5 Tips to Get Your Personal Loan Approved Instantly

India's personal loan market is booming, expected to hit $26.05 billion by 2025.

This surge suggests that more Indians are opting for personal loans rather than pledging or borrowing money from family in times of crisis. And why not? They give you the confidence to face every challenge with dignity.

But then again, do all personal loan applications get accepted? Well, you know the truth. So, read this blog as we enlist five tips for faster personal loan approval.

Understanding Personal Loan Approval Mechanics

Personal loan approval is when a lender decides to lend you the requested loan amount.

You start by filling out an application and sending in the required documents. The lender looks at things like your credit history, how well they think you can pay back the loan, and if you generally meet their standards. Then, they decide whether to approve your loan. This process usually takes hours/days if you meet the criteria easily.

By understanding these approval criteria, you can prepare a better loan application and minimise the chances of rejection. That's not all. It also aids financial planning. If you know what lenders look for, you can choose the right loan tenure and manage EMIs without straining your budget.

Common Reasons Why Personal Loan Applications Get Rejected

Before we discuss the ways of personal loan approval, let's understand why lenders reject applications in the first place. Here are a few reasons -

Low Credit Score

A poor credit score (650 or below) indicates you're a risky borrower who can default on the loan. This triggers banks and NBFCs to reject your application.

Know your CIBIL score for free—calculate it here.

High Debt-to-Income Ratio

If a big portion of your income goes towards paying off other debts, lenders sense default risks. They might worry you can't handle another loan on top of the existing ones and reject your application.

Inaccurate Documentation

Three out of five Indians exaggerate their income on loan applications to qualify for the loan. However, this is a malpractice and also one of the leading reasons why personal loan applications get rejected.

Multiple Recent Loan Applications Within a Short Period

Multiple loan applications suggest you're dependent on credit for survival. So, the more loans you apply for, the less likely you are to get any.

