What Is Personal Loan Verification Process & How Does It Work?

- What is the Personal Loan Verification Process?

- Step-by-Step Personal Loan Verification Process

- Documents Needed for Personal Loan Verification Process in India

- What Affects the Loan Verification and Approval Process?

- How to Speed Up Your Verification

- Timeline of Personal Loan Verification in India

- Get Instant Personal Loan Approval with Hero FinCorp

- Frequently Asked Questions

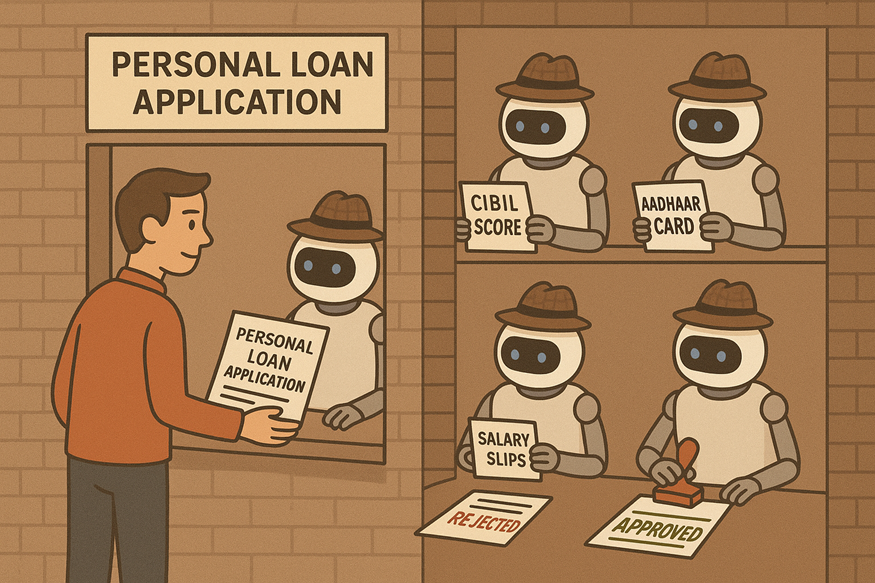

You’ve filled out a personal loan form, uploaded the documents, and clicked on ‘Submit’. Ever wondered what happens next?

This kicks off the loan verification process. It’s how lenders ensure everything checks out before approving and releasing the funds from your details to your documents to your credit standing.

It’s a trust exercise that protects both you and the lender. Let’s break down the personal loan verification process in India.

What is the Personal Loan Verification Process?

Lenders follow the personal loan verification process to verify your identity, income, credit history, and documents before approving your loan. It has a two-fold goal. One, to confirm your details. And two, to ensure that you can comfortably repay the borrowed sum.

The personal loan verification process is more than a formality. It’s what keeps the borrowing system fair and safe. By verifying your details, lenders protect themselves from fraud and make sure borrowers only take on what they can reasonably repay.

In India’s fast-growing digital lending space, verification is also about compliance. Every NBFC, including Hero FinCorp, follows RBI guidelines that require checks on identity, income, and credit history.

It's the lender’s safeguard, confirming that everything’s genuine before saying yes. It continues to lend responsibly and transparently, as it should.

Also Read: How to Track Personal Loan Application Status Online?

Step-by-Step Personal Loan Verification Process

Here’s the chain of events that trigger when you apply for a personal loan.

Step 1: Loan Enquiry and Eligibility Check

The journey starts with you, the borrower. You’ll find yourself comparing lenders, interest rates, eligibility criteria, and repayment tenures during the research stage. This inquiry stage ensures you’re applying for the right amount, saving time down the line.

Few lenders make this easier with their instant eligibility check. They take into account factors like age, income, employment type, and existing liabilities to give you a clear picture of your eligibility for a personal loan.

Step 2: Loan Application Submission

Once you’ve found your fit, it’s time to fill out the loan form, either online or at a branch. Here, accuracy is everything. You must enter every little detail with utmost care and accuracy. A slight mistake could delay approval or trigger re-verification. So, take your time but get it right the first time!

Step 3: Document Collection

Next comes the paperwork (or its digital twin). Lenders usually ask for your ID proof, address proof, income proof, and employment proof. Keep these handy.

Hero FinCorp offers a 100% digital process so that you can skip the paperwork hassle and upload everything securely from your device.

Step 4: Document and Information Verification

Cue behind-the-scenes action. Lenders verify the documents submitted using online tools. There are checks on Aadhaar, PAN, and credit bureau reports. In some cases, lenders conduct a quick field verification to confirm your residence or workplace.

Your credit score plays a critical role here. It demonstrates your repayment discipline, helping lenders determine your eligibility and interest rate. But do note that it’s not the only thing that matters.

Step 5: Loan Sanction and Agreement

Your loan officer reviews the findings. They then approve the loan once everything checks out. Next, you’ll receive a sanction letter outlining the loan amount, tenure, interest rate, and EMI.

Once you accept these terms digitally or on paper, you move one step closer to getting the funds.

Also Read: Personal Loan Agreements: Know the Terms and Conditions

Step 6: Loan Disbursal

Finally, the exciting part: funds are disbursed to your bank account. For Hero FinCorp Personal Loans, this usually happens within 24–48 hours after final approval, given you meet all the terms and criteria.

Documents Needed for Personal Loan Verification Process in India

Let’s look at the documents involved in the personal loan verification process. You just need to hand in the documents for an instant and complete digital process..

• Identity Proof: Aadhaar Card, PAN Card, Passport, or Voter ID

• Address Proof: Utility Bill, Aadhaar Card, Passport

• Income Proof: Salary slips, Bank Statements, or ITR

• Employment Proof: Offer/Appointment Letter or Business Registration

Also Read: What is Personal Loan Application Process | Step-by-Step Guide to Approval and Verification

What Affects the Loan Verification and Approval Process?

Here’s a roundup of a few elements that can make or break your verification speed:

• Your credit score and repayment track record

• Income stability and consistent employment

• Accuracy of the details you submit

• Frequency of recent loan applications

How to Speed Up Your Verification

Need to fast-track the personal loan verification process? Try these tips:

• Keep digital copies of all required documents ready.

• Choose lenders like Hero FinCorp that offer instant digital checks.

• Maintain a healthy credit score (700+ ideally).

• Respond quickly if your lender asks for clarification.

Timeline of Personal Loan Verification in India

| Stage | Typical Time Taken |

| Application & Eligibility | 1 Day |

| Document Review | 1–2 Days |

| Verification & Sanction | 1–3 Days |

| Disbursal | Within 24–48 Hours |

Get Instant Personal Loan Approval with Hero FinCorp

A smooth personal loan verification process means a smooth journey to loan approval. Just keep the documents ready and organised. Fill out your form carefully. And let the lenders take over from there.

Want to experience a hassle-free loan verification process? Check your eligibility and apply for a Hero FinCorp Personal Loan.

Frequently Asked Questions

1. What if my documents are rejected?

You’ll be notified by the lender. Rectify the issue and reapply.

2. Is physical verification mandatory?

Not always. Many digital lenders rely solely on e-KYC and online credit checks.

3. Does my credit score affect verification?

Absolutely. A higher score improves your chances of faster approval.

4. Do self-employed applicants undergo a different loan verification process?

Yes. Their income verification usually involves reviewing business proof, ITRs, or financial statements.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented Here is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.