Digital Personal Loan Application: Meaning, Benefits & How to Apply

Whenever we hear the word ‘loan’, we often picture a bank desk with a representative verifying stacks of documents against our originals. But that's no longer the case. With digital Personal Loan applications, primarily through new-age apps like Hero FinCorp, you can quickly apply for a paperless loan. Curious to know more? Let’s explore.

What is a Digital Personal Loan Application?

As the name suggests, a digital loan application is an online way of applying for a loan. It eliminates the need for traditional paperwork and branch visits. Through a paperless loan application, you simply provide your KYC details to the lender. This not only makes the process more convenient but also faster than the offline method. The shift from manual procedures to digital platforms in India has made the Personal Loan process quicker, more accessible, and more manageable.

Benefits of Digital Personal Loan Applications

Here are some benefits of an online loan application that make borrowing a Personal Loan of up to Rs 5 Lakh hassle-free.

- Instant Approvals: Digital platforms check your eligibility online in minutes, which leads to faster approvals.

- Paperless Documentation: You only need to provide your KYC details when applying online.

- 24/7 Accessibility: You can apply anytime, anywhere using your smartphone or laptop.

- Faster Fund Disbursal: Once approved, the loan amount is credited to your bank account quickly.

- Secure Data Handling: Your personal information is protected through encryption and digital verification.

- User-Friendly Experience: Instant digital loan apps have a simple application process that makes borrowing stress-free. All these benefits make borrowing simpler and faster than traditional loan processes.

Also Read: Tips Of Personal Loan Approval

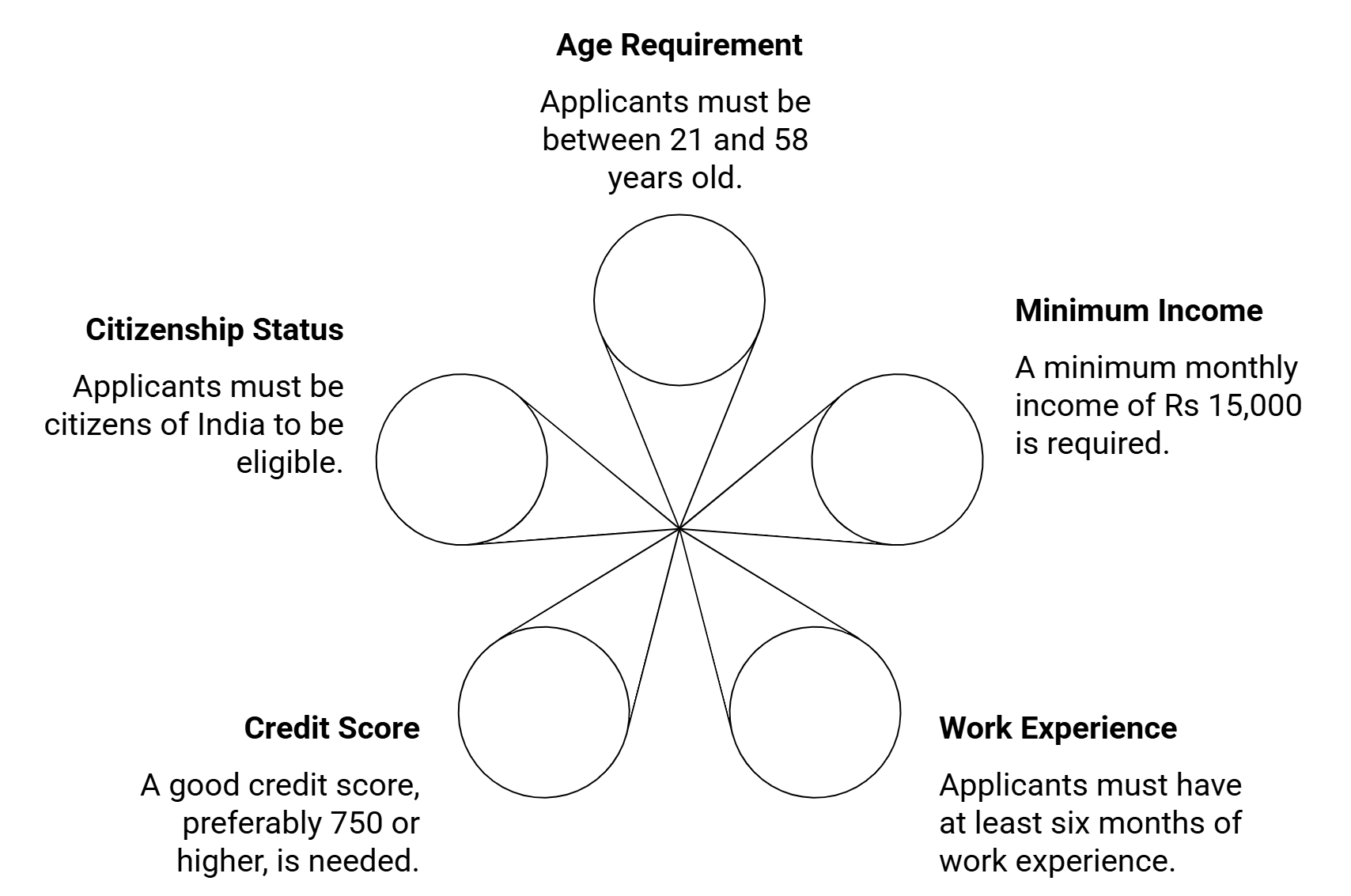

Eligibility Criteria for Digital Personal Loans

To apply for a Personal Loan, you need to meet the eligibility criteria. Here are the eligibility requirements to apply for a loan at Hero FinCorp.