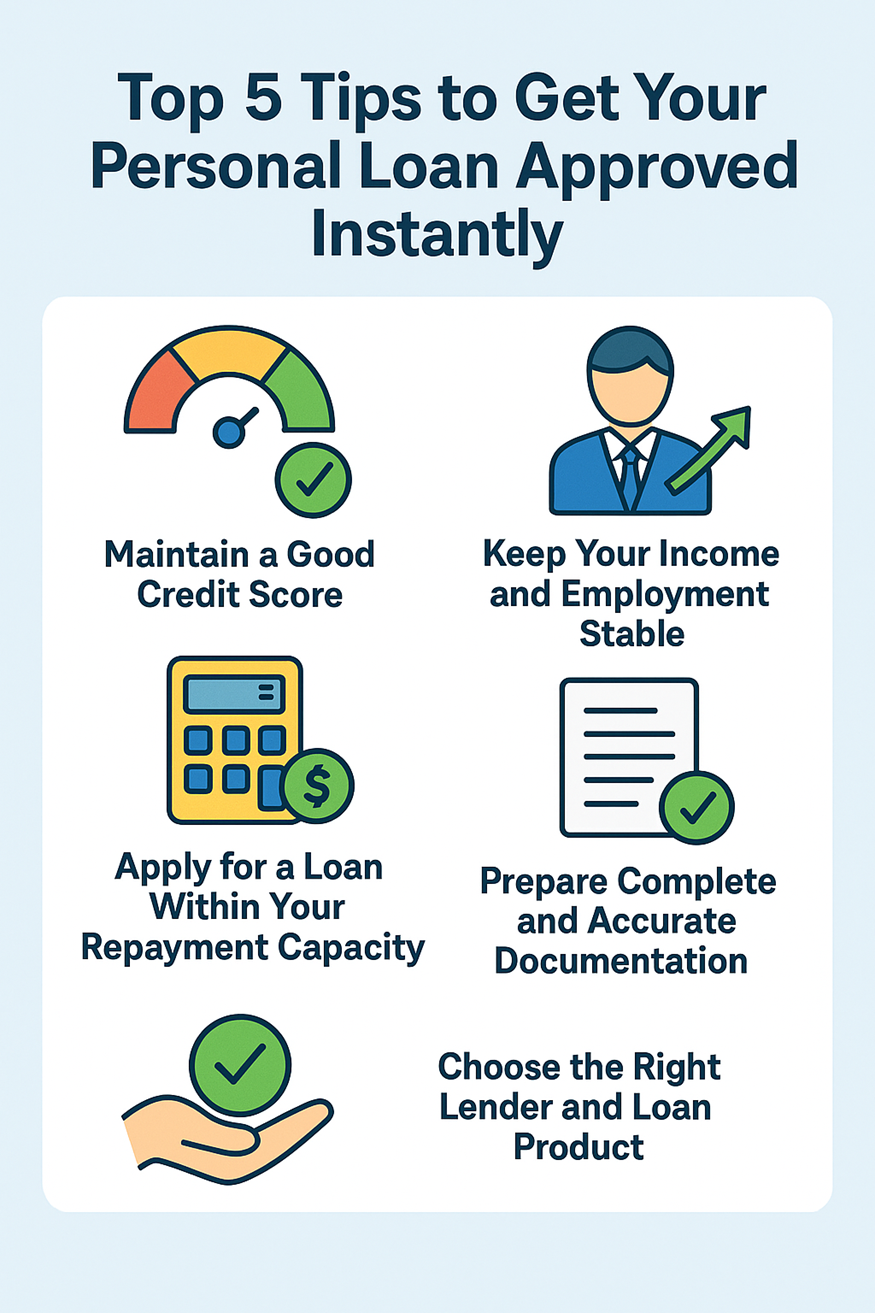

Top 5 Tips to Get Your Personal Loan Approved Instantly

Don't let the fear of rejection get the better of you. Here are five tips for personal loan approval -

1. Maintain a Healthy Credit Score

A credit score of 750 or higher makes it easier to get approved. So, pay your bills on time, and keep credit utilisation low to improve your credit score.

2. Ensure Stable Income and Employment

Lenders gauge your income stability to understand whether you'll be able to pay back the loan. So, maintain a steady employment record. Also, try to build passive income streams to boost your earnings.

3. Apply for a Loan Within Your Repayment Capacity

Apart from your income, lenders evaluate your EMIs and existing debt burden to measure your repayment capacity. If you apply for a loan amount that's beyond it, your application might get rejected. So, always apply for a personal loan amount you can pay back.

Want to check the personal loan amount you're eligible for? Try our free Personal Loan EMI Calculator now!

4. Prepare Complete and Accurate Documentation

Before applying for a personal loan, double-check the attested documents, like your ID proof, income proof, bank statements, etc. Make sure they're valid and up-to-date to prevent delays and rejections.

5. Choose the Right Lender and Loan Amount

The interest rates, eligibility criteria and loan terms vary from lender to lender. So, compare options to find the lender whose offerings best align with your financial capabilities.

Most importantly, borrow an amount depending on your income and other financial liabilities to avoid burdens.

How Hero FinCorp Simplifies Your Personal Loan Approval Process

Now you know about the tips to get your personal loan approved. But the next big question is, who should you apply with for a hassle-free experience? The answer is—Hero FinCorp.

An RBI-registered NBFC like Hero FinCorp lets you avail personal loans of up to ₹5 lakhs with a minimum salary of just ₹15K per month. The best part? The loan application process is 100% digital and paperless with instant loan approvals.

Here's what our customer has to say -

Hero FinCorp's personal loan app is easy to use with a user-friendly interface. I was initially apprehensive, but later was quite satisfied with their application. The process was quite smooth and hassle-free. I took a loan of ₹2 lakhs from here for my brother's wedding, and it was approved quickly. -Gaurav Mittal, New Delhi

So, hurry up! Get funds instantly without any fuss. Apply for a personal loan with Hero FinCorp.

FAQs

What credit score is required for instant personal loan approval in India?

The minimum credit score required for personal loan approval in India is often 750 and above.

Can I increase my loan amount after initial approval?

Yes, you can. Many lenders offer a "top-up loan" that lets you borrow additional funds over your existing loan amount.

Can I get a personal loan approved with zero credit history?

Yes, you can. But you may have to pay higher interest rates and face stricter loan terms.