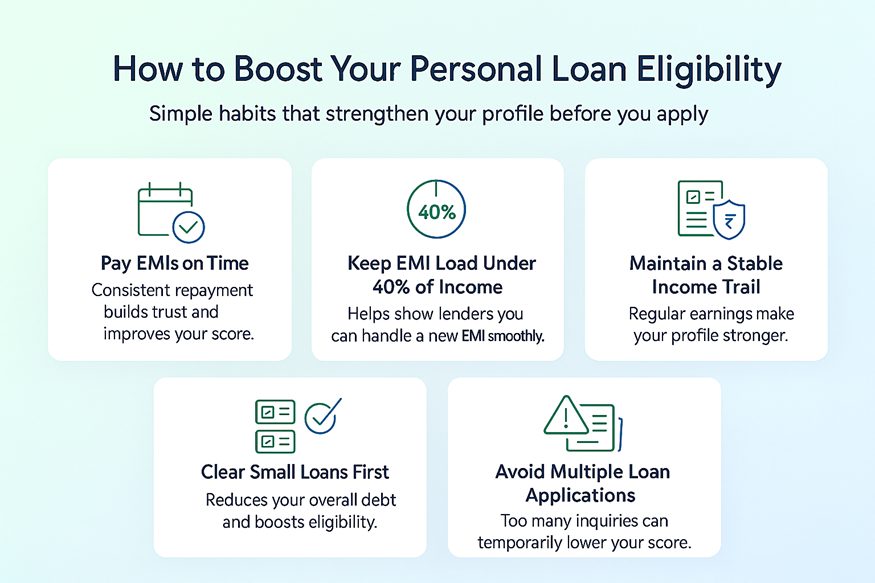

Here's why finding your perfect fit really matters -

- Save more than expected. Even a small drop in interest rate can save thousands over the loan term.

- Keep repayments comfortable. The right tenure keeps EMIs smooth and your budget breathing easy.

- Build better credit health. When your loan aligns with what you can truly afford, on-time repayments follow naturally.

- Skip hidden traps. Transparent fees and clear terms mean no surprise charges later.

Choosing wisely sets the tone for your entire borrowing journey. Run a quick eligibility check on Hero FinCorp to know where you stand before comparing offers.

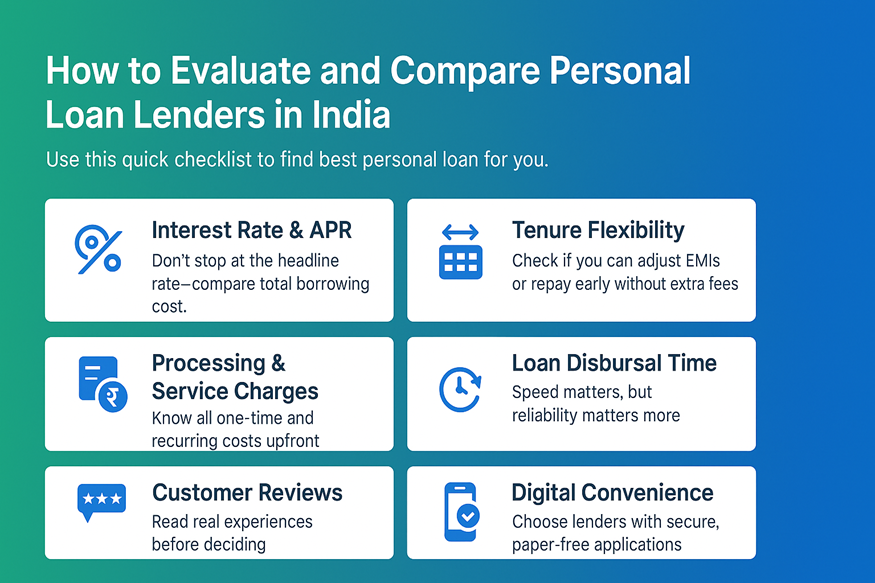

Key Factors to Consider When Finding the Best Personal Loan for You

Each lender sets up their loan terms in different ways. Looking closely ensures what seems good on paper also fits your pocket. Here are the key things to compare:

1. Interest Rates and Processing Fees

We all love the sound of a "low interest rate," but don't stop at the headline number. Always check the Annual Percentage Rate (APR), which includes interest, processing fees, and all other charges, to show the true cost of your loan.