Even if your credit score is not perfect, you may still get a loan, though the interest rates may be slightly higher.

How to Apply for a Digital Personal Loan

Follow this application process to secure a Digtial Personal Loan online

- Install the App: Download and install the loan app from the Play Store.

- Select Loan Details: Choose your desired loan amount (up to Rs 5 lakh) and preferred EMI plan.

- Provide Basic Information: Enter your Name, Income, Loan Purpose, and PAN Card number.

- Complete KYC: Verify your identity by completing the KYC process.

- Enter Bank Details: Input your bank account details for loan disbursement.

- Get Approval: Receive real-time loan approval.

- Sign Digitally: Digitally sign the e-Mandate and loan agreement.

- Receive Funds: The approved loan amount is credited directly to your bank account.

How does a Digital Loan Application Ensure Speed and Security?

A paperless loan application uses advanced technology to maintain speed and security:

- Encryption: Protects your sensitive data during transmission.

- Digital KYC Verification: Confirms your identity without physical documents.

- e-Signatures: Secure and legally valid for agreements.

- Multi-Factor Authentication: Adds extra protection against unauthorised access.

- Regulatory Compliance: Ensures borrower protection and adherence to RBI guidelines.

These features make the process quicker, safer, and more convenient than traditional paper-based loans. You can apply, verify, and get approval online without visiting a branch.

Also Read: use cases of personal loan

Common Types of Digital Loans Available in India

Several online loan types have simplified borrowing in India, making funds accessible quickly and securely. Below are the most common options and their typical use cases:

| Loan Type | Features | Typical Use Case |

|---|---|---|

| Personal Loan | Fully online, unsecured | Short-term personal needs, debt consolidation |

| Business Loan | Digital processing for small amounts | Expansion, working capital for established businesses |

| Two-Wheeler Loan | Online application for scooters and bikes | Purchase motorcycles and repay in EMIs |

| Loan Against Property | Partial online process, secured | Leverage property for personal or business funds |

Digital platforms ensure that Personal Loan digital applications are faster, paperless, and accessible 24/7, reducing the delays associated with traditional offline methods.

Also Read: types of personal loan

Top Tips to Choose a Genuine Digital Loan Provider in India

Choosing a genuine online loan lender ensures a safe and hassle-free borrowing experience. Consider these practical tips:

- Check Registration: Make sure the lender is registered with the RBI.

- Read User Reviews: Check user feedback on app performance and customer service.

- Transparent Fees: Ensure interest rates, processing fees, and charges are clearly stated.

- App Security Features: Platforms should use encryption, OTP verification, and secure data storage.

- Clear Terms & Conditions: Avoid hidden clauses or confusing policies.

- Watch for Red Flags: Be cautious of promises that offer instant approval without proper verification or require unusual upfront payments. A safe online loan application starts with selecting a trustworthy provider.

Common Challenges & How to Overcome Them When Applying for Digital Loans

Some of the challenges and solutions to overcome when applying for an instant digital loan are:

- Digital Literacy: Use app tutorials or stepwise guidance.

- Connectivity Issues: Apply from a stable internet connection.

- Document Errors: Upload clear and valid digital copies.

- Data Privacy Concerns: Use only secure and verified lender platforms.

- Verification Delays: Contact customer support promptly for clarification and assistance. These tips help ensure a seamless application experience.

Conclusion

A Personal Loan through a digital loan application brings speed, convenience, and security. The paperless loan application process eliminates paperwork, enables instant verification and provides faster approvals. You can complete the entire journey online, making the loan process simple, stress-free, and suited to today’s financial needs.

Frequently Asked Questions

1. What documents are required for a Rs 5 Lakh digital Personal Loan?

You only need your KYC details to apply for a Rs 5 Lakh loan from lenders.

2. How fast can I get approval on a digital loan application?

You can get approval for a loan application within 10 minutes when you apply online with Hero FinCorp.

3. Is a digital Personal Loan unsecured, or does it need collateral?

Yes, a digital Personal Loan is unsecured, so you do not need to provide any security or collateral.

4. What repayment options are available for digital Personal Loans?

When you apply with Hero FinCorp, you can choose a repayment tenure from 12 to 36 months.

5. What are the main benefits of applying for a Personal Loan digitally vs offline?

A Personal Loan applied digitally offers faster approval, paperless processing, instant verification, convenience, and secure online transactions versus offline methods.