What is Digital Rupee (e₹) and How Does it Differ from UPI?

Paying through UPI has made money feel almost effortless because transfers happen in seconds, and the process rarely needs a second thought. When people hear about the digital rupee, the reaction is often hesitation rather than clarity. The name sounds official, yet its purpose feels unclear. If payments already work smoothly, it becomes difficult to understand what this new form of money is actually meant to change.

That confusion usually comes from seeing both as digital and assuming they work the same way. In reality, UPI and the digital rupee serve very different roles. This blog explains the differences in simple terms, showing what each does, how they work, and where their use begins and ends in everyday transactions.

Introduction to Digital Rupee: India’s New Digital Currency

Before getting into features and comparisons, it helps to understand why this concept exists at all. India has built one of the world's strongest digital payment systems. At the same time, the money we use still exists either as paper notes or as balances inside banks.

The digital rupee arrives as the next step in this journey. It focuses not on how payments move, but on what form money itself can take in a digital economy.

Defining the Digital Rupee (e₹)

When people first hear about the digital rupee, the natural reaction is to compare it with UPI because both appear on a phone screen. The similarity ends there. With UPI, money always moves from one bank account to another. With the digital rupee, nothing is being transferred at that moment.

The amount already exists as currency, only without physical notes. Instead of sitting in a bank account, it sits separately in digital form. That small difference is what makes the idea feel new, even though the value itself never changes.

Key Characteristics of India’s Digital Currency

India’s digital currency works differently from regular online payments in several important ways.

● The Reserve Bank of India issues it directly

● It holds legal tender status like physical cash

● It does not depend on bank deposits for value

● It allows direct settlement between users

● It can support limited offline usage during pilots

● It reduces reliance on printing and handling notes

Understanding UPI: India’s Revolutionary Payment Interface

To understand the difference clearly, it helps to look at UPI separately. Many people assume UPI itself is digital money, but that is not the case. UPI acts as a system that moves money from one bank account to another.

Unified Payments Interface works like a fast messenger between banks. When you send money, it simply instructs banks to shift existing balances. The money never leaves the banking system. This is what made UPI simple, fast, and widely trusted.

How UPI Works and Why It’s Popular?

When you initiate a UPI payment, the system verifies your identity, checks your bank balance, and completes the transfer instantly. The entire process happens within seconds, even though multiple banks communicate in the background.

The benefits of UPI come from this convenience. It works all day, connects to different banks, and removes the need to share account details. These features turned UPI into an everyday habit for millions of Indians.

Also Read: Is It Safe to Share Your UPI ID?

Digital Rupee vs UPI: A Detailed Comparison by Hero FinCorp

At this point, the difference starts becoming clearer. Digital rupee vs UPI is not a choice between two payment apps. It is a comparison between money itself and the system that moves money.

UPI helps your bank balance travel from one account to another. The digital rupee represents actual currency in digital form. Both serve different purposes and solve different problems.

Core Differences: Digital Rupee vs UPI

Point of Comparison | Digital Rupee | UPI |

Issuer | Reserve Bank of India | Banks under NPCI |

Nature | Digital form of cash | Payment interface |

Legal status | Legal tender | Transfer system |

Settlement | Direct and final | Bank to bank |

Bank account needs | Not always required | Mandatory |

Offline capability | Limited pilot use | Not available |

Primary purpose | Currency evolution | Payment convenience |

Also Read: What Is Personal Financial Management (PFM)?

Similarities Between Digital Rupee and UPI

Even though they differ in structure, both systems share common goals.

