Paperless Personal Loan Application: Why Our Loan Application is Safer and Faster

Earlier, applying for a loan meant standing in long queues, running around for documents, and waiting days for approval. Traditional banks had their ways, but now things have changed. With online platforms, the loan process is now faster, simpler, and surprisingly effortless. You only need to provide a few necessary details to get things moving, making approval quicker than ever. What once felt slow and exhausting has turned into a fast, convenient, and stress-free experience.

What Is a Paperless Personal Loan Application?

A paperless loan application enables you to apply online without completing lengthy forms or submitting stacks of documents. Instead, you provide required details digitally, complete e-KYC, and receive faster approvals. This approach offers convenience and quicker processing than traditional paper-heavy applications.

Also Read: How to get Instant Cash Loan in 1 Hour Without Documents

Benefits of a Paperless Loan Application

A digital loan application offers a faster and more convenient alternative to traditional methods.

- Faster Approvals: Automated systems instantly verify eligibility, reducing waiting times from days to minutes. This means you can get financial support exactly when you need it.

- Paperless Documentation: Instead of submitting bulky files, you just need to share your KYC details online, making the process much simpler.

- Secure Digital Verification: With encrypted systems and e-KYC, both personal and financial data remain safe throughout the process.

- Environment-Friendly: A digital loan application reduces paper use, helping you borrow in a more eco-conscious and efficient way.

- 24/7 Accessibility: You can apply anytime, whether on a weekend, during late hours, or while travelling, directly from your smartphone or laptop.

Together, these benefits ensure that a digital loan application is faster, safer, greener, and more convenient, meeting the needs of today’s borrowers.

Also Read: Personal Loan Verification Process In India

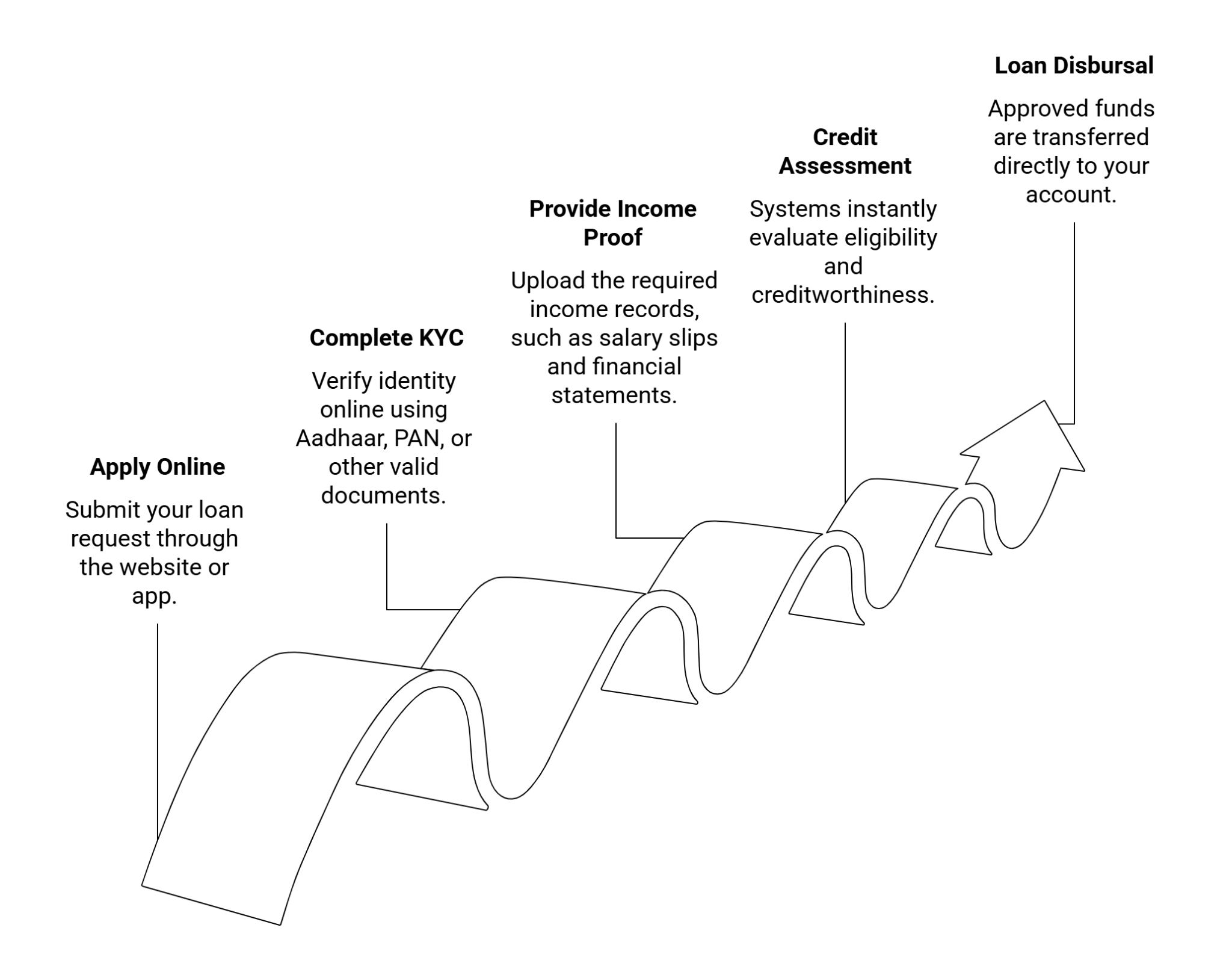

How Does a Paperless Loan Work?