Let's see how two sample offers can differ once you factor in every cost:

| Lender | Loan Amount | Interest Rate | Processing Fee | Other Charges | Total Over 3 Years |

|---|---|---|---|---|---|

| A | ₹5,00,000 | 20% | 2.5% (₹12,500) | ₹5,000 | ₹6,84,500 |

| B | ₹5,00,000 | 19% | 3.5% (₹17,500) | ₹12,000 | ₹6,99,300 |

After including all charges, Lender B actually costs about ₹15,000 more than Lender A.

Pro Tip - Ask if you're getting a fixed or floating rate. Fixed keeps EMIs steady; floating moves with the market. Choose what fits your comfort and monthly rhythm.

2. Loan Amount and Tenure Flexibility

It can be tempting to take a little extra "just in case," but it often stretches your monthly budget. Borrow only what you truly need and keep some breathing room for surprises.

- Longer tenure: Smaller EMIs and easier cash flow, but you'll pay more interest overall.

- Shorter tenure: More EMIs and a heavier lift, but you'll clear the debt faster and save on cost.

Not sure what feels right? Try our personal loan EMI calculator to test different amounts until you find your comfort zone.

3. Eligibility Criteria and Documentation Requirements

Before you hit apply, see what most lenders in India look for. It improves your approval odds and also gets you better terms.

| Age | 21 to 60 years |

| Income | Regular monthly earnings as per lender norms |

| Credit Score | Around 700+ for stronger approval chances |

| Employment | Salaried or self-employed with a steady work history |

| Current EMIs | Minimal ongoing loans for better eligibility |

| Documents | PAN, Aadhaar, salary slips, bank statements |

Pro Tip - Want to simplify the paperwork? Connect through an Account Aggregator to share verified data instantly and speed up approval.

4. Loan Disbursal Speed and Application Process

Why visit branches or stand in queues when you can do everything from your phone? The way you apply shapes how smooth your loan journey feels, and going digital is the smarter choice.

- Apply anytime, anywhere with no branch visits or fixed timings

- Get quick checks, video KYC, and e-signatures for faster approval

- Receive funds within 24 to 48 hours once verified

With the Hero FinCorp Digital Lending App, you can experience all this, supported by RBI consent and data safety guidelines.

5. Added Benefits and Features

When you're trying to find the best personal loan for you, extra perks are a game-changer. Here's what to check -

- Top-up loans - Access extra funds easily without starting a new application

- Customer benefits - Enjoy faster approvals or loyalty loans as an existing borrower

6. Customer Service and Support Availability

A good loan experience doesn't end with approval. The best lenders provide prompt support, EMI reminders, and flexible repayment assistance when needed.

Step-by-Step Guide to Applying for a Personal Loan with Hero FinCorp

Applying for a personal loan doesn't have to feel complicated. With Hero FinCorp, you can go from "just checking" to "approved" in a few simple steps.

Step 1 - Check Where You Stand

Head to the Hero FinCorp personal loan portal or app, enter a few basics like your income, age, and job type, and you'll know your eligibility in seconds.

Step 2 - Make Your Loan Fit Your Life

Think about how much you need and the tenure that works for your budget. With Hero FinCorp, you can get up to ₹5 lakh with flexible repayment tenure (12-36 months).

Step 3 - Complete and Submit Your Application in Minutes

Enter your details, upload documents, and that's almost it. Quick video KYC or Account Aggregator verification moves your loan toward approval in no time.

Step 4 - Get Instant Approval & Disbursal

Once approved, e-sign your agreement. The funds usually hit your bank within 24–48 hours (sometimes even sooner).

Say Yes to Smarter Borrowing

The best personal loan isn't just about the rate. It's about ease, trust, and control. Hero FinCorp brings all these together with a transparent, fully digital process that helps you borrow confidently and reach your goals faster.

Start your personal loan journey today and experience the Hero FinCorp edge.

Frequently Asked Questions

1. What documents are required to apply for the best personal loan in India?

Just the essentials! Your PAN, Aadhaar, income proof (salary slips or ITR), and recent bank statements.

2. Can I get a personal loan with a low credit score?

You still might! Lenders today don't just go by your score. They also check alternate data like your rent payments, utility bills, and digital spending to see the full picture.

3. How do lenders decide my interest rate?

Your credit score, job type, income, and repayment history all play a part. Strong profiles get better rates.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.