ACH Mandate - What Is ACH Full Form in Banking and Its Meaning

An ACH mandate is the reason why your loan EMI gets deducted on the same date every month, without reminders, queues, or manual clicks. It’s one of those behind-the-scenes stage coordinators that quietly keeps the play of your financial life running smoothly.

Whether you’re repaying a loan, paying insurance premiums, or handling monthly bills, ACH mandates helps. It automates payments safely and effortlessly.

Let’s break the concept down and understand how ACH (or in our case NACH) works in India.

Understanding ACH: Full Form and Origin

The full form of ACH mandate is Automated Clearing House mandate. In simple words, ACH is a system that lets money move from one bank account to another automatically. No cheques, no reminders, no manual steps. It’s widely used for recurring payments such as EMIs, SIPs, insurance premiums, and salary credits.

ACH originated in the United States as a faster, cleaner replacement for cheques. In India, the National Payments Corporation of India (NPCI) runs a similar system called NACH (National Automated Clearing House). NACH powers most automated debits and credits today, making recurring payments smoother for millions of users.

Also Read - Personal Loan eNACH vs UPI AutoPay for EMI Repayments

How Does ACH Mandate Work?

At its heart, an ACH mandate is just a permission slip. It is an authorisation you sign off, allowing a bank or lender to debit your account automatically.

Here’s how the process usually works -

1. You give permission via a paper form or digital ACH e-mandate on your bank app or lender’s platform.

2. Your bank verifies the details. Everything goes under scrutiny, your account number, signature, limits, and authorization.

3. The mandate is registered through NACH, and the NPCI validates it for security.

4. Once everything is verified, automatic payments begin.

5. Your account will be debited on the scheduled date every month. You’ll receive alerts and confirmation messages for each successful debit.

Once set up, the entire process becomes seamless and hands-free.

Also Read: What is NACH Mandate? Meaning, Full Form & How It Works

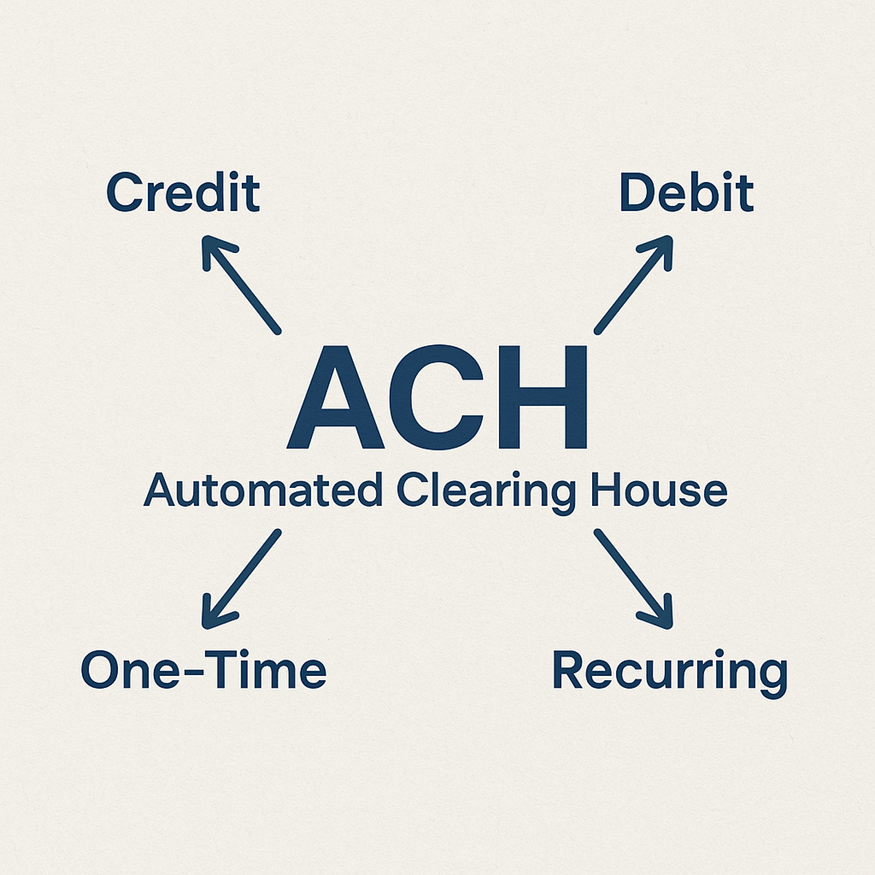

Types of ACH Transfers & Mandates

Different ACH mandate types serve different purposes. Here’s a simple breakdown -

| Types of ACH Mandate and Transfers | Definition | Example |

| ACH Direct Deposit (Credit) | It’s when money flows into your account | Salary credits, tax refunds, government subsidies |

| ACH Direct Payment (Debit) | It’s when money moves out of your account automatically | EMIs, SIPs, utility bills, subscription payments |

| One-time ACH eMandate | These are used for single debit or one-time payments | Paying a one-off bill or fee |

| Recurring ACH eMandates | These facilitate regular and periodic payments where the amount may be fixed or variable | EMIs (fixed-amount recurring mandates), electricity bill (variable amount recurring mandate) |

Also Read - Benefits of Regular EMI Payments

Benefits of ACH Mandate in India

ACH mandates offer several real-world advantages -

• Automatic payments that help you avoid missed deadlines.

• Secure processing thanks to multi-layer verification and encrypted data.

• Low or zero charges, making it a cost-friendly payment option.

• No late fees since payments are timely and consistent.

• Zero paperwork, making the process fully digital and eco-friendly.

• Better financial discipline as payments run on autopilot.

ACH Mandate Form: How to Register & Important Details

Registering an ACH mandate form is simple.

You fill in details such as your name, bank account number, IFSC, mandate amount, and duration. Lenders or banks may also ask for a cancelled cheque or bank verification.

Most banks and NBFCs today support ACH e-mandates, letting you set everything up digitally through netbanking or debit card authentication. Once verified, the mandate becomes active within a few days.

Stay Ahead with Smarter Payments

ACH mandates keep your repayments organised without fuss. They’re secure, predictable, and designed to save you time. If you're planning a loan or looking for a smooth EMI experience, consider Hero FinCorp. You get seamless digital applications, fast approvals, and hassle-free ACH mandate setups so you never miss a payment.

Ready to simplify your repayments? Explore Hero FinCorp’s loan solutions today.

Frequently Asked Questions

1. How can I register for an ACH e-mandate?

You can register through your bank’s netbanking, debit card authentication, or via a lender’s digital onboarding flow.

2. What happens if my account has insufficient balance during an ACH debit?

The payment fails, and you may face penalties or bounce charges depending on your bank/lender.

3. Can I cancel an ACH mandate?

Yes. You can request cancellation through your bank or service provider anytime.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.