An online Personal Loan is designed to simplify, expedite, and make the borrowing process transparent. Here is how it works:

- Fill in your loan application through the app or website.

- Complete e-KYC and submit the required documents.

- Enter your personal and professional details online.

- The system automatically verifies eligibility and conducts a credit check.

- Loan approval is communicated digitally, subject to verification.

- Funds are transferred directly to your bank account.

By moving every step to a digital loan application, the process becomes secure, faster, and far more convenient compared to traditional methods.

Eligibility Criteria for Paperless Personal Loan

To apply for a Rs 5 Lakh Personal Loan online at Hero FinCorp, you must meet the basic eligibility criteria. Here are the key factors to ensure quick and seamless approval.

- You must be between 21 to 58 years.

- You must be an Indian citizen.

- Salaried applicants require at least 6 months of experience; self-employed businesses must have been operational for at least 2 years.

- To qualify for a Personal Loan, you must earn a minimum of Rs 15,000 per month.

How Hero FinCorp Enables a Fully Paperless Personal Loan Experience?

Hero FinCorp’s Personal Loan App makes it simple to apply for a loan entirely online. It supports secure KYC submission, quick verification, and approval typically within minutes for eligible applicants, eliminating the need for physical paperwork. You can select your loan amount, provide the required documents for a Personal Loan, and complete the agreement online in just a few steps from the comfort of your home.

Step-by-Step Guide to Applying for a Paperless Personal Loan Online

Applying for a loan with Hero FinCorp is a simple and fully digital process. Here is how you can apply for a loan online:

- Visit the Personal Loan page on Hero FinCorp and click on ‘Apply Now’.

- Enter your mobile number and verify it using the OTP sent to you.

- Select the loan amount you wish to apply for.

- Verify your KYC details to confirm your income eligibility.

- Click ‘Submit’ to complete your application.

Comparing Paperless vs Traditional Loan Applications in India

Today, borrowers can choose between digital and traditional loan methods, making the process easier than ever.

| Feature | Digital Paperless Loan Application | Traditional Loan Application |

|---|---|---|

| Documentation | Paperless documents, verified online | Physical forms and multiple documents are required |

| Processing Time | Quick, real-time verification and approval | Slower, dependent on manual verification |

| Convenience | Apply anytime, anywhere via app or website | Must visit the branch or office physically |

| Approval Speed | Instantly or within a few minutes | Several days to weeks |

| Customer Satisfaction | Higher due to ease and speed | Lower due to lengthy procedures |

This online application process makes borrowing faster and more convenient. Today, digital loan applications are increasingly preferred by people who value efficiency, simplicity, and a hassle-free way to manage their documents.

Common Concerns About Paperless Loan Applications and How We Address Them

Applying for a loan digitally raises a few common questions about security, trust, and ease of use.

Is my data secure when I submit an online loan application?

Yes, Hero FinCorp ensures complete digital loan security with encrypted data transmission and secure storage, protecting your personal and financial information.

How can I trust the lender?

Our platform connects you with a regulated and verified system, ensuring authenticity and transparency throughout the loan process.

I am not tech-savvy. Can I still apply?

The app and website are user-friendly, guiding you step-by-step through a smooth loan application process.

Are digital approvals reliable?

Yes, all approvals are legitimate, backed by real-time verification, and follow the same standards as traditional loan applications.

Conclusion

Hero FinCorp’s online loan application offers a fully digital experience, combining speed, security, and convenience. With paperless process and real-time verification, you can complete the process smoothly. Approval is quick, subject to verification and eligibility, addressing common concerns about trust, data security, and usability.

Frequently Asked Questions

1. How fast can I get approval online?

Most approvals for Personal Loans are completed within a few minutes.

2. Is my personal and financial data safe during a digital Personal Loan application?

Yes, all data is protected with secure encryption and verified through e-KYC.

3. Can I apply for a paperless Personal Loan without a good credit score?

A higher credit score improves approval chances, but lenders also consider other factors.

4. What are the repayment options for digitally applied Personal Loans?

You can choose flexible EMIs and repayment terms depending on your eligibility.

5. Can I track my digital Personal Loan application status online?

Yes, you can track the status of your loan application directly through the Hero FinCorp loan app or website.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.