How UPI AutoPay Reduces the Risk of Loan Penalties

UPI's immense convenience and real-time transaction capability make it the most preferred payment method today. In August 2025, UPI recorded 20 billion transactions worth INR 24.5 lakh crores.

In addition to the retail niche, UPI is making its convenience known in the financial services sector as well, with features like UPI AutoPay. UPI AutoPay automates your recurring payments—EMIs, subscriptions, etc. —improving payment convenience a notch further. Let's understand that in more detail.

What is UPI Autopay?

UPI AutoPay is a handy feature in your UPI app that lets you schedule automatic payments. You can utilise this feature for recurring expenses like subscriptions, utility bills, EMI payments, etc., so that the right amount gets transferred at the same time every cycle.

It makes payments easier because you won't have to remember to make recurring payments yourself every time. There won't be any risk of missed payments, ensuring that time-sensitive payments, such as EMIs, are always made on schedule.

Why UPI AutoPay Matters for Loan Payments in India

Scheduled EMI payments are supposed to be made at the same time every month. However, it is common to miss a few payments for simple reasons, such as forgetting to pay, technical issues with apps or servers, or unavailability of funds at the right time.

Consequently, if you miss a payment by more than a week, NBFCs and banks charge you late payment penalties. Not only do these penalties increase the total cost of the loan for you, but they also impact your credit score negatively.

In turn, this could make it harder for you to take out loans in the future by raising your interest rates.

Fortunately, with UPI AutoPay, some of these challenges are effectively addressed.

How UPI Autopay Prevents Loan Penalties

UPI AutoPay ensures that your payments are made automatically, securely, and on schedule:

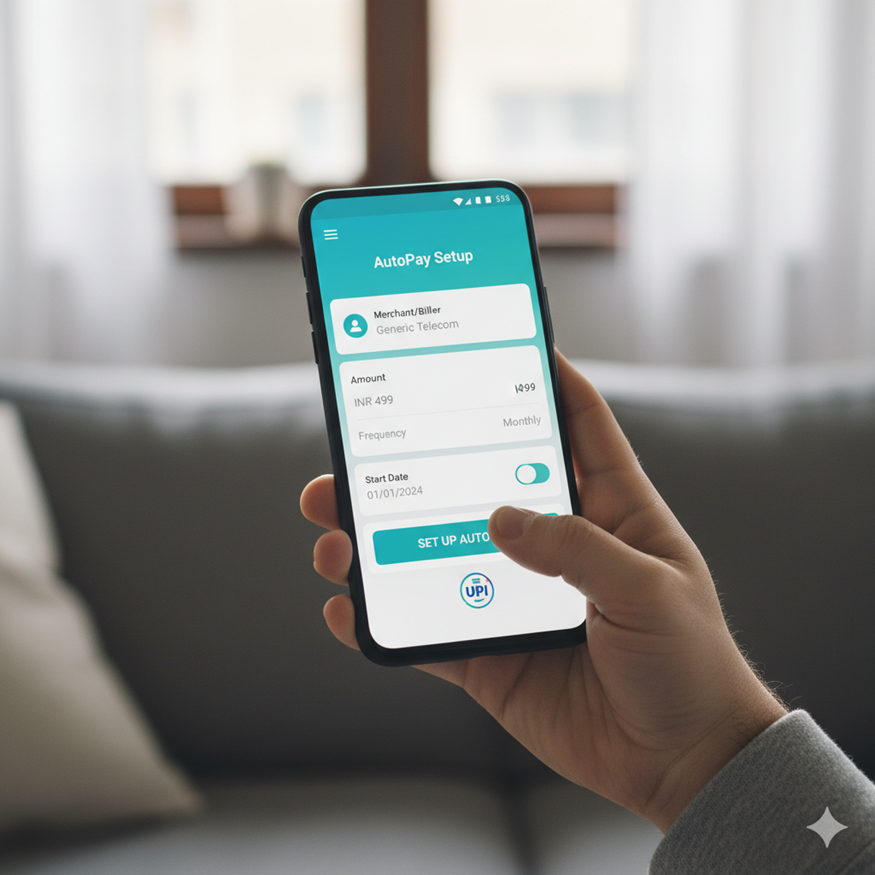

● Users create a mandate for recurring payments (like EMI) on their UPI app.

● The app automatically transfers the mandate directly from the chosen account on a set date, requiring no further approval.

● You don’t have to deal with any more missed deadlines, forgotten payments, or grappling with technical issues at the last minute.