● Both enable fast digital transactions

● Both reduce dependence on physical cash

● Both strengthen transparency in payments

● Both aim to improve financial efficiency

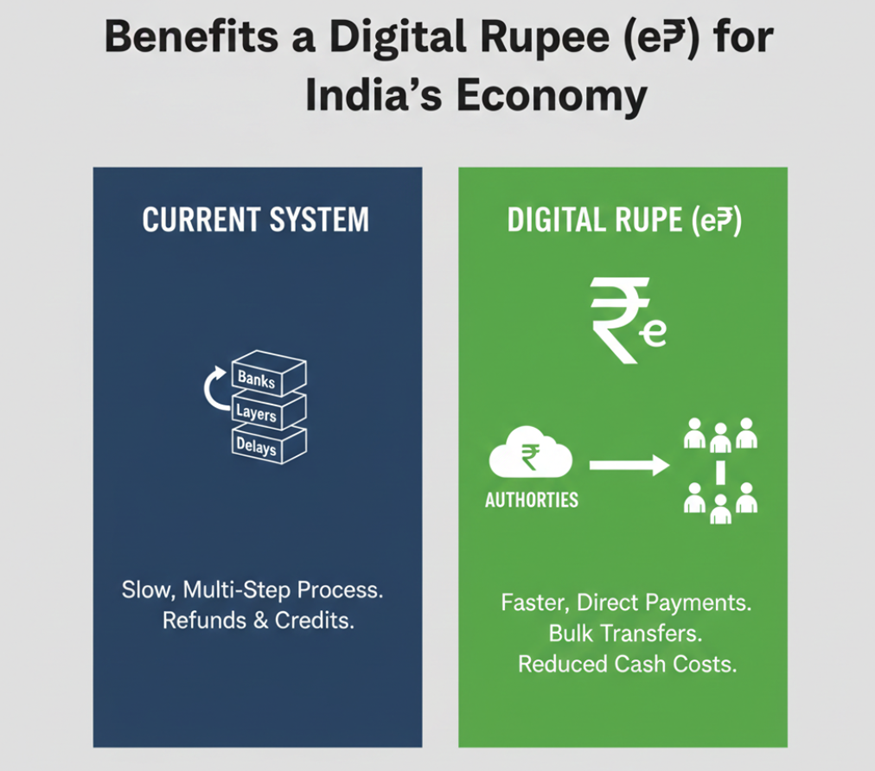

Benefits of the Digital Rupee for India’s Economy

When money moves through several banking layers, delays and confusion often follow, especially during high-volume payments. Anyone who has waited for a refund or a government credit knows how unclear these moments can feel. Digital rupee reduces that dependency by allowing value to move in digital form without passing through multiple settlement steps.

This setup becomes useful when authorities need to send funds to many people at once, where timing and visibility matter. Over time, digital currency also reduces the need to print, move, and store cash while maintaining the rupee’s value for everyday use.

The Future of Digital Payments: Coexistence of Digital Rupee and UPI

The future of digital payments in India does not involve replacing existing systems. UPI will continue handling daily transfers between bank accounts. Digital rupee will operate alongside it as a digital form of cash.

This coexistence allows people to choose based on usage. UPI remains ideal for account-based payments, while the digital rupee supports direct currency transactions. The digital rupee future strengthens the system rather than disrupting habits people already trust.

Hero FinCorp’s Perspective on India’s Digital Financial Evolution

Digital payments already shape how people handle money, from everyday transactions to larger financial decisions. As newer systems appear, knowing how they fit into existing habits makes a real difference. The same understanding becomes important while borrowing, where clarity often matters more than speed. Working with a reliable NBFC helps keep that experience straightforward.

When a planned expense or an unexpected need arises, Hero FinCorp offers fully digital, paperless personal loans. Apply here!

Also Read: How to Calculate Personal Loan Eligibility?

Frequently Asked Questions

What types of Digital Rupee e₹ are being piloted in India?

The RBI is testing retail and wholesale versions to evaluate consumer and financial institution usage.

Can users earn interest on Digital Rupee holdings?

Digital rupee does not earn interest because it functions like physical cash.

Is the Digital Rupee a cryptocurrency?

Digital rupee is not a cryptocurrency and does not rely on blockchain mining.

What security features protect the Digital Rupee?

The system uses encrypted wallets, controlled issuance, and RBI-regulated infrastructure.

How can users get a Digital Rupee wallet?

Selected banks currently provide wallets as part of the ongoing pilot programs.

Will the Digital Rupee replace cash or UPI?

Digital rupee will complement existing systems rather than replace cash or UPI.