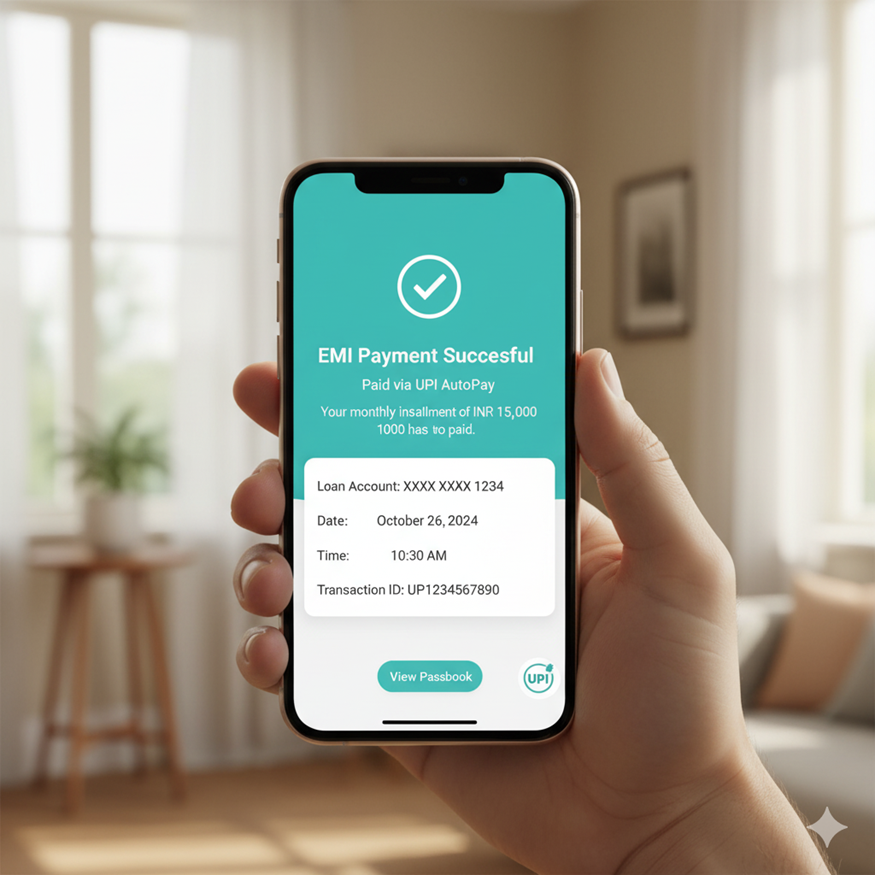

● Users stay updated with prompt reminders, notifications, and status updates.

● By setting up UPI AutoPay for loan payments, you minimise the risk of late fees, penalties, and disruptions.

Setting Up UPI AutoPay for Your Loans

Activating UPI AutoPay is a simple, 3-step process with Hero FinCorp:

1. Open your UPI app and select the Hero FinCorp EMI option.

2. Click on “AutoPay” and set the schedule, amount, and frequency of EMI repayment to Hero FinCorp.

3. Use your biometrics or UPI PIN to authorise this mandate.

Hero FinCorp makes it easy for you to make EMI payments on time by combining state-of-the-art technologies like UPI AutoPay with its handy personal loan app. The top-notch customer service ensures that you always know the status of your recurring payments, balance, and other key details.

Is UPI AutoPay Safe: Security Features

Yes, security is built into the core of UPI payments with the following features:

1. To authorise mandates, you need to provide your biometrics or UPI PIN.

2. User data remains protected with end-to-end encryption.

3. Every mandate payment generates instant notifications to keep you updated.

4. Mandates can be created only on verified apps, reducing phishing risk.

5. The NPCI and RBI regulate these payments to ensure compliance and provide resolution avenues.

Also Read: Know UPI Payment is Safe

Benefits of UPI AutoPay for Indian Borrowers

Automating EMI payments using UPI apps delivers several key benefits:

● The UPI AutoPay feature helps you make payments on time, eliminating delays and missed payments. It saves you from paying penalties.

● A one-time setup ensures every single EMI payment goes out on time. This includes multiple loans from different banks.

● Automated reminders help you plan your finances and predict outgoing payments.

● The process is entirely transparent through payment confirmations, instant alerts, and records for future financial planning. You always know where your funds are transferred. There is no risk of missed payments with UPI AutoPay, providing peace of mind and penalty savings.

● You improve your credit health and score by paying every EMI on time, securing lower interest rates for future loans.

Also Read: advantages of upi payment

Payment Reliability Put on a Timeline: UPI Autopay

UPI AutoPay takes the mental load of recurring payments off your mind. Explore Hero FinCorp's wide range of quick-approval, 10-minute loan options with the peace of mind that you can easily automate your EMIs, preserve and improve your credit score, and avoid penalties.

Tired of missing payments? Click here to check out Hero FinCorp's competitive personal loans today.

Frequently Asked Questions

1. Can I stop or modify a UPI AutoPay mandate?

Yes, you can pause, modify, or cancel any mandate at any time through your UPI app.

2. Do I need sufficient funds in my account for every EMI payment?

Yes, UPI AutoPay will only work if there is an amount equal to the mandate set in your account.

3. Is there an upper limit on the mandate amount for recurring payments?

NPCI has set certain maximum limits, but most loan payments fall within them.

4. Do all lenders support UPI AutoPay?

Major lenders, including Hero Fincorp, support AutoPay for quick and secure payments.

5. Do I get notified of each EMI payment?

Yes, UPI AutoPay generates instant confirmation and notification to keep you updated.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.